A simple definition of investment diversification is conveyed in the overused statement, “Don’t put all your eggs in one basket.” The basic buy-and-hold, set-it-and-forget-it style of investing is often premised in a 60 percent global stock and 40 percent bond allocation (known as “60/40”) and sold as enough diversification to handle whatever market turmoil might come your way over the long term.

Two major shortcomings spoil this view of investing. First, what is the long term? From 2000–2010 (the lost decade), the U.S. stock market did not make anyone money. We observed 10 years of varying degrees of market volatility and no return. We have found that most investors, ourselves included, aren’t interested in leaving 60 percent of their money in assets that don’t add value for a decade.

A second and less obvious flaw of traditional “diversification” is that its basic assumptions are defective. Why? Because they assume that when stocks fall, bonds will go up and provide risk mitigation, and when U.S. stocks fall, stocks in other countries will go up, thereby also providing risk mitigation. These negative correlation assumptions do not necessarily hold true, especially as it is commonly and erroneously expected that these correlations remain static over time.

These mistaken assumptions can lead to some painful outcomes. Anyone who lived through 2008 will recall that the S&P 500 dropped 37 percent that year. European stocks plummeted 41 percent and emerging market stocks were cut down nearly 50 percent. Owning all 3 of these broad asset classes as “diversification” didn’t provide investors any form of downside risk management.

More recently, in early 2018, the S&P 500 fell 10 percent in short order. Bond prices also dropped. The negative correlation assumption of the two simply did not work. This happens much more frequently than most would like to believe.

This isn’t to say that holding a diversified group of asset classes doesn’t reduce risk. It does reduce volatility compared to holding just the more volatile asset classes, but drawdowns can still be painful. So holding onto a mix of assets can be too simple a view and doesn’t protect investors during periods of high stress and when the correlation of asset classes spikes up.

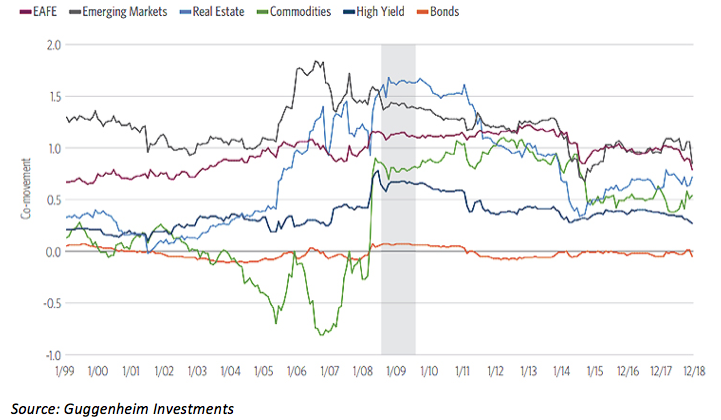

Guggenheim Investments published fascinating research documenting shifting correlations. Their chart shows the co-movement of the S&P 500 and different assets over the past 20 years ended December 2018. A measure of 1 or above means that assets are moving strongly in the same direction as U.S. stocks. The shaded area highlights when stocks were crashing in the 2008 period. This is exactly when the co-movement of commodities and bonds jumped up. Translation: All the eggs in all the baskets made a mess of the “diversified” portfolio.

All Eggs In All The Baskets

Co-movement of the S&P 500 and different asset classes over the past 20 years.

What is “True Diversification”?

We recommend looking beyond traditional asset classes, and holding alternatives whose sources of risk are truly differentiated from mainstream stocks and bonds. Managed futures strategies, for example, and volatility managed alternative strategies are two ways to accomplish that.