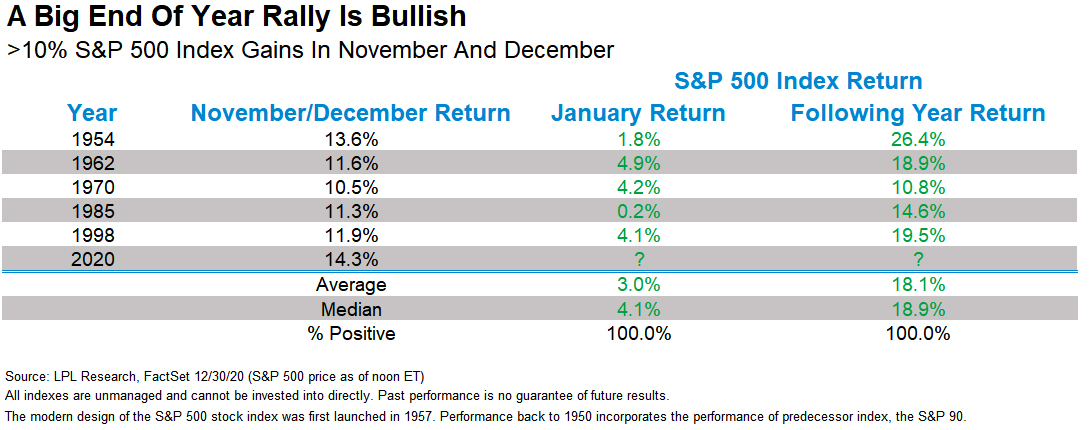

A 10%-plus gain the final two months of the year has led to a higher S&P 500 the following year every time since World War II.

Welcome to the last day of 2020! It has been a devastating year in so many ways, yet for investors it has been quite rewarding. Much of the gains in 2020 have taken place in the final two months, with the S&P 500 Index up more than 14% in November and December so far, the best end to a year since WWII.

A big end-of-year rally could have bulls smiling in 2021.

Turns out a 10% or more gain the final two months of the year has equaled a higher S&P 500 the following year every single time since World War II. In fact, January was also higher every single time as well, so maybe this strong rally to end the year is a clue for higher prices into next year.

As shown in the LPL Chart of the Day, the S&P 500 gained an average of more than 18% the year following a 10% or more surge during the final two months of the year. Meanwhile, January was up 5 for 5 as well, rising an impressive 3% on average.

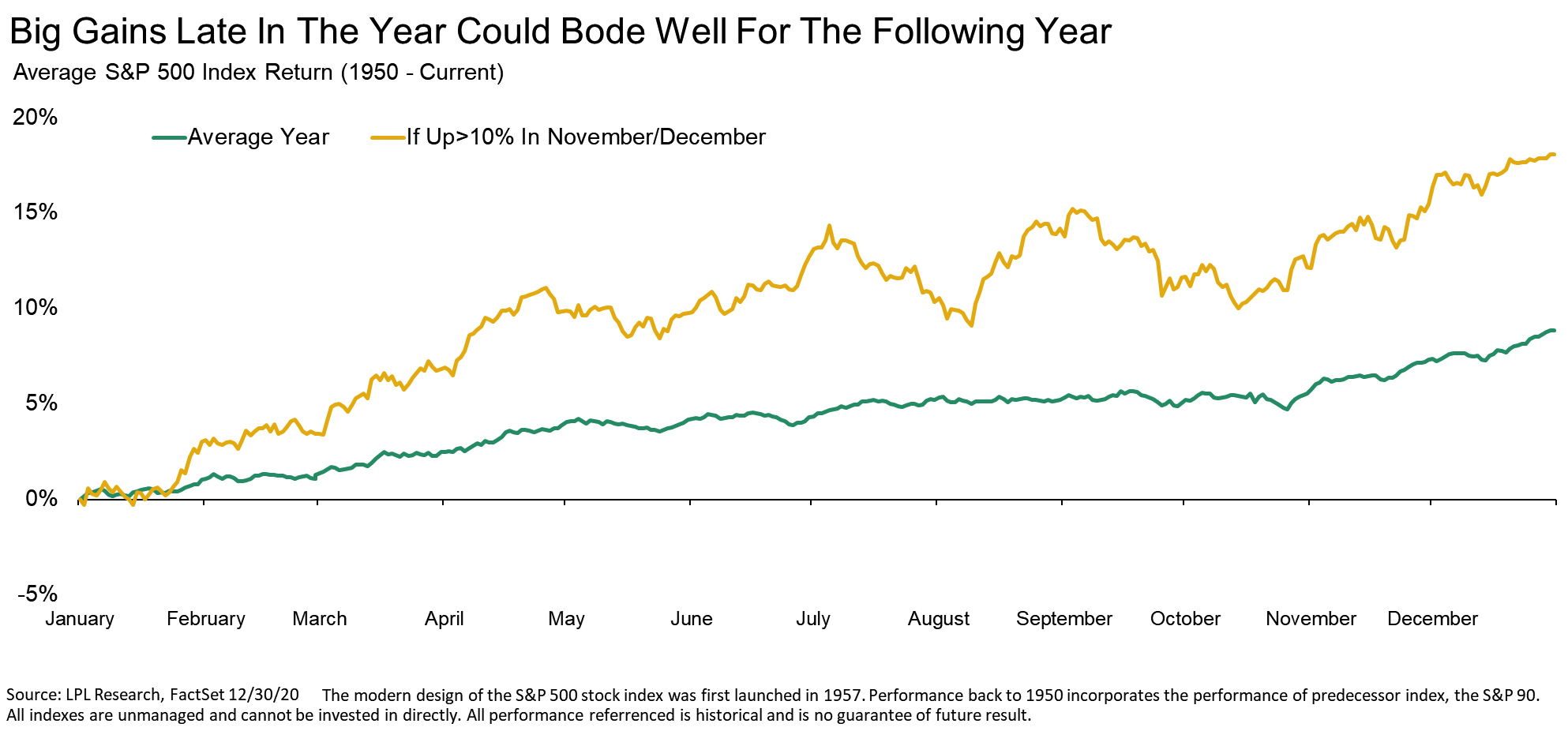

Here’s what the average year looks like after the prior year gains 10% or more the final two months compared to a typical year. Once again, strong returns are the playbook historically.

We wish everyone a happy and safe New Years Eve and we’ll see you in 2021!

Ryan Detrick is chief market strategist for LPL Financial.