There is no shortage of research on the benefits of dividend investing. The most tangible benefit is the consistent occurring cashflow that comes into a portfolio as dividends are paid. Investors not only benefit from compounding over time, but their portfolio may benefit from lessened swings in value due to the consistent inflow of dividend payments.

Our experience has shown that when choosing dividend payers, there are three important characteristics when choosing companies.

1. Go Beyond Yield

2. Dividend growth leads to better governance and company quality

3. A company’s risk profile is always changing

Look Beyond Current Yield

The last several years have seen a dramatic shift in the interest rate landscape. In March 2009, the Federal Reserve began Quantitative Easing. On April 1st, 2009, the U.S. 10-year Treasury yield stood at 2.65% and the S&P500 had a yield of 3.43%As of Aug. 31, 2020, the U.S. 10-year Treasury yields 0.69% and the S&P500 had a yield of 1.56%. Investors have responded to this “scarcity of yield” by focusing on yield-oriented equities over the last decade plus.

Typically, to find yield, investors have historically focused on sectors that demonstrated “constant demand,” which many investors perceived as helping to offset some uncertainty. Those higher than market yields and demand characteristics are typically found in Consumer Staples and Utilities. On April 1, 2009, the yields in those sectors stood at 2.68% for Staples and 4.74% for Utilities respectively (Historical yield data for the S&P500, U.S. 10-year Treasury, Consumer Staples and Utilities sectors provided by Factset Research Systems). Investors perceived these sectors as “defensive” as the population consistently need to eat and power their homes. Given the mature nature of these sectors companies that reside within them tend to have slower growth and higher yields. It is also not uncommon to find dividend growth rates of 2-4% in these sectors as they tend to grow along economic growth rates. While yield is important, the growth of dividend cannot be understated.

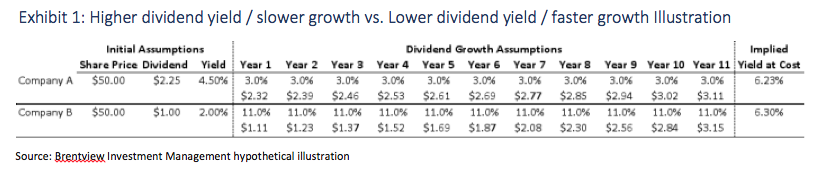

Below in Exhibit 1 is an example of two companies that both pay an annual dividend. One company offered a yield that was substantially higher than the other, however, the higher yielder also had a slower dividend growth rate. As you see below the lower yielding dividend grower provided the strongest propulsion towards compounding. Over this timeframe, the 2% yielder ended up having a higher yield at cost (cash dividend divided by original cost basis) over the 4.5% yielder. More importantly the cash flow from the lower yielder more than doubled during that timeframe whereas the higher yielder only grew by 38%. If investors were seeking a dividend payer in March 2009, they were most likely drawn to the higher yielder.

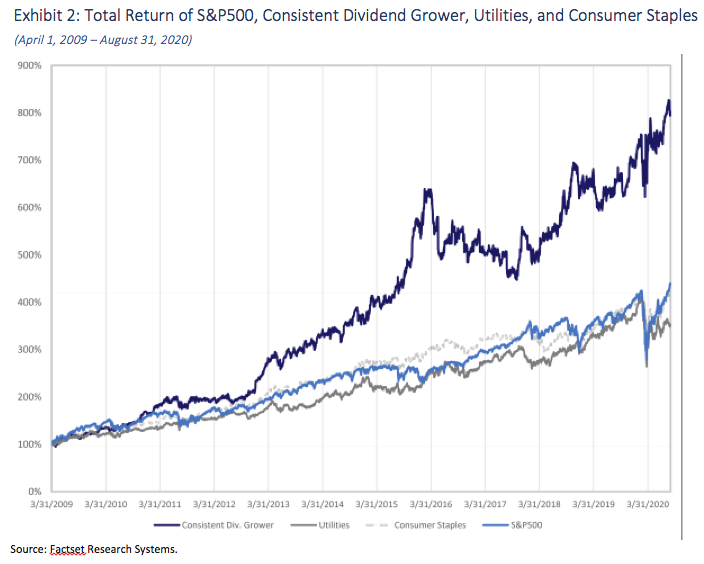

To underscore the importance of company selection, Exhibit 2 shows the total return performance of the S&P500, Consumer Staples, and Utilities. Also inserted is a consumer staples company that demonstrated 11% consistent dividend growth since 2009. This same company had almost the same characteristics in the previous example. The yield for this company was 2.38% on April 1, 2009, which was not only lower than the Consumer Staples Sector but also much lower than the S&P500.

When selecting companies, the importance of underlying fundamentals, which drives dividend growth, is especially important.

Dividend Growth Leads To Better Governance And Company Quality

The 1990s are frequently used as an example of a speculative bubble that exceeded expectations, specifically in the “dot-com” oriented internet companies. Executives of these companies were heavily incentivized via stock option benefits to run their respective businesses to increase the market value and grow the stock price. Increasing company franchise value is the goal of every business owner. However, the short-term nature of stock options, which can expire worthless, created an incentive that was misaligned with longer-term stockholders. For example, the shareholder friendly act of paying a dividend makes stock options worth less as option pricing requires that the value of the dividend payments is subtracted from the value of the option. Needless to say, not many corporate managers would willingly take this action as it negatively impacts their net worth!

As a result of this mismatch, management teams became more focused on short-term objectives versus building businesses that were built to last for the benefit of shareholders. The bursting of the dot-com bubble showed that managers needed an alignment in incentives. Expediting the changes in option issuance came from the Financial Accounting Standards Board; FAS123R, which was an accounting rule that mandated expensing options against income as opposed to footnoting. Enter the concept of RSUs, restricted stock units.

Ever since the decade of the ‘90s the utilization of restricted stock units has grown in utilization and stock options, while still used, have diminished. The compensation change now drives management decisions that are longer-term in nature and aligned with shareholders. Additionally, the issuance of dividends and growth of dividends are both incentivized. The main reason is that dividends are received by RSUs as well and are no longer a detractor as they were in the stock option era. While executive compensation is important from a governance perspective, the use and deployment of capital may also impact facets of company quality.

Companies have several ways to deploy their capital. A company can reinvest in its business via acquisitions, capital expenditures, share buybacks, or paying a dividend. Among those three items a cash payment, such as a dividend, is a significant commitment to shareholders as it is recurring over time and is a cash payment to every shareholder. Share buybacks may be announced but may not be fully implemented or implemented at all. Committing to dividend growth is an even larger pledge to shareholders. Why? Because in order to deliver growth of that dividend, companies have to institute cost controls and operational governance that leads to better consistency. The operational consistency flows through towards consistent dividend growth and is derived from a well-run company.

Company Risk Profiles Evolve And Change

Finding a solution to address rising volatility many investors flocked to exchange traded funds or stock screens to find “Low Beta” stocks. Beta, like standard deviation, is a measure of risk. In the case of beta, this factor measures the sensitivity of one security to the broader market, for example the S&P500. If a security has a beta of 0.80, it has 80% sensitivity to any change of the S&P500, which is assumed to have a beta of 1 since it is the market benchmark. For example, if the S&P500 were to decline by 1%, the company with a beta of 0.8 should decline by 0.80%, all things being equal.