We came up with a theory many years ago to address how important psychology is to owning common stocks. We found that the risks go up in a stock market, or in an individual stock, when a “well-known fact” (WKF) was acted on in the extreme. It is a leading cause of stock market failure for professional and individual investors alike. In our world, a well-known fact is a body of economic information that is known to everyone, has been acted on by everyone and has attracted the most speculative investors (aka investors using borrowed money or options).

The Covid-19 virus and all its implications got priced into the stock market very quickly in February and March in a 36% decline in the S&P 500 Index. Since March, the stock market participants set about recognizing who was winning from people voluntarily imprisoning themselves in their homes and apartments. Work from home, shop from home, exercise from home, worship from home and recreate from home took over the imagination of investors.

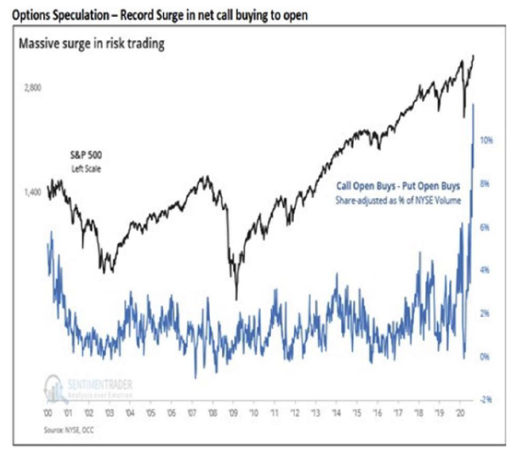

The problem comes when the speculation in option contracts and borrowed money gets fully connected to the well-known facts. Here is what happened in option contracts attached to stocks:

Simultaneously, margin debt in the stock market has reached epic proportions. The problem with margin debt is that someone who wants to own a stock gets forced out on the way down by the minimum margin (equity) requirements. You see, a well-known fact, regardless of how much wisdom was connected to the fact, must die at some point, because it runs out of buyers. Historically, a well-known fact that comes true ends up being much more damaging to common stock investors than one that is a pipe dream.

Let me give you two current examples. Jeff Bezos and Amazon have crushed their competition with cut-to-kill delivery pricing, aggregation of information and massive scale. Everyone knows how dominant and important they have become, and this has all been exacerbated by Covid-19. Amazon sells things people want and they are likely to be in business for a long time. Everyone who has bet on Amazon based on the well-known facts of Covid-19 imprisonment has made great money. They have been right about a well-known fact.

Peloton is an exercise machine and exercise membership business. Investors love how great their business is during the pandemic. However, there is a severe flaw in investor enthusiasm for Peloton. The largest group of Americans (millennials) have been slow to marry, slow to buy houses, slow to have kids and are forced to try and stay in shape in case they ever want to marry, buy houses and have kids. Peloton is a bet, like all the prior devotion to exercise bets, that people will stay imprisoned in their own home to exercise. In our opinion, it is a pipe dream built on bicycle pipes.

The problem with Amazon is the price, which has been put on the well-known fact and what money is left to act on it. RCA was going to completely dominate the radio business in 1929. The stock got crushed from 1929-1932 and never got even until 1953. Disney was a super glam stock in 1972 and got crushed from 1973 to 1982. Microsoft, Intel and Cisco were going to provide the infrastructure for technology and the Internet for the last 20 years in 1999. The well-known fact was that the Internet was going to change our lives. It did, and investors lost 60-80% of their money from 2000 to 2003. Intel and Cisco shareholders have never been ahead of their early-2000 highs. If you’re not good at math, that is 20 years of no price appreciation on a fact that came true.

The millennials and investors seem dumb enough to think that this generation of 30-year-olds won’t end up married with kids and way too busy at age 40 to be devoted to exercise. The Peloton machine will join the elliptical and stair climber in the garage. The membership expense will go towards new shoes for the kids or home improvement. The dad bod will take its ever-present place in our society.