How Do They Choose?

There are three steps that people take in choosing an advisor:

Exploration: When they have the interest in advice (but not yet the intention to act), people begin collecting information. During this stage, they ask around and compile a list of firms to check out. They also do some basic research on how to choose an advisor, what questions to ask and what to expect. Many consumers may not get past this stage and fail to act on that initial interest.

Whether your firm appears on somebody’s exploration list depends on its reputation and people’s awareness of your brand.

Examination: During this stage, people have compiled the list of names and begin to connect with potential advisors, performing due diligence. They will contact firms to talk and exchange information. They’re also likely to conduct their own research by reading through an advisor’s website and social media and by seeking references. A firm’s ability to respond to inquiries in a timely and compelling manner, as well as the results of the individual’s behind-the-scenes research, determine whether an advisor gets examined at this point. An advisor’s success in this stage is a function of their sales process and skill.

Determination: In the last stage, the consumer chooses the firm they like best and engages in some level of contracting, setting expectations and negotiating price and other parameters of the engagement. An advisor’s success in the determination stage is a function of their responsiveness and negotiation skills.

These three stages are not always distinct. Consumers may perform them simultaneously and not in a very systematic manner. In fact, when they select an advisor, in 35.6% of cases they look at only one.

The Exploration Stage

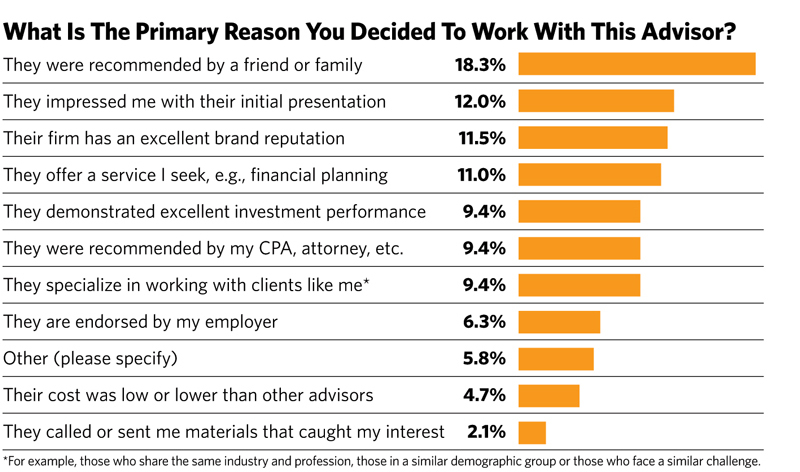

When looking for an advisor to trust, people mostly seek out the recommendations of people they know. When asked how they first heard about their advisor, 38.2% of consumers said the names came from friends (18.3%) and family (19.9%). Another 13.1% of the clients said they were engaging the firm for some other service and then added financial advice later. Some 9.9% got the names from online searches and 10.5% said it was some other resource. Notably, CPAs and attorneys did not play a significant role as referral sources in the survey, perhaps because many already offer advice as part of their distribution strategy.

These results indicate that advisors who want to be considered in the exploration stage most of all have to impress their existing clients. While advisors should not perhaps be explicitly asking for referrals (only 12.0% of referrals originate this way), they should be asking questions such as: “Who are your closest friends?”

The decision to seek an advisor in the first place is not driven by a single event. Of the consumers surveyed, 17.8% cannot identify any specific occurrence or challenge that sparked their search. The most discernible reason, named by 15.7% of them, was that they felt some general anxiety over their ability to meet their goals. And it’s also significant that 11.5% said they were urged by others to seek out help.