Over the last five years, the fund has captured 86.3% of the upside of the Russell 2500 Index, a benchmark for small and mid-cap stocks, but only 68.7% of its downside. The fund’s five-year standard deviation (a measure of volatility) is 9.76%, while it’s 11.23% for the fund’s Morningstar peers. Over the same period, the fund’s 1.43 Sharpe ratio (a measure of risk-adjusted return) is well above the 1.10 for the category average.

“We tend to underperform the benchmark when the market is going straight up and stocks with high price/earnings ratios are leading the pack,” says the 59-year-old Jones. “On the other hand, the fund usually outperforms in slack or down markets.”

To cover a range of different stock market scenarios, the fund’s holdings fall into one of three categories that provide uncorrelated sources of potential alpha. The mispriced growth portion of the portfolio, which can range from 50% to 70% of equity assets, concentrates on stocks whose prices understate the growth potential of their companies.

While these names tend to earn the highest returns for the fund in rising markets, they may be less resilient in negative market environments. Steady eddies, which make up 20% to 50% of the fund, are companies with stable growth characteristics, such as recurring revenues and strong cash flows. While their growth rates are typically not as high as those of the mispriced growth stocks, they tend to have more consistent earnings and hold up better in declining markets.

“Turnarounds,” which account for 0% to 20% of fund assets, are stocks of companies that have suffered some type of misfortune and have been punished by overwrought investors, even though they have the potential for improvement. Their performance is less predictable than that of the other two groups when taking overall market conditions into account, but they can pep up performance if a turnaround materializes.

Jones crafted the strategy decades ago; she had realized that market inefficiencies in small caps provided better opportunities for active management than more widely followed large caps, yet she didn’t like smaller companies’ higher volatility. She decided to invest in a way that combined companies with different investment characteristics and risk profiles in order to capture the benefits of active management in small caps without the same risks.

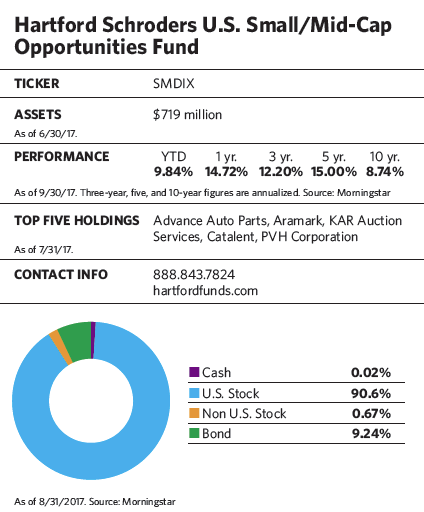

The proportional mix of the three categories at any given time reflects her views of which companies will do well in a particular market environment, as well as where she sees the best values. Before the market downturn in 2008, for example, the percentage of the portfolio invested in steady eddies was relatively high as the consistency of their earnings and their high free cash flows trumped high growth as desirable attributes in a frothy market. That year, the fund fell about five percentage points less than the Russell 2500 Index, and about seven percentage points less than its peer group in the mid-cap blend Morningstar category. In the world of small and mid-cap stock investing, Jenny Jones’s investment style is a study in contrasts. On the one hand, she operates in a universe that is known for its volatility and unpredictability. On the other, she has managed to navigate that universe with a steady and consistent hand for over 20 years by selecting good stocks, enforcing strict buy and sell disciplines, and being mindful of how portfolio constituents play against one another. Since 2006, that mind set has guided the fund she manages, the Hartford Schroders U.S. Small/Mid Cap Opportunities Fund (SMDIX), through bull and bear markets to outstanding risk-adjusted returns and a notable resilience during tough market times.

In the world of small and mid-cap stock investing, Jenny Jones’s investment style is a study in contrasts. On the one hand, she operates in a universe that is known for its volatility and unpredictability. On the other, she has managed to navigate that universe with a steady and consistent hand for over 20 years by selecting good stocks, enforcing strict buy and sell disciplines, and being mindful of how portfolio constituents play against one another. Since 2006, that mind set has guided the fund she manages, the Hartford Schroders U.S. Small/Mid Cap Opportunities Fund (SMDIX), through bull and bear markets to outstanding risk-adjusted returns and a notable resilience during tough market times.

When Tough Times Hit, This Fund Doesn’t Quit

November 1, 2017

« Previous Article

| Next Article »

Login in order to post a comment