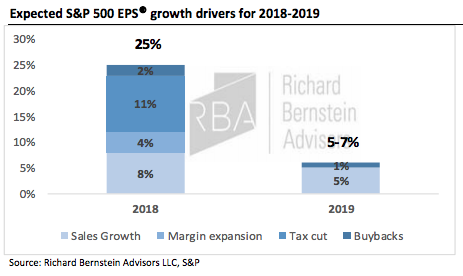

At RBA, we expect S&P 500 corporate profit growth to slow from roughly 25 percent in 2018 to mid-single digits (~5-7 percent) in 2019. We have gotten some questions as to what exactly will drive the slowdown. The main driver is the absence of the two biggest contributors to last year’s impressive growth: (1) corporate tax cuts and (2) the doubling of energy sector profits as oil prices recovered. Excluding those benefits, S&P 500 reported EPS growth would have been closer to 9-10 percent rather than 25 percent. The rest of the deceleration to 5-7 percent stems from (1) slowing economic growth—as was widely reported this week, the IMF expects global GDP growth to slow from 3.7 percent in 2018 to 3.5 percent in 2019 while the United States slows from 2.9 percent to 2.5 percent—and (2) the stronger U.S. dollar (up 8 percent vs. a year ago), along with some potential increases in input costs (e.g. labor, tariffs). Where could we be wrong? Upside risk: global growth reaccelerates and/or trade issues get resolved. Downside risk: policy uncertainty causes activity to freeze up. (Either way, it could change the growth number but it won’t change the trend.)

Our research suggests that markets continue to appreciate as the profit cycle slows, but higher quality companies with more stable earnings and cash flows tend to outperform because investors increasingly avoid the companies who are most negatively impacted by the slowing economic and corporate profit backdrop. While the recent rebound in oversold markets has benefitted beaten-down high beta cyclicals, it seems highly unlikely that cyclicals would be able to outperform for a prolonged period if growth does continue to slow.

Dan Suzuki, CFA, is a portfolio strategist at Richard Bernstein Advisors.