With the era of quantitative easing by central banks coming to an end, fundamental and economic forces, rather than accommodative monetary policy, could drive the markets toward longer lasting, more pronounced trends. Periods of market volatility are lasting for longer periods than they have in the recent past, giving trend-based strategies a bit more room to run.

With their ability to sell bonds short, managed futures have generally performed well in prolonged rising interest rate environments, and Osborne thinks that the current period of increasing rates may follow that pattern. The Fed has signaled its intention to increase rates at least through the end of 2019, which may mean a sustained headwind for fixed-income markets and opportunities for short selling. At the same time, U.S. equities still carry extraordinarily high valuations and face threats from tariffs, trade wars and political discord. If those problems eventually settle into the stock market for more than a few weeks it would open up opportunities for profitable short selling.

Trends in other assets are also emerging. Despite widespread predictions it wouldn’t, the U.S. dollar strengthened against other currencies in 2018 and could continue to do so in 2019 if the U.S. economy remains strong. If it does, it could be profitable for investors to short foreign currencies and go long on the U.S. dollar. With the exception of oil, commodities have shown few trends, Osborne says. But that could change if investors perceive them as undervalued and their prices trend upward.

An Uphill Battle

Over the long term, managed futures portfolios tend to move independently of equities or bonds, and several studies document their value as a long-term diversifier with a very low correlation to stocks, bonds and other investments. These studies also show strong evidence that managed futures managers have been able to identify market downturns early on and take short positions, giving themselves an edge during times of extreme stock market stress. Osborne thinks investors should allocate in the neighborhood of 10% toward a managed futures investment if it is to have any real impact on portfolio returns.

But he cautions that investors need to have realistic expectations about what such funds can or can’t do. “Some people have been conditioned to expect that managed futures funds will always go up when the market goes down over short periods, and that is not always the case,” he says. “The fact is they have a zero correlation to equity markets, not a negative correlation.” It takes anywhere from a few weeks to a few months or more of a sustained trend before the benefits of any asset class play out, he says.

A common criticism of managed futures funds is their high costs. Investors in private funds specializing in managed futures typically pay a “2 and 20” fee structure (a 2% annual management fee and an additional fee of 20% on any profits). The fund fees are somewhat more palatable in the mutual fund world, though the cost of running the strategy and frequent trading makes the fees here higher than they are in the average equity fund.

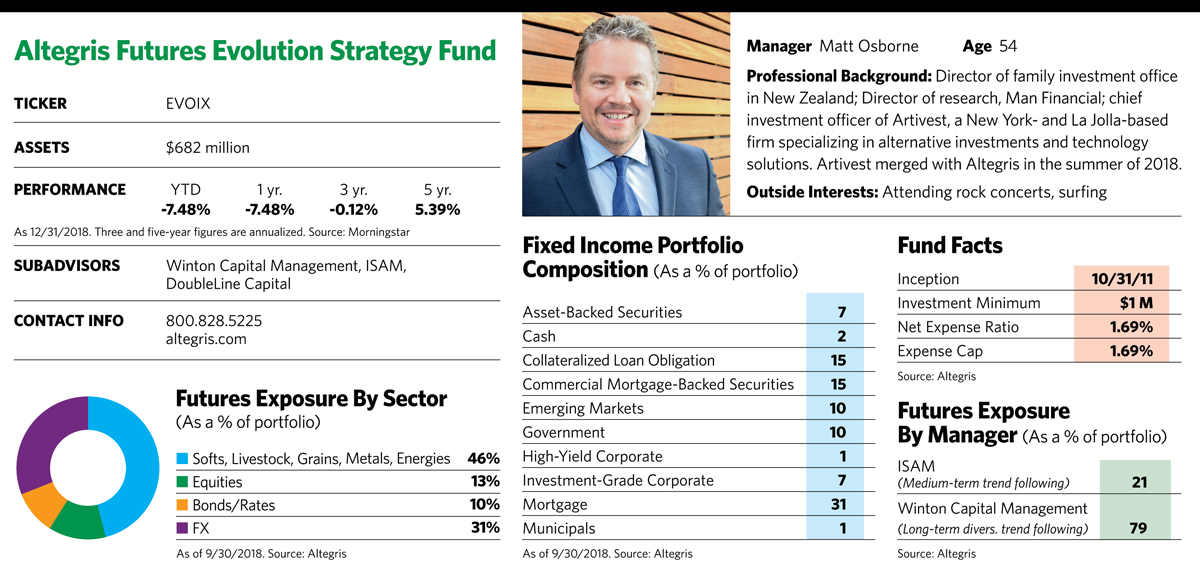

The expense ratio for the Altegris Futures Evolution Strategy fund is 1.69% for institutional class shares, which require a minimum investment of $1 million. Management of the fund is split between three subadvisors. Winton Capital Management, a large managed futures specialist with $26 billion in assets under management, handles longer-term futures strategies using trend following and other investment strategies involving futures contracts. ISAM, a boutique alternative investment management firm with $3.5 billion in assets under management, focuses on medium-term futures strategies and is a more pure trend follower. DoubleLine Capital handles the bond portion of the fund, which is used to maximize returns on assets that aren’t being invested in futures contracts. Because futures contracts are highly leveraged, only about 20% of fund assets are actually invested in them at any one time.

In an era dominated by trendless and unpredictable markets, Altegris Futures Evolution Strategy and other managed futures funds have faced an uphill climb in the battle for investors, and several smaller funds have liquidated. Skeptics aren’t hard to find, either. In a report early last year, Morningstar analyst Tayfun Icten warned that the funds “can be highly vulnerable to a rapidly developing risk-off scenario, in which riskier assets such as equities sell off while bonds and the U.S. dollar rally.” If the markets remain range-bound and without clear direction, the funds could continue to struggle.