They say there’s nothing like hearing it directly from the horse’s mouth. And certainly when it comes to growth and marketing, there is nothing like hearing directly from consumers—the people who hire financial advisors.

But we’re often coming up with wrong assumptions and ignoring important things by not listening to the broader audience of present, past and potential future clients. Instead, it appears to me, the conversations and data used by advisory firms often focus on the advisory firms themselves and best practices data gathered within the business community. If clients are ever involved, we tend to gather the opinions of a very biased sample—the people we’re working with now.

That approach has us working in an echo chamber and possibly taking away flawed insights, something that could hurt us if we’re using this information to change or build marketing strategies.

If you’re talking to people already around you—instead of talking to people you’d like to be around—that’s a bit like asking other Americans what their favorite restaurants in Rome are. You might get some good information, but it would be better to ask Romans.

In the last two years, the Ensemble Practice has been surveying different kinds of people: These include those who may become clients of a financial advisor, not just those who already are. We created a sample of 1,000 people with incomes above $100,000. We wanted to hear from those who work with an advisor, who have not yet worked with an advisor, or who had terminated one and never hired another.

Our data suggest there’s a rich opportunity for advisors to grow and reach more consumers. The growth, however, may require examining our generic assumptions: Our potential future clients respond better to more differentiated strategies, things that go beyond asking “How much do you have in manageable assets?”

Men And Women

One of the first things we noticed in our data is a misconception about male and female clients. While men and women are somewhat different in how they approach advisors, they’re not as different as you think.

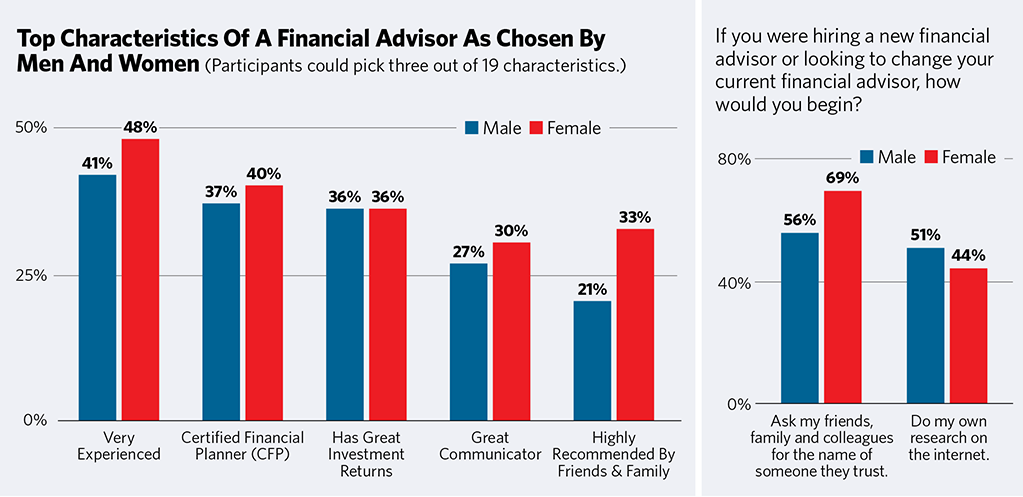

Men and women largely look for the same traits in advisors: We gave survey participants 19 characteristics to choose from in an ideal professional, then asked them to pick their top three. The choices of men and women were very consistent. Both men and women look for somebody very experienced—that’s the overwhelming first choice for both. They also want someone who is a CFP and who has great investment returns. Note that the last characteristic is really discouraging to the planning profession—despite two decades in which we’ve been emphasizing planning, clients still want returns.

The answers start diverging after that, and when we get down to the fourth trait, women start mentioning that they’d like somebody they got through a recommendation. Men start saying they want a “fiduciary.”

What’s almost as interesting is the traits that were not as important to them.

• Female clients did not seem very focused on choosing a female advisor. When given advisor traits to choose from, neither men nor women seem to be focused on gender. Only 6% of women chose “female” as being one of the top three traits of the advisor they wanted to work with (while 3% of males did). This is not to say that it’s never important. A female advisor is more important to female widows and divorcees, But overall, it seemed to be less important in our data.

• Independence does not seem to matter as much. Overall, only 9% of consumers chose “independent” as one of the top three characteristics, and it matters a bit more to men than women (12% versus 6%). We purposefully did not define independent because most advisory firms don’t define it either. Many firms describe themselves as “independent” on their site but don’t say what that means.

• Consumers also don’t care as much if the advisor is published, works with celebrities or has the same hobbies the clients do. All these things were chosen by fewer than 5% of the respondents.