President Donald Trump hailed the Great American Comeback in Tuesday’s State of the Union address. It came at the end of a 24-hour period that will leave his detractors in a state of almost total despair. The Democrats’ awful fiasco in Iowa leaves the chances of a Trump re-election looking stronger than ever.

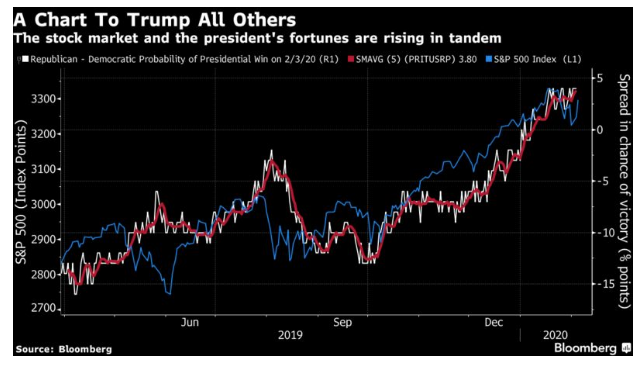

This all wraps together with the stock market, which has been rallying in line with the perceived improvement of Trump’s chances of prevailing in November’s election. The following chart shows the Republicans’ chance of victory minus the Democrats’ chance on one scale, and the S&P 500 on the other. It may be even more unpalatable for Democrats than the farce in Iowa, or the text of the president’s speech:

Trump has that critical quality that Napoleon demanded of his generals: He is lucky. And as ever, some of his claims are stretched. Here is the key passage from the State of the Union on markets:

Since my election, United States stock markets have soared 70 percent, adding more than $12 trillion to our Nation’s wealth, transcending anything anyone believed was possible—this, as other countries are not doing well. Consumer confidence has reached amazing new heights.

All of those millions of people with 401(k)s and pensions are doing far better than they have ever done before with increases of 60, 70, 80, 90, and even 100 percent.

Let’s do some fact-checking. The S&P 500, by far the most widely used measure of the U.S. stock market, is up 54% since Trump’s election on a price basis, and 64% on a total return basis. These numbers are very good. He exaggerated them, but not by all that much. And presumably there must be someone out there who took some extremely risky positions in their 401(k) and managed to double their money in barely over three years, but they needed to gain about 25% a year to do so, so it is unlikely they had many bonds in their portfolio.

It is true that certain areas of the market are performing quite remarkably. It is also true that the U.S. has easily outpaced the rest of the world. It might, however, be wise not to be too triumphant about this, as the gains don’t look sustainable. The rise in the internet-leader FAANG stocks has gone vertical in recent days:

As for the idea that 401(k)s are doing better than ever before, it is nonsense. We don’t have to go back very far at all to find better. Assuming that 401(k)s are 100% invested in an S&P 500 tracker fund, which is the implicit assumption, there have been periods of three years and three months (the period that has elapsed since Trump was elected) under each of his three immediate predecessors when the stock market did even better. Here is a chart, on a log scale so that similar percentage increases all appear equal: