Remind the client that…“it’s my job to discuss ways to help protect and grow your assets, not watch them decline.”

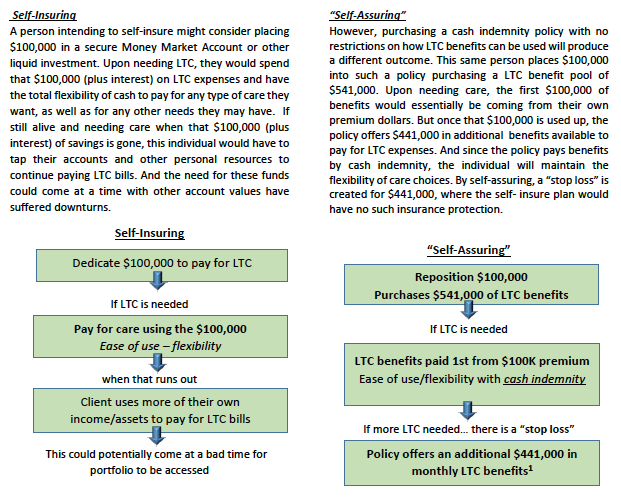

Affluent clients may find a discussion centered on protecting the portfolio to be of more interest. It all comes down to how to “self-insure.” Agree with your client that they can afford to self-insure, but then add that there is more than one way to self-insure and you would like to show them a more cost efficient way to do it. Have your affluent client think in terms of “SELF-ASSURE” instead of self-insure.

LTC solutions will be dictated by assets or income the client may have available and/or other financial needs the client should address. The client may have more need of life insurance coverage now with a need for LTC funding later. Or the client may be in a position where LTC specific coverage may be more appropriate. There are LTC solutions in the market place that can handle the various combination of needs your client may have.

Let’s look at an example using a cash indemnity linked benefit policy and how it would play out in a self-insure scenario vs. a self-assure scenario. This example uses smaller numbers for simplicity, and assumes a 55-year-old female, couples rate, non-tobacco, 6-year benefit duration, and no inflation option. (Stated benefit amounts are based on hypothetical examples, and actual benefit amounts received will vary with changes to age and ratings.)

Summary

When discussing long-term care with affluent clients, the key to a successful conversation ending with your client taking action may be to center the discussion on portfolio success and the use of insurance that can help protect the portfolio with a “stop loss” against LTC expenses. By doing so, you can help lead them through the back door to purchasing LTC coverage.

Shawn Britt, CLU, CLTC, is the director of long-term care initiatives for Nationwide Financial.