Wall Street investors have gone cold on one of the main mechanisms banks invented to fund the green-energy revolution.

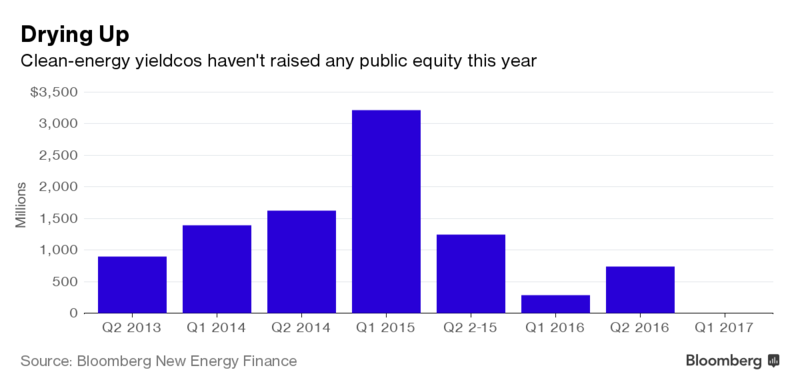

The business structure, known as the yieldco, feeds dividends from operating solar and wind farms to investors. Yieldcos raised $7.9 billion in public equity in 2014 and 2015 but only $1 billion since then, according to Bloomberg New Energy Finance.

The shift is further fallout from the collapse of yieldco promoter SunEdison Inc. and has changed the way clean-energy developers finance themselves. In years past, they started yieldcos to buy projects once they were operating, recycling the capital into new installations. Now, they’re turning to a large and deepening pool of buyers -- insurance companies and pension funds -- to provide funding and sometimes take control of income-producing assets.

“The idea of a you-have-to-have-a-virtuous circle -- that idea that you’re hooked at the hip between the public markets and growth -- is dead,” Mike Garland, chief executive officer of the San Francisco-based yieldco Pattern Energy Group Inc., said in an interview. “The market is saying, “‘Come to us last, not first.’ When we started, it was ‘Come to us first.’”

Yieldcos first emerged in 2013, when the largest U.S. independent power producer, NRG Energy Inc., launched NRG Yield Inc. The parent formed the yieldco to hold operating wind and solar farms that it had built or acquired. Revenue from those assets funded dividends.

Pattern Energy and NRG Yield are projected to pay 12-month dividend yields of 6.4 percent and 6.5 percent respectively, according to data compiled by Bloomberg. That’s about three times higher than the average 2.1 percent yield of 500 companies on the Standard & Poor’s index.

The yieldco structure became a major growth engine for renewables, spawning at least eight yieldcos in North America and similar entities in the U.K. and continental Europe. Investors liked the story: support the growth of clean-energy while also reaping dividends that flow from electricity sales guaranteed by long-term contracts. And because the yieldcos promised to buy more and more projects, the dividends would only grow.

Fading Appeal

But headwinds -- most prominently the run-up to SunEdison’s bankruptcy in April 2016 -- stopped at least three other would-be yieldcos from forming and have forced others to eschew public markets for private fundraising. SunEdison had relied on its two yieldcos to finance its dizzying multi-continent buying-binge, thrusting them into turmoil and introducing doubt that the companies would be able to grow fast enough to pay rising dividends. The company’s struggles contributed to a broad renewables slump that made it more difficult to raise funds from the public equity markets.

As the business case for yieldcos has lost favor, a new group of buyer has emerged: pension funds and insurance companies hungry for wind and solar farms’ steady revenues. And the green bond market has boomed. Issues of bonds linked to environmental projects is set to surpass $100 billion this year more than 10 times the scale of the market in 2012, according to BNEF.