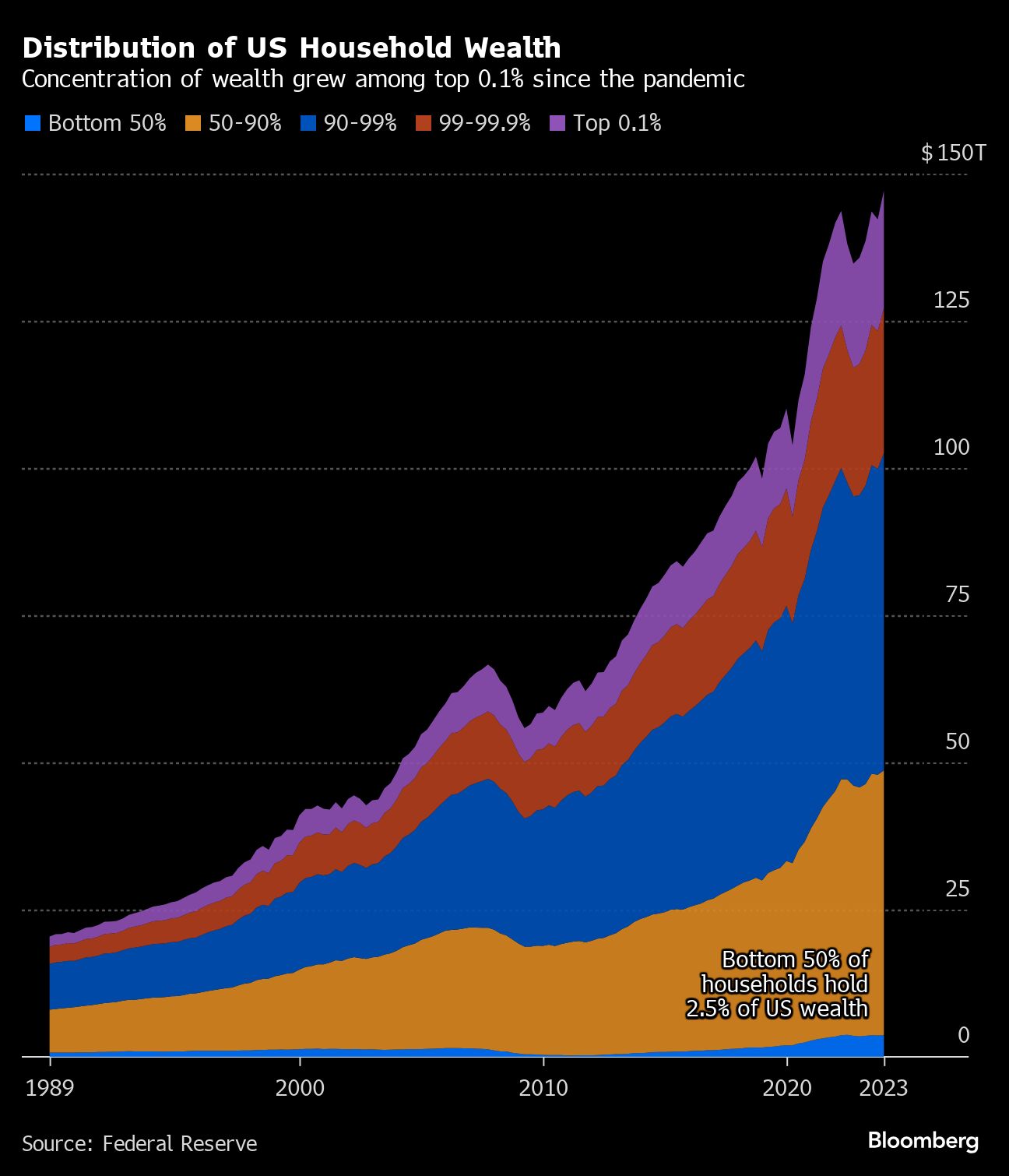

Virtually all Americans have gotten wealthier since the pandemic. But as the overall pie has gotten larger, the slice for a group of affluent households is shrinking.

Since the end of 2019, households in the 90-99.9% bracket of wealth have lost their share of the US total mostly to those in the bottom half and the top 0.1%, according to data from the Federal Reserve. These families, who are well off but shy of the mega rich, typically earn around $430,000 in annual income.

US households have added $37 trillion in wealth in the past four years, but the distribution has become more concentrated among the very rich — the top 0.1%. Those roughly 133,000 split about $20 trillion in wealth between them as of the end of 2023, equating to some $150 million per household. That’s a 47% increase in that time.

The 0.1% now account for 13.6% of total household wealth, near a record for that group in Fed data back to 1989. The shares held by the bottom half and much of the middle class have also continued to grow, while the proportions for the 90-99% and 99-99.9% are each near their lowest since the early 2000s.

To be sure, the pandemic era has done little to improve growing inequalities in the country. The roughly 13 million households who make up the tier just below the top 0.1% are still very much upper tier and hold slightly more than half of the nation’s wealth. By contrast, the 66 million households in the lower half only hold 2.5% of the US total.

The top 0.1% holds close to half of their assets in corporate equities and mutual funds, with stock holdings adding more than $3 trillion in the past four years. These households also have nearly a quarter of their wealth tied up in private businesses.

For the bottom half, however, real estate makes up the majority of their assets. Consumer durable goods, like cars, are the next biggest holding, comprising about one-fifth of their assets.

Broken down by demographic factors, the biggest losers of wealth since the pandemic are households that are Black, middle age and those with less education.

Middle-age Americans, who are between 40 and 69 years old, hold a smaller share of US wealth now compared to the end of 2019. Before the pandemic, those households held close to 70% of US wealth, but that shrank to under 63% by the end of 2023. At the same time, the share held by older Americans grew to a record 30.8%.

Some of that reflects an aging population — there are simply more older people, and it takes time to accumulate wealth. But other factors are also at play.

US equity markets near record highs helped older Americans — who have more assets invested — to gain a greater share of overall wealth. Further, many people over 70 own their homes, so robust housing price gains in several parts of the US have helped increase their wealth as well.

Continuing a long-term trend, a growing share of overall wealth is held by households with a college degree. That now makes up nearly three quarters of the total, compared to around 70% before the pandemic.

Only around 11% of wealth is held by households without any college education. A generation ago, that share was closer to a third.

In the late 1980s, roughly 90% of US wealth was held by White Americans — a proportion that’s since fallen to around 84.5%, but increased a bit since Covid. However, the share held by Black Americans shrank nearly a full percentage point in that time, while that held by Hispanics was little changed.

This article was provided by Bloomberg News.