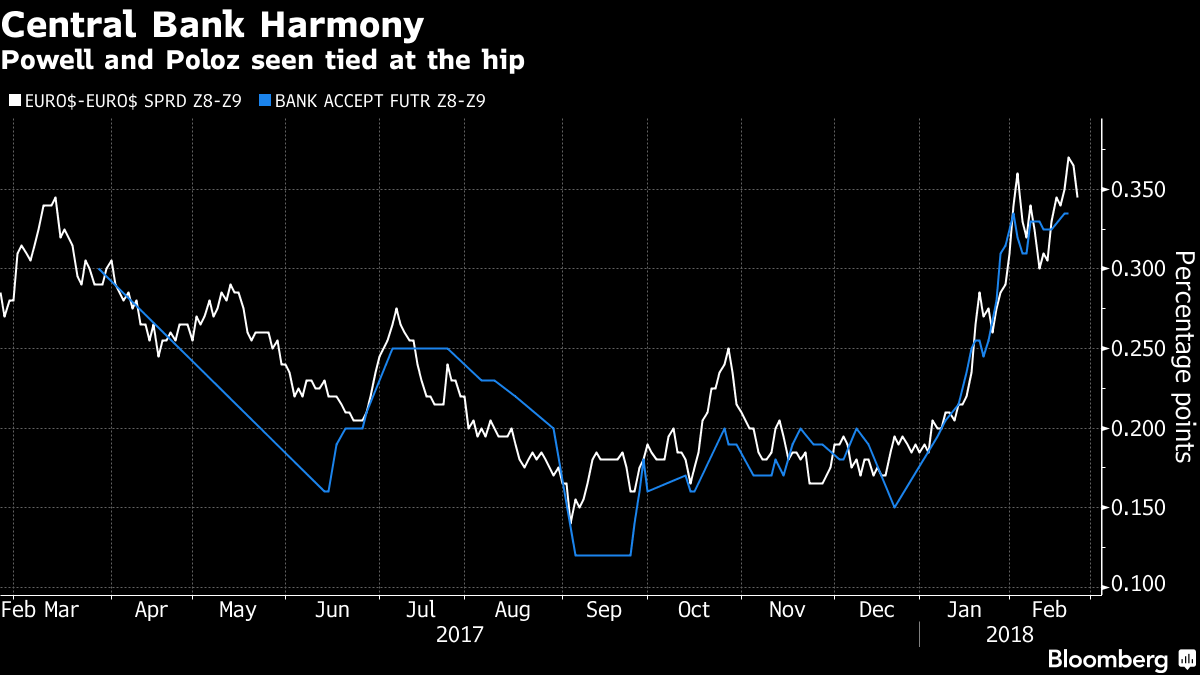

The two biggest North American economies might as well share one central bank as far as traders are concerned.

Market-implied tightening by the Federal Reserve and Bank of Canada through 2019 is priced nearly identically despite mounting signs that the latter is presiding over an economy that’s lost much of its momentum.

Bespoke Investment Group estimates that Canada’s second-half average monthly growth in 2017 slowed to 0.13 percent, the most sluggish pace since August 2016. Yet traders still seem to be taking their cues for Bank of Canada tightening for the remainder of 2018 as well as calendar 2019 based on what they think the Fed will do.

“The March 2018-2019 spreads in BA futures are 59.5 basis points, versus only 52.5 in the U.S.,” adds Bespoke. “In short, markets are pricing too much hawkishness from the BoC.”

This dynamic could be a spot of bother for Bank of Canada Governor Stephen Poloz, who has stressed that America’s neighbor to the north has ample room to set monetary policy independently of the Fed and cited the central bank’s two rate cuts in 2015 as proof.

To be sure, economic and financial linkages between the U.S. and Canada are traditionally intense. From mid-1961 through the third quarter of 2017, the two economies have either grown or contracted in sync on a quarterly basis 86 percent of the time. During the 1980s and 1990s, the Canadian central bank often mimicked the movements of its U.S. counterpart with only the smallest of lags.

The Canadian economy, however, may prove much more sensitive to rate hikes at this juncture, preventing Poloz from following in new Fed Chair Jerome Powell’s footsteps as closely as some of his predecessors had done with their southern peers. Macquarie Capital Markets analyst David Doyle has emphasized the dramatic divergence in credit cycles for the two North American economies as capping the scope for Bank of Canada interest rate increases. The U.S. deleveraged materially in the wake of the financial crisis while Canada continued to push its private sector debt-to-GDP ratio ever higher.

The potential for “monetary policy divergence between the BoC and Fed gives a nice theme to provide a short side for broader dollar strength,” writes Bespoke, which targets the greenback rising to 1.35 versus the loonie, an implied advance of more than 6 percent from current levels.

This article was provided by Bloomberg News.