Planned gifts are donations made to charitable organizations, arranged in advance, often as part of a person’s estate plan. What characterizes planned gifts is the attention paid to the individual’s overall financial and estate planning goals, often providing tax benefits. Many nonprofits have planned giving officers who are responsible for facilitating planned gifts for their organizations. At the same time, private wealth industry professionals, from wealth managers to lawyers and from accountants to life insurance agents, also work to facilitate planned gifts, usually as part of charitable and related wealth planning.

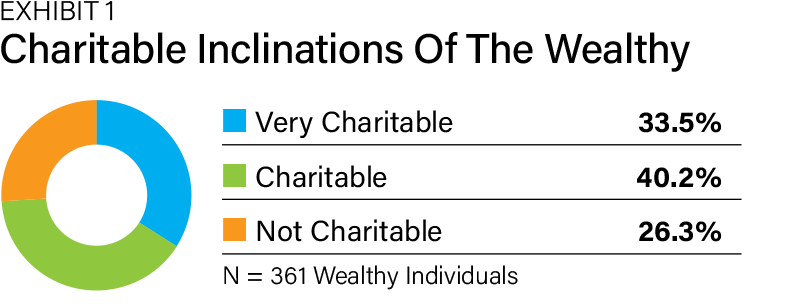

Most of the wealthy are committed to supporting charitable causes (Exhibit 1). In a meta-analysis of 361 wealthy individuals and families with $10 million or more in investable assets, a third say they are very charitable, another two-fifths identify themselves as charitable, and about a quarter say they are not currently charitable. A sizeable portion of the wealthy is charitable. For more research findings, see Why Wealth Managers Miss Philanthropic Opportunities.

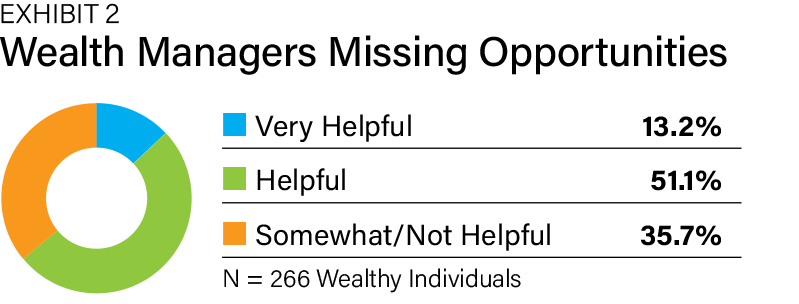

Of the 266 wealthy individuals and families who reported being very charitable or charitable, half said the professionals they worked with were helpful (Exhibit 2). Meanwhile, 35% reported the professional being somewhat or not helpful, and only 13% said they were very helpful.

There are several reasons wealth managers are poorly serving the philanthropic affluent. While the private wealth industry is biased toward professionals, resulting in high-net-worth individuals and families being poorly served, when it comes to these wealthy individuals, the situation is often compounded by neglect and a lack of technical and process proficiency. This situation provides a significant opportunity for those wealth managers who want to support these wealthy individuals and families and substantially build their practices.

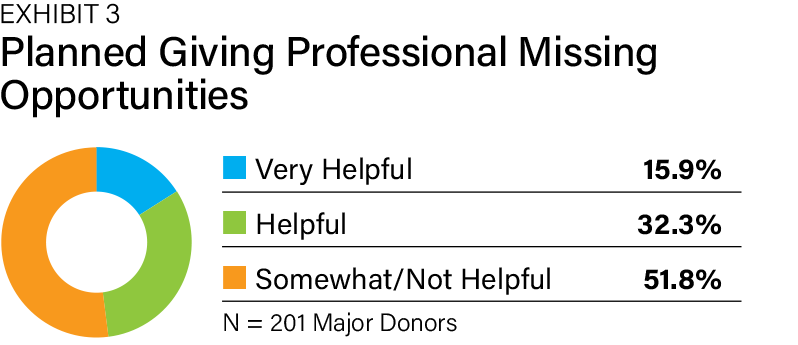

It is not only wealth managers who are missing opportunities to help the wealthy make planned gifts; planned giving professionals sometimes miss significant opportunities. In a survey of 201 major donors committed to the nonprofit, only 15% reported the planned giving professionals were helpful (Exhibit 3). A third said they were helpful, and half said they were somewhat or not helpful.

As with the wealth managers, these circumstances can enable astute planned giving professionals to raise substantial money for their causes and nonprofits. Substantially increasing planned gifts is a deep understanding of the psychology of the philanthropic affluent. Wealth managers and planned giving professionals must realize that the philanthropic affluent are not a homogenous cohort, leading to more impactful messaging and support.

The Philanthropic Affluent

Based on extensive research, a psychographic framework of the philanthropic affluent was constructed to understand what motivates them to give and their attitudes toward gifting (see: The Seven Faces of Philanthropy). The result of all this effort has been the identification of seven distinct philanthropic personalities, which is a helpful lens to view clients and prospects:

• Communitarians tend to focus their charitable efforts parochially. They concentrate on their local environment. They are often business owners deeply committed to seeing their community prosper.

• The devout are primarily motivated to give for religious reasons. As such, they tend to be major supporters of churches, synagogues, mosques, and so forth. Moreover, the Devout will support various worthy causes beyond religion.

• Investors incorporate a monetary calculus into their giving decisions. It is essential to understand that their decision to give is not based on a financial analysis. Investors are caring people who want to use their money to effect positive change. It is just that economic considerations, often tax-related, highly influence the amounts they contribute and the way they give.

• Socialites use their social peers to determine which non-profits to support. They are well-connected with people similar to themselves and use this network to transfer information. They make extensive use of the experience of their peers to decide to whom to give, how much to give, and to what extent they should get personally involved in a non-profit.

• Repayers are supporting non-profits because of perceived obligations to the organization. They commonly support health-oriented non-profits such as hospitals and educational non-profits such as universities.

• Altruists give because doing so creates a high level of self-satisfaction for them. They are giving because it is the appropriate thing to do. Thus, they are not looking for anything in return, so anonymous givers tend to be Altruists.

• Dynasts are socialized to the culture of philanthropy. Growing up, they learned from their family and others to be charitable. Dynasts need not be as affluent as they were growing up.

Implications Of Wealth Managers And Planned Giving Professionals

Each philanthropic personality employs a somewhat different vocabulary and focus when discussing their reasons for charitable giving. For example, with the devout, extensively discussing values is very important. However, such a discussion will be less meaningful to socialites. Therefore, wealth managers and planned giving professionals can be more effective with the philanthropic affluent by aligning their narratives appropriately.

Additionally, each philanthropic personality has different expectations concerning the character of their relationship with the private wealth industry and the planned giving professionals they engage. For example, investors will expect detailed discussion on tax and control implications of the various planned gifts. In contrast, repayors, while looking for tax benefits, are unlikely to want to go into very much detail.

By understanding the psychographic framework discussed, wealth managers and planned giving professionals can better customize their narratives to resonate with the philanthropic affluent truly. Such insights prove enormously valuable in generating planned gifts.

Using the psychographic framework can also result in many more planned gifts through referrals from clients and donors. Six of the seven philanthropic personalities tend to know others well, like themselves. With some prompting, wealth managers and planned giving professionals can get referrals to other wealthy individuals inclined to make a planned gift.

Jerry D. Prince is the director of Integrated Academy, part of Integrated Partners, a leading financial advisor firm. Russ Alan Prince is a strategist for family offices and the ultra-wealthy. He has co-authored 70 books in the field, including Making Smart Decisions: How Ultra-Wealthy Families Get Superior Wealth Planning Results.