Saylor and Cipolloni’s desire to avoid risk and sit out hot markets has both helped and hurt the fund over the years. In 2008, its low allocation to stocks helped limit its decline to 10%, which was mild compared to the 16% decline for its Morningstar peers and the 37% drop in the S&P 500. The fund also performed well in 2013, when it loaded up on stocks and convertible bonds. But the fund’s high cash position and low allocation to equities in 2017 led it to underperform its peers.

This year, the fund has been light on stocks and that’s helped shareholders on down days in the market; it could pay off again if markets take a turn for the worse. On October 10, when stock markets tumbled over trade war tensions and concerns about rising interest rates, the S&P 500 fell 3.29%. Balanced mutual funds dropped about half as much, while the Berwyn Income Fund fell a mere 0.37%. The next day, when the index fell 2.06%, the fund fell just 0.15%.

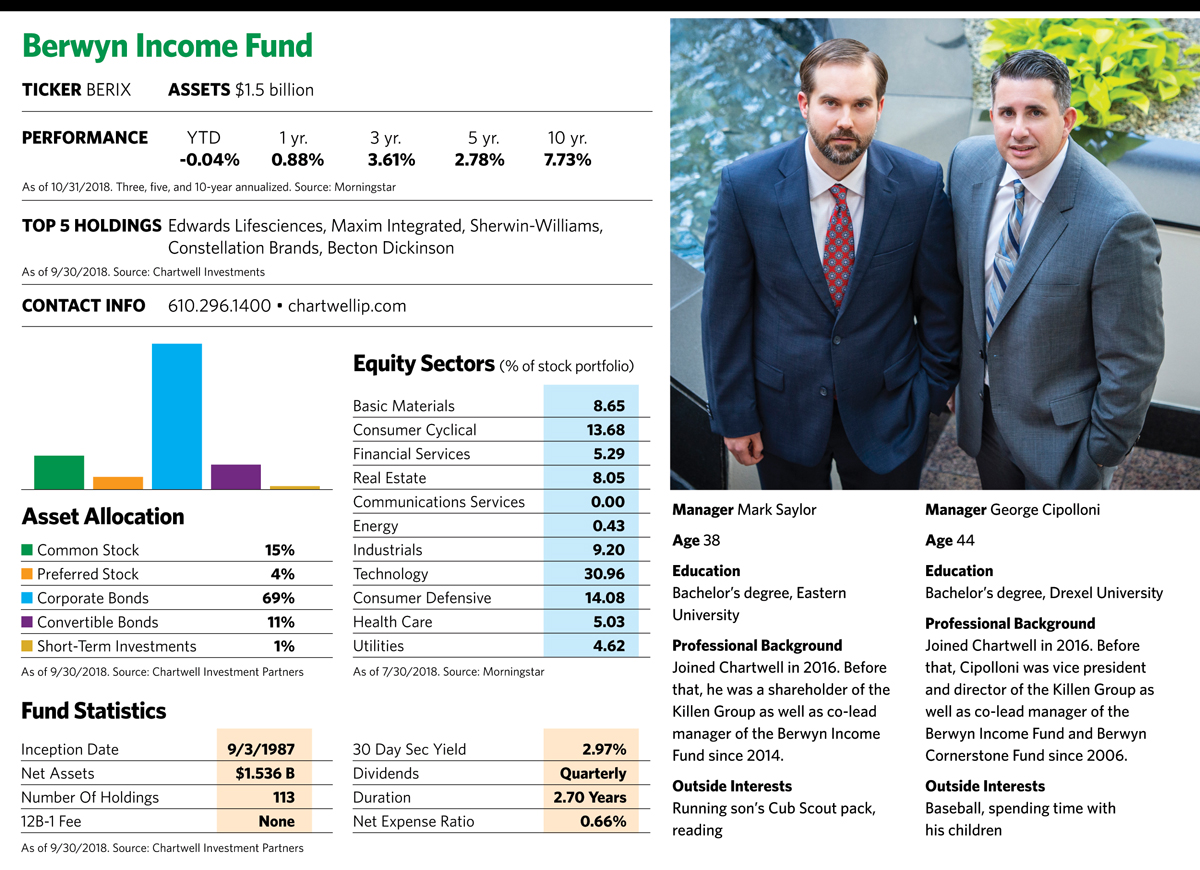

Over the years, Cipolloni says, investors have gravitated toward Berwyn Income because of its strong performance in difficult markets. A few years ago, the fund had $2 billion in assets, and at one point it closed because so much new money was coming in. But it’s shrunk to $1.5 billion as the bull market has lured investors toward riskier fare. “Our hope is that as the markets get more volatile, we will attract more investors,” he says.

Taking A Contrarian Stance

The fund’s allocation changes and security selection are in line with the managers’ insistence on going where they think the best values are and avoiding risk. “This fund moves away from areas that are very popular and overvalued,” says Saylor. “Our asset allocation and security selection [are] a byproduct of what’s making it through our screens.”

The managers research companies first, then determine whether their stocks, bonds, convertibles, or preferred securities represent the best buy on the asset spectrum. Any investment in equities must be able to achieve at least a 50% total return over three to five years. Companies whose bonds make it into the fund must have improving credit strength, substantial free cash flow and improving margins.

Over time, the stock side of the portfolio has undergone a shift in character. In 2009, the managers invested heavily in what are now considered growth stocks, things such as Microsoft and Intel, because they were so cheap. Over the last few years, a contrarian value flavor has taken hold as the managers gravitate toward cheaper stocks that have lagged or been unjustly punished by the market.

Last year, Saylor and Cipolloni saw a buying opportunity in apparel retailers Macy’s, DSW Inc. and American Eagle Outfitters, whose pressured stocks endured worries about the future of the industry and competition from online sellers. Since then, the three retailers have seen better-than-expected same-store sales, profitability has improved, and the stocks have rebounded sharply.

The fund tilts toward contrarian value stocks, so it hasn’t ridden the growth train led by Netflix and Amazon. Those market favorites, along with many other technology stocks, have been just too expensive for Saylor and Cipolloni’s taste.