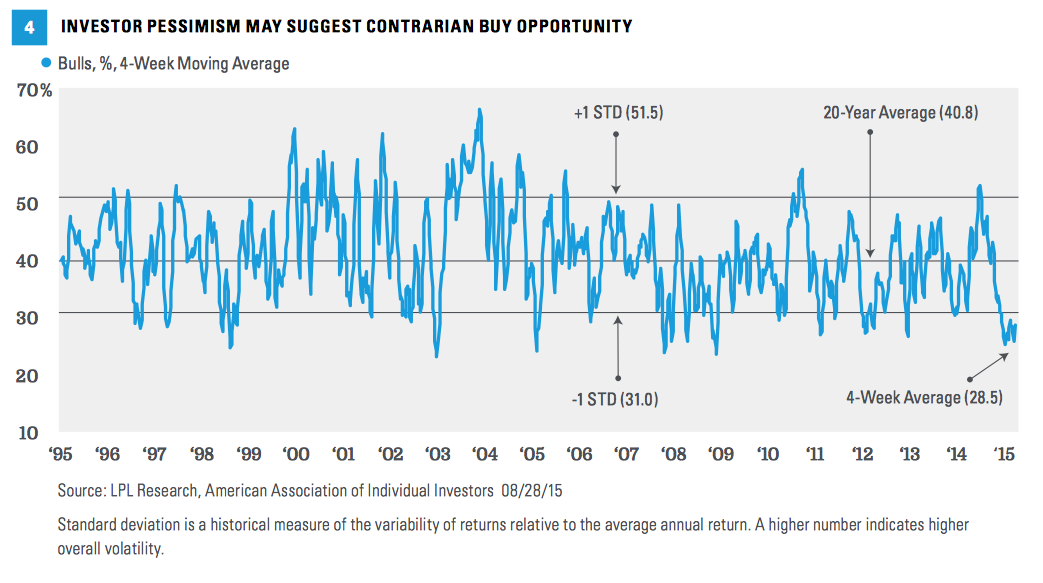

12. Is negative investor sentiment signaling a buying opportunity? The American Association of Individual Investors (AAII) bull/bear survey currently shows a very low percentage of bulls, with a four-week average of 28.5 percent [Figure 4].

At more than one standard deviation below the long-term average reading of 40 percent, this smaller percentage of bulls, corresponding to a high level of pessimism, has historically indicated a potential contrarian buying opportunity. For comparison, even during the financial crisis in 2008 –2009, the percentage of bulls bottomed at about 20 percent.

Burt White is managing director and chief investment officer for LPL Financial. White provides strategic guidance for the LPL Financial Research team, ensuring alignment with the firm's goals for maintaining the highest levels of integrity in pursuit of conflict-free, objective investment advice.