Plus Ça Change

It would be an understatement to say that Americans and broader the population worldwide have experienced several significant events with a profound impact on their lives. Advisors and economists often field questions around prediction of the next economic decline or recession. The Y2K scare, 9/11, the DotCom crash, the global recession of 2008 and, most recently, the Covid-19 pandemic are each etched in our individual and collective memory. Apprehension that the next recession will have as much impact as these events is pervasive.

‘But It's Different This Time...’

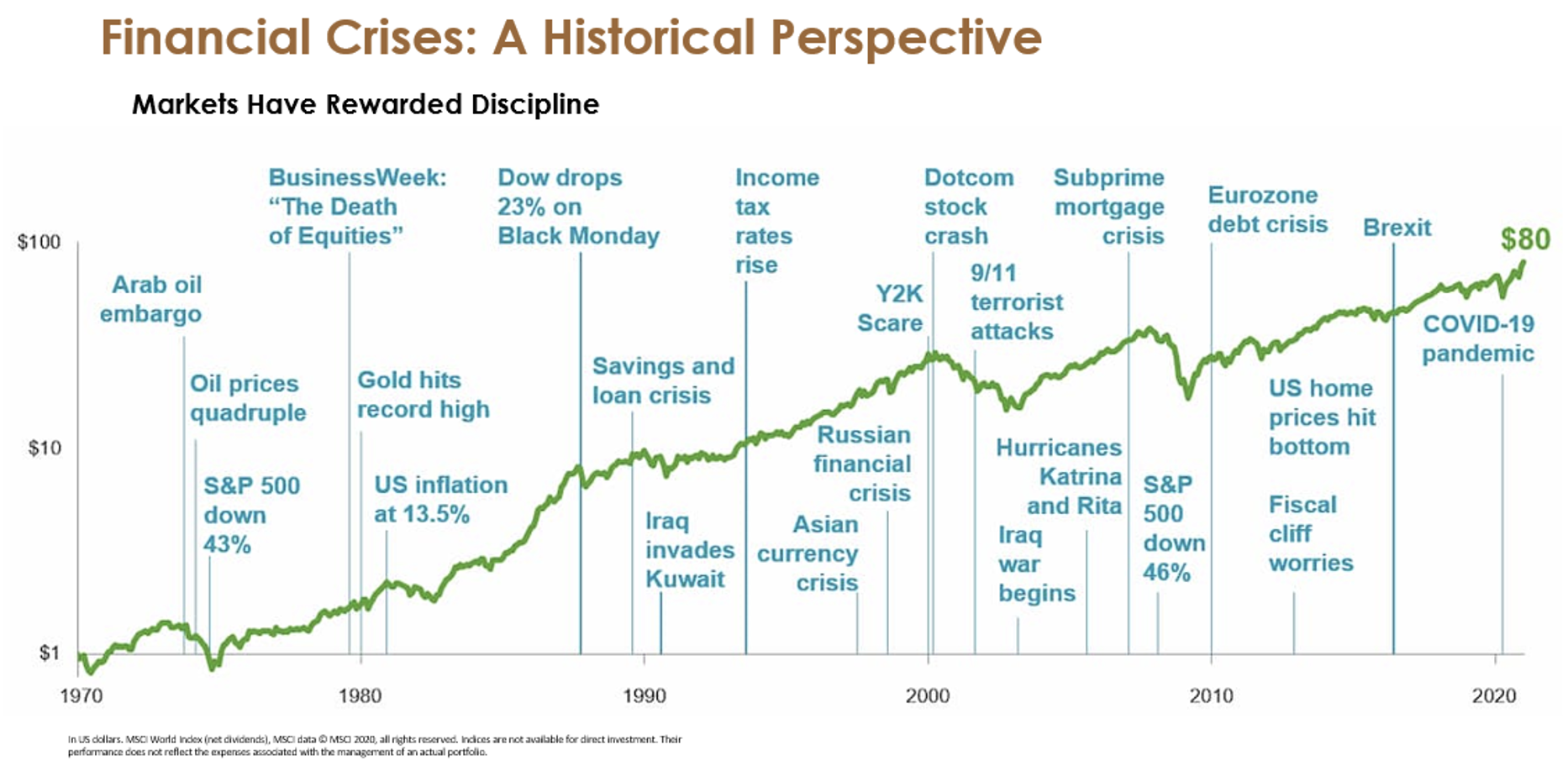

To illustrate how these predictably unpredictable events affect investors, consider this popular chart depicting the growth of the world stock market from 1970 to 2020. The data incorporates major headlines from the period that may lead one to assume that [insert each event here] will trigger an economic decline, prompting individuals to safeguard their finances and avoid the stock markets.

That desire for safety is understandable, but we can challenge this line of thinking by examining the events on the chart starting from the mid-1990s, then working backward, drawing comparisons to our present-day news cycle.

Let us start with the rise in income tax rates in the mid-1990s. It is worth noting that unless legislative action is taken, our current income tax rates are set to increase at the beginning of 2026 upon expiration of the 2017 tax act. Under this scenario, the 12% tax bracket will rise to 15%, the 22% to 25%, the 24% to 28%, and so on. Continuing the headlines, as of early 2022 and ongoing, the world faces geopolitical risk with Russia’s invasion and ongoing war with Ukraine, echoing the Iraqi invasion of Kuwait in the early 1990s. Defaults of Silicon Valley Bank and First Republic Bank in the spring of 2023 created concerns about potential ripple effects within our current banking system, similar to the Savings and Loan crisis of the late 1980s and the Global Financial Crisis of the late aughts. Although the stock market in 2022 did not experience an event on par with Black Monday, the S&P 500 saw 87% of trading days with swings of 1.0% or greater and the VIX volatility index remained above 20 for over 91% of trading days, indicating significant stock market upheaval.

The echoes do not end there. Inflation has been the most prominent headline item since the beginning of 2022, reminiscent of the late 1970s and early 1980s. Since the start of 2022, the Federal Reserve has raised rates to unprecedented levels to curb the current inflation, mirroring the approach taken in 1980 to combat inflation. That led to the highest 30-year fixed mortgage rate of 18.63%, in October 1981. While gold prices may not be in the headlines, Bitcoin has risen by 83.88% from January 1, 2023, to July 1, 2023, consistently generating inquiry to if Bitcoin can be an investment alternative. Continuing through the chart, the decline of the NASDAQ by 33% in the calendar year 2022 falls short of, but does emulate, the S&P 500's 43% fall from 1973 to 1974. Although they have not quadrupled, as oil prices did from 1973 to 1980, gas prices in the United States have increased by 67% from January 2015 to June 2023.

Examples abound that connect these historical events to more recent developments. Arguably the most noteworthy headline from the referenced chart is the August 13, 1979, BusinessWeek declaration of "The Death of Equities: How Inflation is Destroying the Stock Market." Shortly after this publication, spurred by the Federal Reserve's implementation of a rate hike cycle: the S&P 500 delivered an annualized return of 17.88% from 1980 to 1999, while international stocks yielded an annualized 14.26% return, and the U.S. Aggregate Bond Index achieved a 10.04% return during that same period.

Importantly, past performance does not guarantee future results. Nonetheless, it is crucial for prudent advisors and investors to remain disciplined and focus on long-term goals instead of day-to-day or even quarter-to-quarter news cycles. As we ask ourselves, “Is it different this time?” Undoubtedly. There will always be distinct global variables and events that shape our outlook and viewpoint. However, adopting a broader perspective may help alleviate anxiety and uncertainty. As credited to Jean-Baptiste Alphonse Karr, a French journalist and novelist, "plus ça change, plus c'est la même chose": the more things change, the more they stay the same.

Frank Cornett is a vice president and member of Innovest’s Education, Due Diligence, Research, Investment Committee; and Capital Markets Teams.