Warren Buffett has taken the investment community on quite an adventure in recent years regarding his relationship with technology stocks.

As recently as five years ago, a full eight years after the launch of the iPhone, the "Oracle of Omaha" remained dubious of Apple shares and technology shares in general, refusing to put them in his portfolio because he considered them too risky and hard to understand.

“I know about as much about semiconductors or integrated circuits as I do of the mating habits of the chrzaszcz (beetles),” he was famously quoted as saying in regards to tech stocks.

In early 2016, however, Buffett surprised analysts, investors and skeptics who openly wondered if he was losing his touch by purchasing 10 million shares of Apple stock.

A few years later, in a CNBC interview, Buffett explained that he no longer viewed Apple as a hard-to-understand technology company.

“I mean it’s an amazing business,” Buffett told CNBC. “You can put all of their products on a dining room table.”

Earlier this month, it was reported that Buffett's Berkshire Hathaway has seen its stake in Apple triple in value, to more than $100 billion. Buffett, the former technophobe, recently called Apple “probably the best business I know in the world.”

There's a simple reason why Buffett's view on Apple stock was so closely watched: People like to mimic the actions famous investors.

In a recent report on hedge fund holdings, WalletHub noted that billionaire hedge fund managers have reached celebrity status because of their wealth.

"Not only are they rich and famous, but they can move markets with just a few words," WalletHub said in the report. "Investors worldwide follow their every move."

The WalletHub report comprised the following billionaire money managers, each listed with the top three holdings of their respective funds:

David Einhorn

Greenlight

1. Green Brick Partners Inc.

2. Brighthouse Financial Inc.

3. AerCap Holdings N.V.

Julian Robertson

Tiger Management LLC

1. Adaptive Biotechnologies Corp.

2. Facebook Inc.

3. AerCap Holdings N.V.

Nelson Peltz

Trian Partners

1. Procter & Gamble Co.

2. Sysco Corp.

3. Mondelez International Inc.

Bill Ackman

Pershing Square

1. Lowe's Companies Inc.

2. Chipotle Mexican Grill Inc.

3. Restaurant Brands International

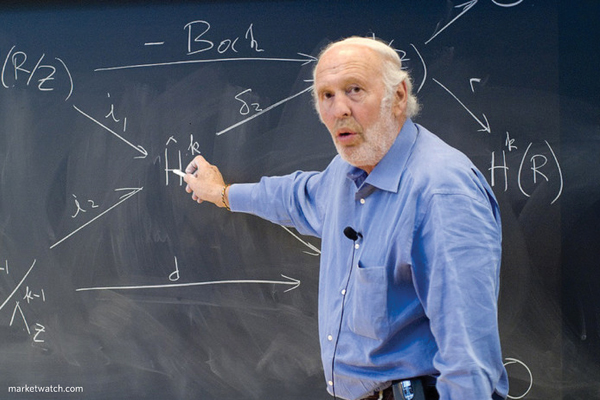

Jim Simons

Renaissance

1. Bristol-Myers Squibb Company

2. Tesla Inc.

3. Zoom Video Communications Inc.

Daniel Loeb

Third Point

1. The Walt Disney Company

2. Amazon.com Inc.

3. Danaher Corp.

John Paulson

Paulson & Co. Inc.

1. Horizon Therapeutics PLC

2. Bausch Health Companies Inc.

3. BrightSphere Investment Group

David Tepper

Appaloosa Management LP

1. Amazon.com Inc.

2. Facebook Inc.

3. T-Mobile US Inc.

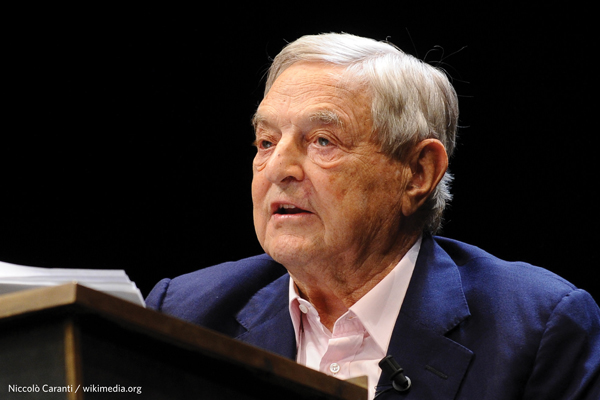

George Soros

Soros Fund Management

1. Liberty Broadband Corp.

2. T-Mobile US Inc.

3. Caesars Entertainment Corp.

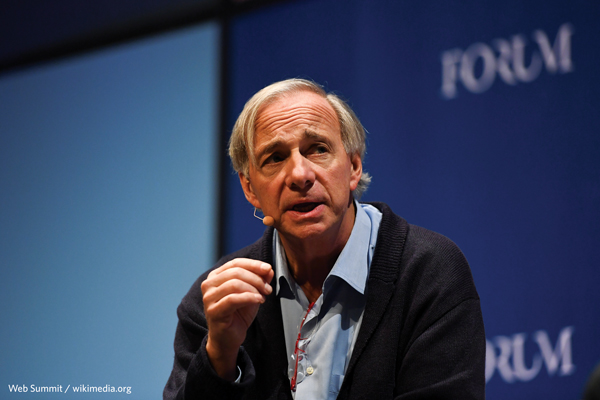

Ray Dalio

Bridgewater

1. Yum China Holdings Inc.

2. Tesla Inc.

3. Lowe's Companies Inc.

Carl Icahn

Icahn Enterprises L.P.

1. Caesars Entertainment Corp.

2. Herbalife Ltd.

3. CVR Energy Inc.

Warren Buffett

Berkshire Hathaway Inc.

1. Apple Inc.

2. Bank of America Corp.

3. The Coca-Cola Company

The full report can be viewed here.