c is the storage cost; and

y is the convenience yield

As we can see, the higher the short-term rate (r), the larger the difference between the spot price and the futures price – and thus the lower or more negative the commodity’s roll yield, all else being equal. However, that is for an unfunded investment; at the same time, a high short-term rate will also increase the yield earned on the collateral backing the commodity futures. The two are offsetting: As the short-term rate moves higher and creates lower roll yields, it also increases the return on the collateral. Given this direct link, we believe the short-term rate and roll yield should be considered together when estimating commodity carry.

Case Study: Gold

Gold provides a good illustration of the direct link between commodity roll yield and the short-term rate, given its minimal storage costs and typically low convenience yield. We looked at the backdrop for gold in two very different market environments: 2006 and 2012.

As Figure 1 shows, the roll yield figures alone suggest that headwinds for gold futures investors were much greater in 2006 than in 2012: In 2006, short rates were north of 5 percent, and the roll yield was similarly negative. So, should the hypothetical investor of 2006 avoid gold futures because the roll yield is negative? What if they were to purchase physical gold to avoid the negative roll yield?

This example reinforces the importance of comparing assets on a like-for-like basis. In the futures market, an investor is gaining exposure without putting up the full notional amount of the asset, so we must give credit for the ability to invest that excess cash. In the example above, once we factor in the offsetting impact of the short-term rate (i.e., Libor), the effective carry is essentially zero. And because physical gold also essentially has a yield of zero, the choice between owning gold futures and owning physical gold is a wash. (We would argue that even though gold pays no coupon, its price has historically kept up with inflation. Thus, it would be most accurate to say its real yield is zero, in our view.)

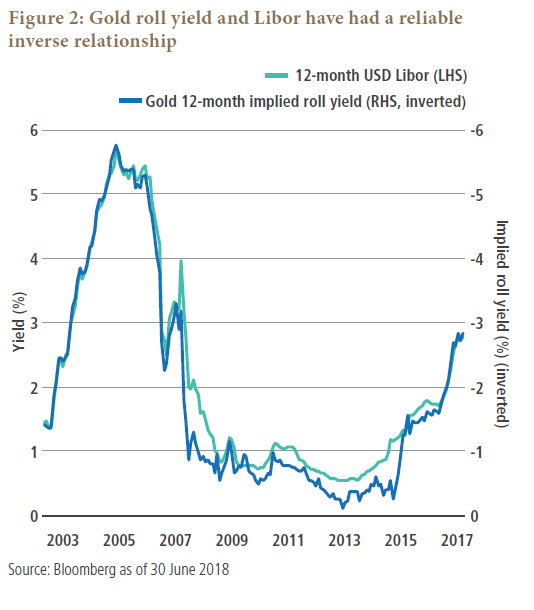

Notably, the carry is the same for gold futures in both 2006 and 2012, once the short-term rate (Libor) is factored in. As Figure 2 shows, the strong negative correlation between Libor and roll yield for gold has held up well over time, and the carry has been essentially zero quite consistently.