It is widely recognized within the wealth management industry that accountants referring their clients is an excellent way to grow a practice. At the same time, relatively few wealth managers capitalize on this business development strategy. While many wealth managers will get a few client referrals from accountants now and again, this is far from a pipeline of new business.

To understand the best practices of wealth managers getting a steady stream of new clients from accounts, we surveyed 328 senior partners in accounting firms with wealth management practices. This means they share in the wealth management revenues. Moreover, the accountant surveyed is responsible for the wealth management practices at their firms.

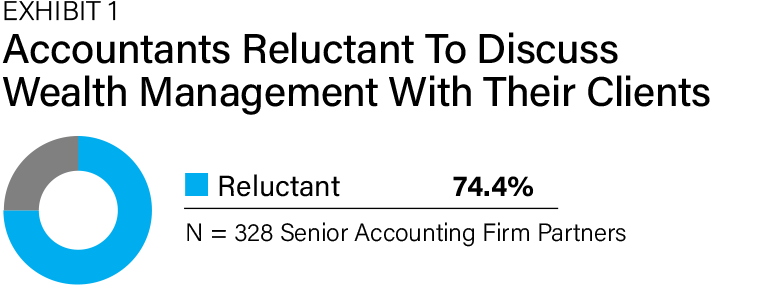

The biggest obstacle for accountants referring their clients to their firm’s wealth management practice is their reluctance to discuss wealth management with their clients, says three-quarters of those surveyed (Exhibit 1).

Reluctance on behalf of many accountants to discuss their firm’s various practices is often not restricted to wealth management. It is common for accountants not to refer their clients to other accounting firm practices, even when they get origination credit.

The Best Approach

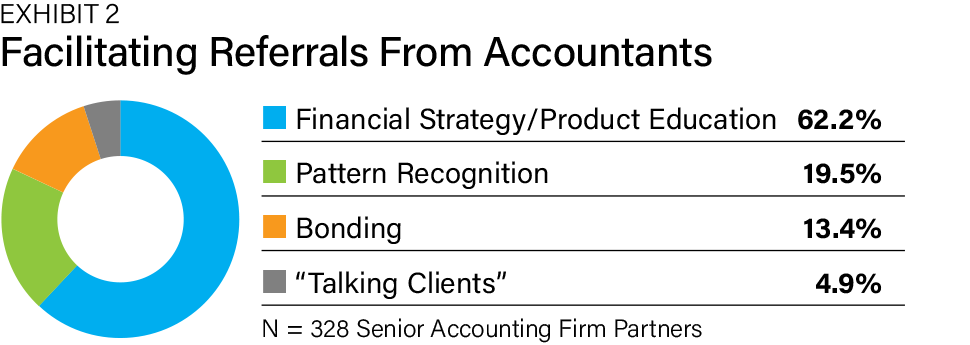

Some methodologies and tactics can meaningfully increase the ability of wealth managers to get referrals from accountants, but most wealth managers fail to use them. A factor analysis of the survey data identifies four major approaches wealth managers can take to facilitate accountant-client referrals:

• Financial strategy and product education. Wealth managers explain various financial strategies and products to accountants in group and one-to-one settings.

• Pattern recognition. Wealth managers provide various client fact patterns that can benefit from wealth management expertise.

• Bonding. Wealth managers develop strong professional and sometimes personal relationships with accountants.

• "Talking clients." Wealth managers discuss specific accountants' clients to determine the appropriate wealth management solutions.

Using a forced choice empirical methodology, the most common approach is a financial strategy and product education (Exhibit 2). These discussions are solidly in the comfort zone of most wealth managers. Many wealth managers see providing this information as an opportunity to demonstrate their technical proficiencies. Also, with their approach, continuing education credit for the accountants is possible, which often gets their attention. About a fifth concentrates on pattern recognition. A little more than a sixth of the senior partners say bonding is the approach used. Less than 5% of wealth managers are “talking clients” with accountants.

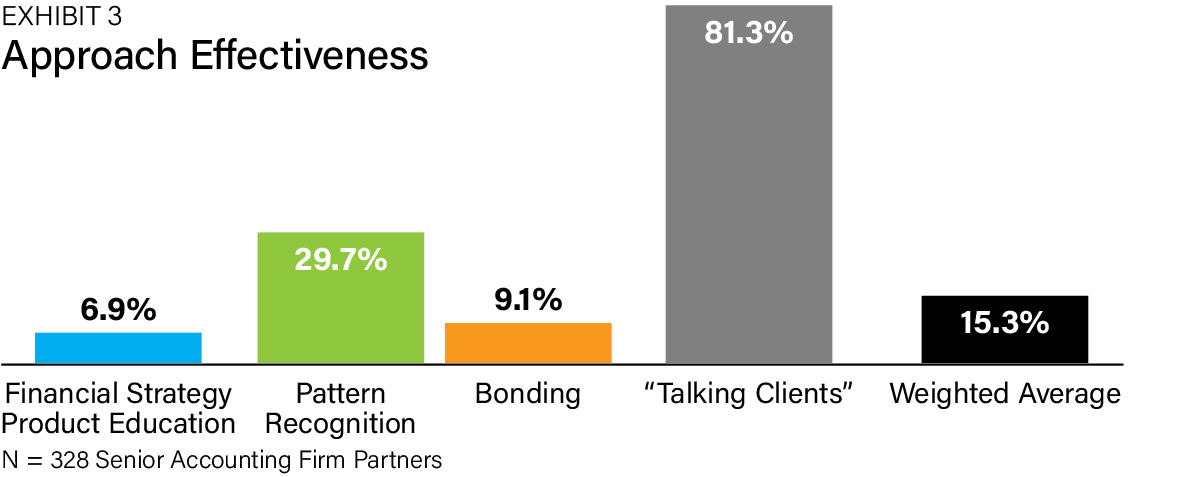

While we know what wealth managers are doing to get referrals from accountants, we still need to determine what works best. The criteria we are using is two or more new client referrals within six months. These referrals did not have to become wealth management clients. All we are addressing is the propensity of the accountants to make referrals.

Overall, 15.3% of the wealth managers received two or more new client referrals within six months (Exhibit 3). However, in evaluating the different approaches, one dominated. Four of five wealth managers who “talk clients” received two or more referrals within six months. About 30% of the wealth managers who concentrated on pattern recognition received two or more referrals within six months. This was also the case for 9.1% of the wealth managers who work to bond with the accountants.

Very telling, the most common approach was the least effective. Only 6.9% of wealth managers providing financial strategy and product education received two or more referrals within six months.

We readily recognize that wealth managers use more than one approach. For example, wealth managers are likely looking to bond on a professional and likely personal level with accountants. Another consideration is that we were looking at a six-month time frame to get new wealth management clients. Maybe the other approaches work well but take longer to get results.

What is clear is the power of “talking clients.” While the other approaches produce results, “talking clients” is highly productive. Therefore, for wealth managers wanting to create a steady stream of new accounting firm clients, it would be wise to become proficient at “talking clients.”

‘Talking Clients’

The aim is to move from hypotheticals and concepts to actual client situations. There are several ways to handle these conversations. One way is to center on process leading to introductions, where the wealth managers start to understand the goals and concerns of the clients.

Another way is to address wealth management possibilities in real-time. Remember, there is no problem in collecting information from the accountant and coming back with some ideas they can bring to their clients in a reasonably short time. Most wealth managers who “talk clients” blend the various ways to handle these conversations.

What is critical is that each time wealth managers and accountants “talk clients,” they:

1. Identify possible clients for the wealth management practice,

2. Understand the relevant idiosyncrasies of the clients and

3. Develop the narrative accountants can use to introduce the wealth managers.

“Talking clients” is the most potent way for wealth managers to connect the dots. This approach is best for wealth managers to create a steady stream of high-quality accounting firm clients for wealth management strategies and products.

Jerry D. Prince is the director of Integrated Academy, part of Integrated Partners, a leading financial advisor firm. Russ Alan Prince is a strategist for family offices and the ultra-wealthy. He has co-authored 70 books in the field, including Making Smart Decisions: How Ultra-Wealthy Families Get Superior Wealth Planning Results.