We have a question to ask you: when it comes time to buy, will you?

It’s fair to guess that you will not want to buy when it comes time to buy, so the question really is: do you have a process and, importantly, the discipline to do it?

What Just Happened?

On a daily and even hourly basis, investors and every day citizens are worried, and they are struggling to determine what the COVID-19 virus means for their personal health and their personal finances. With no shortage of uncertainty, a rush to the exits has fed all forms in a swift and scary global sell-off of stocks. Like the undefeated team finally losing at home, the longest bull market in history has stunned its fans and sucked all the enthusiasm out of the rest of the season.

If a bear market means a 20% drop from a high, there can be no debate we are now firmly in a bear market. Fear shrinks lives and it also shrinks investment portfolios, this time to the tune of a 30% loss in stock market value in 18 trading days in a selling frenzy that many seem to worry is bottomless.

As the uncertainty sinks its claws in deeper, it should be no surprise that corporations are beginning to face very real contractions in sales and earnings, and therefore cuts for 2020 earnings estimates. Ten weeks ago, heads of U.S. corporations were printing 8% to 9% year-over-year earnings gains for 2020, but those numbers have been chopped. Indeed, some companies have added to the confusion by excising any 2020 earnings estimates at all, making it that much harder for market participants to get any clarity or “2020 vision.”

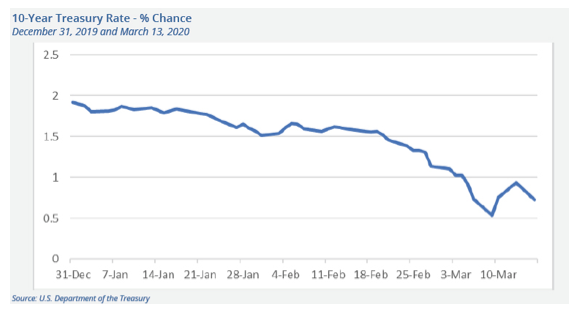

We have many examples of the rampant investor fear, including this one: investors are clutching to find their security blankets, snatching up Treasury bonds. The heavy demand for safety is pushing Treasury bond prices up and yields down. Earlier in March and for the first time ever in the history of the United States, the yield on the 10-year Treasury fell below 1%. In fact, that yield has remained doggedly below that key level for most of March.

It feels quite easy to hit the sell button, which is why we ask again: when it comes time to buy, will you?

A Process For Selling

Right now, our portfolios are sitting on a whole lot of dry powder after acting in an orderly way on sell signals that our rules-based discipline generated in late February and into early March. Here is a brief summary:

• In the 7 days from February 19 through February 28, all our stops were hit for U.S. and international stocks resulting in a total exit during that period (with those asset classes careening down another 15% in March so far).