3 Reasons Why Covered Call Investors Welcome Back Volatility

3 Reasons Why Covered Call Investors Welcome Back Volatility

Covered call strategies have historically outpaced the market during volatile periods. After three years of record low volatility, covered call strategies might once again be poised for outperformance. Here are the reasons why.

1. Possible higher yields. During periods of heightened volatility, option premiums have a tendency to increase in price, as more investors are willing to pay for a hedge in their portfolios. Because covered call strategies are designed to sell options for income purposes, these higher premiums can result in a higher yield to the investor. For example, the Iron Horse Covered Call fund typically yields 6 percent to 8 percent annually, but we are currently clipping annualized yields in the range of 12 percent to 15 percent due to higher overall market volatility.

2. May provide protection. Because covered call portfolios are designed to potentially provide a higher income stream than most long-only equity strategies, they tend to do a particularly good job of protecting portfolios when the market declines. Call premiums can provide an income buffer that helps mitigate downside exposure, and this buffer potentially expands as volatility rises.

3. Research. Numerous studies published on the CBOE website have concluded that covered call strategies can provide roughly the same return as the stock market over the long term, but with less overall market exposure.

Market Look-Back: Covered Calls Outperform During Volatile Periods

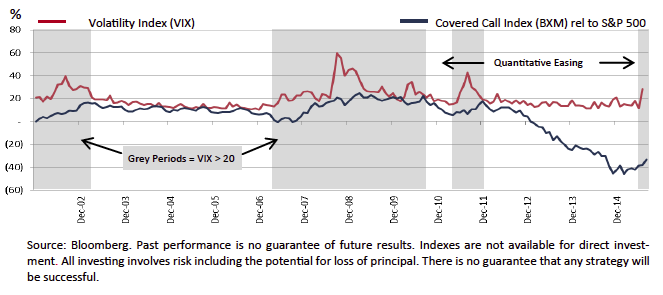

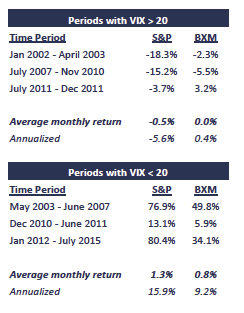

The CBOE volatility index (ticker VIX) has averaged ~20 over the long term, meaning the market typically expects future volatility to be around 20 percent. The VIX is often referred to as the market’s “fear gauge” since it spikes during periods of uncertainty. A quick look at the data, since Van Hulzen has been managing covered calls, shows investors that utilized covered calls generally outperformed during periods of volatility.

John Pearce joined Van Hulzen in February 2008. He co-manages the firm’s equity and covered call strategies and serves on the board. Prior to joining Van Hulzen, John was a director in the investment banking division of Credit Suisse Securities. Prior to Credit Suisse, he was an equity analyst at HOLT. John holds a B.A. in economics from the University of Virginia and a M.S. in accounting from the College of Charleston. Please visit our website for more information at www.vaminstitutional.com.

In the chart below, the grey periods represent stretches when VIX traded above its long-term average of 20, while the white periods represent below average stretches. There are two long periods of low volatility displayed here: 2003-2007 and 2012-2015. In the teams view, the difference between the two periods of low volatility is simple: quantitative easing.

The Federal Reserve banks “easy money” policy has fueled stocks and depressed volatility over the past three years, creating headwinds for risk managed strategies like covered calls. But the Fed completed its last QE program late last year and is unlikely in our opinion to continue these policies going forward.

At Van Hulzen Asset Management the Investment Committee believes the market has entered a new (potentially lengthy) period of above average volatility. Covered call strategies have historically been well suited for this environment. If the team is right, then now may be an ideal time to reallocate some capital from long-only equities into covered calls.