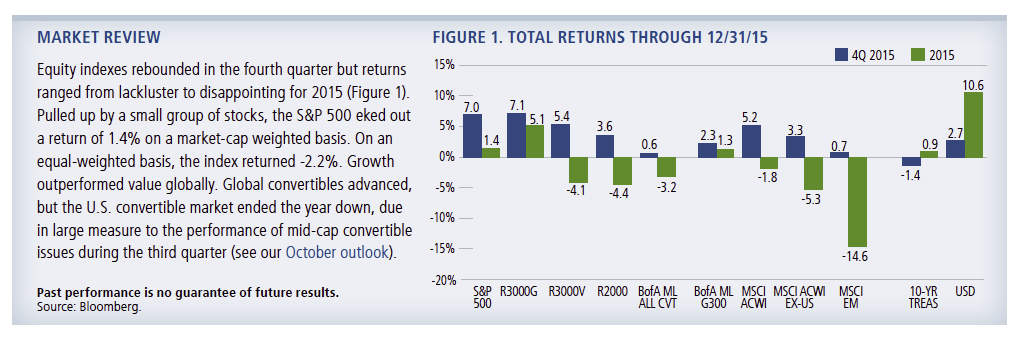

In 2015, we saw significant bifurcation between the haves and have-nots (within asset classes, across asset classes and among economies), as well as high volatility. We expect bifurcation and volatility to remain dominant themes in 2016, making positioning especially important. The causes of investor apprehension have been well documented: global growth concerns, low commodity prices, sectarian turmoil in the Middle East, and of course, a lack of visibility surrounding the U.S. presidential election. Also, although the Fed has signaled plans for moderate rate tightening throughout 2016, the European Central Bank, the People’s Bank of China, and the Bank of Japan are more accommodative. This global central bank policy divergence is likely to contribute to market rotations throughout the year.

The year has gotten off to a rocky start, but we believe 2016 ultimately will prove to be a lowreturn environment. We expect elevated volatility as market participants grapple with a range of unknowns. While this isn’t a market we would choose, we are confident in the choices that we have made to navigate it, and we believe there are a range of opportunities across asset classes.

Outlook and Positioning

U.S Equities. While we do not believe a recession in the U.S. is imminent, U.S. economic growth will be slow in 2016, supported by favorable trends in employment, consumer confidence and housing. Although the recent budget deal marked a slight shift in a favorable

direction, fiscal policy and political uncertainty remain formidable headwinds to more robust growth. Against this backdrop and in light of global growth concerns, the Fed may not carry through with as many rate increases in 2016 as it has indicated. At this point, we believe two increases in 2016 as being more probable than four. Additionally, our view is that long-term rates are unlikely to move significantly unless the economy accelerates in a meaningful way.

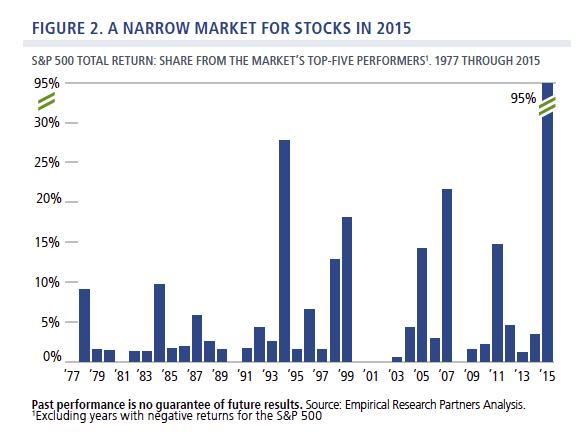

Our positioning in the U.S. equity market is cautious but not defensive. Although U.S. equity valuations are somewhat above average on the whole, the bifurcation in valuations is high and only a handful of names drove returns in the U.S. equity market in 2015. As Figure 2 shows, 95% of the S&P 500’s return was attributable to the top five performing names. Moreover, the elevated expectations we see in some areas of the market suggest a degree of complacency has set in. Because complacency typically gives way to volatility when negative news occurs, we are maintaining a cautious valuation approach. We are positioned to avoid the crowded trade, reducing exposure to valuation risk in favor of names that are not trading at extreme prices.