First quarter earnings season kicks off this week with several big banks reporting this Friday, including sector bellwether JPMorgan Chase (JPM). This quarter will seem quite similar to the fourth in terms of growth and drivers, with mega cap technology leading the way. But importantly, the point when the “493” will start contributing to overall profits is drawing closer (the 493 refers to the S&P 500 minus the seven mega cap technology stocks). Here we preview first quarter earnings season, which will benefit from an improving economic environment and continued strength in technology.

Bar Neither High Nor Low

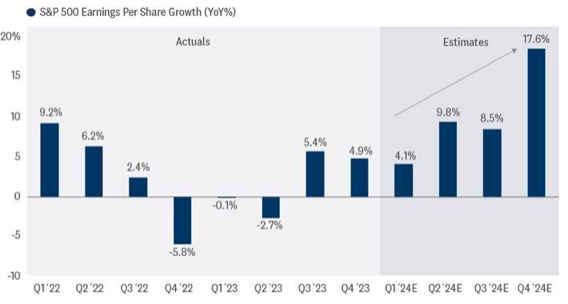

Heading into the last reporting period, the consensus earnings estimate for the fourth quarter came down quite a bit, falling 6.8% between October and December. That low bar helped drive a solid average upside surprise of nearly 5% for S&P 500 constituents. The picture is different this quarter, with just a 2.5% cut to Q1 numbers from January through March, so the bar isn’t as low.

The good news is that the economic environment has been supportive enough that the typical three to four percentage points of upside to current estimates (+3%) is probably reachable, potentially putting S&P 500 earnings per share (EPS) growth for the first quarter at around 6%.

Watch Movement In Expectations For Late-2024 Earnings Ramp During Earnings Season

Most of the data is consistent with a resilient U.S. economy. Since the start of this year, Bloomberg-tracked consensus gross domestic product (GDP) growth has increased from 0.5% to 2.0%. The manufacturing Purchasing Managers’ Index (PMI) from the Institute for Supply Management (ISM) jumped from 47.1 in December to a mildly expansionary 50.3 in March (highest since September 2022). The widely followed Citigroup Economic Surprise Index has jumped from a slightly negative reading in January (-2.4) to a solidly positive 39 on April 1 (no foolin’). And some green shoots are emerging in Europe and China.

Also, consider that sticky inflation supports revenue (inflation is pricing power). Revenue grew 4% year-over-year in the fourth quarter and may match that in Q1. Some inflation also helped via higher commodity prices, as West Texas Intermediate (WTI) crude oil jumped 17% during the quarter and copper rose 3.5%, which should help mitigate earnings declines for the natural resources sectors—though offset some by the double-digit decline in natural gas prices. Artificial intelligence (AI) investments will provide a tailwind again.

But it won’t be easy. The biggest challenge may be the strong U.S. dollar, which rose nearly 3% during the first quarter and will clip non-U.S. earnings. Other challenges include wage pressures, the cumulative effects of inflation and rising interest rates on consumers’ spending power, shipping disruptions from the Baltimore bridge collapse (though late in the quarter on March 26), and the increasing difficulty exceeding expectations as the economic cycle matures.

Putting all of this together, our best guess is about 3% upside and 6% earnings growth. During reporting season, we’ll be watching the ramp in earnings growth reflected in current estimates to identify any movement. A material move downward could remove valuation support for stocks and be a catalyst for a pullback—though likely a modest one that we would expect to be bought based on the supportive macro backdrop.

One Thing Is Clear: It’s All About Big Tech

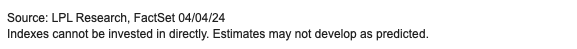

One thing that hasn’t changed from the fourth quarter to the first is that the big technology companies will again do the heavy lifting. Based on current consensus estimates, the five “Magnificent 7” stocks that are expected to report earnings growth in the first quarter are expected to drive all—more than five percentage points—of the increase in S&P 500 EPS for the quarter. Those five are Alphabet (GOOG/L), Amazon (AMZN), Meta (META), Microsoft (MSFT), and NVIDIA (NVDA), while Apple (AAPL) and Tesla (TSLA) are both expected to report earnings declines.

As a group, the Mag 7 are expected to report earnings growth near 40% year over year, while the rest of the S&P 500—the 493—will need to deliver some healthy upside just to match the earnings from the year-ago quarter.

Big Tech Still Dominates Earnings Growth, But Help Is On The Way

What About Margins?

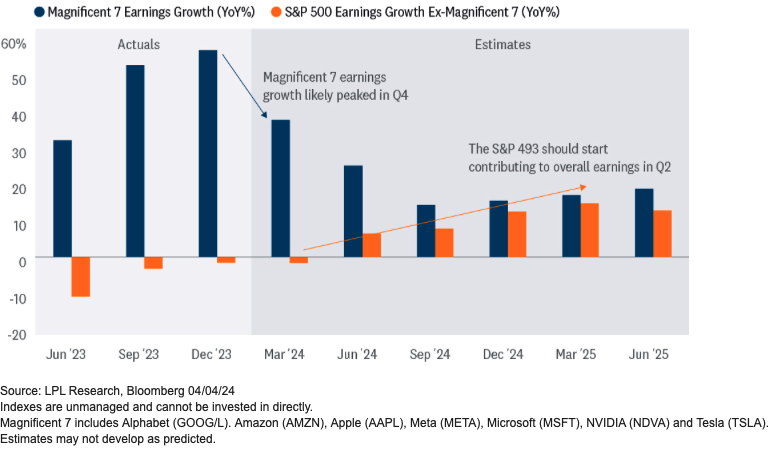

Big tech will certainly play a key role if corporate America is going to deliver upside to the consensus S&P 500 EPS estimate. But margin improvement may also help. Net margins for the S&P 500 are sitting at around 12.2% currently, but consensus is calling for 13.3% in Q3 2024—just two quarters away. If companies can effectively control costs while revenue continues to rise, consistent with the growing U.S. economy, margins should rise this year. A healthy two-point difference between the consumer price index and the producer price index is indicative of a favorable margin environment, while elevated borrowing costs, rising commodity prices, and wage pressures from a tight labor market are among key risks to margins.

Margins Poised To Take A Big Step Forward In Coming Quarters

Trajectory Of 2024 Estimates Is Key To Declaring This Season A Success

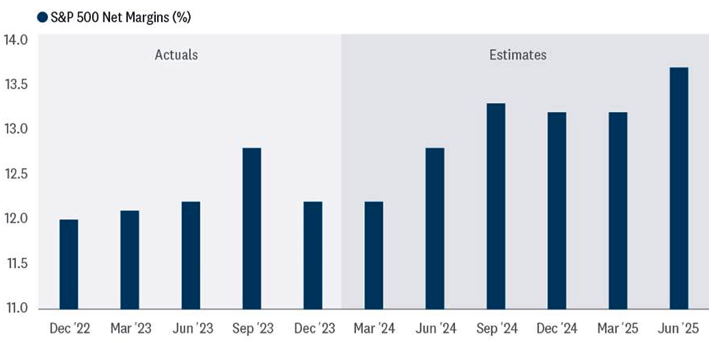

It’s the case every quarter, but we will watch company guidance closely throughout earnings season to help us gauge just how much earnings growth corporate America might be able to produce in 2024.

Estimates have been remarkably resilient over the past several quarters as the economy has surprised to the upside. Given the continued resilience of the economy, executives are unlikely to find much of a reason to cut their outlooks—especially after holding estimates in January and February, a logical time to lower the bar at the start of the new year. If estimates hold up again this quarter, markets are likely to react positively to results. AI spending should help prop up estimates, though currency headwinds have stiffened.

So, for now, we’ll keep our 2024 and 2025 S&P 500 EPS estimates at $235 and $250, respectively, both reflecting growth in the mid-to-high single digits and below current Wall Street consensus estimates at $242 and $275. However, we recognize that corporate America could do better, and our bias is to likely raise those forecasts pending final results. Earnings growth rates are getting a boost from inflation-driven pricing power, ongoing fiscal stimulus, healthy job growth, AI investment, and easy comparisons in the healthcare and natural resources areas.

Earnings Estimates Continue To Hold Up Very Well

Conclusion

The economic environment and AI investment remain supportive of corporate profits, so downside surprises this earnings season seem unlikely. Expectations for economic growth have firmed recently while earnings estimates have remained steady, an indication that the bar is not too high or too low. The big tech companies will generate strong profit growth again, while the rest of the market, the so-called “493,” is moving in the right direction.

Bottom line, expect corporate America to produce typical upside relative to expectations in the quarter and deliver S&P 500 earnings growth of around 6%. Estimate cuts are probably not in the cards, though currency headwinds may temper companies’ outlooks a bit.

Jeffrey Buchbinder, CFA, is chief equity strategist at LPL Financial.