The Disappointed

As much as the survey results reveal a lot of opportunity for advisors in the future, the data also shows that we have already disappointed many potential clients. Again, nearly a quarter of consumers (23.9%, to be exact) have left an advisor and have no immediate plans of coming back.

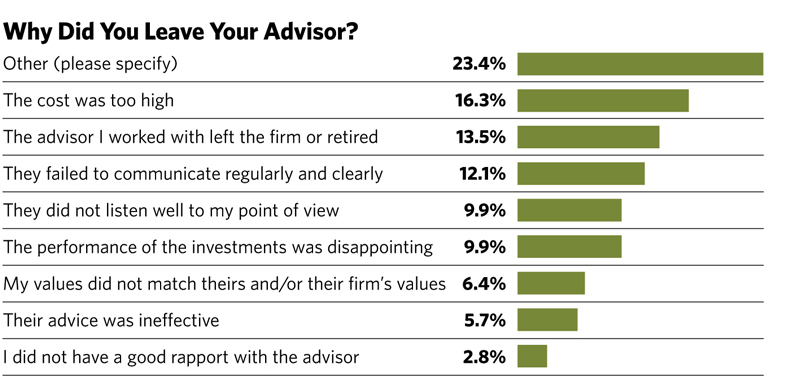

These disappointed consumers left for a variety of reasons, from their advisor’s failure to communicate (12.1%) to poor performance (9.9%) or a mismatch of values (6.4%) to the perception of high costs (16.3%). Most commonly, there was just a general sense of dissatisfaction with the relationship (this is how we interpret the “other” response selected by the 23.4% of those surveyed).

Notably, 13.5% of the respondents left when their advisor retired or changed firms. As we already know, clients value both their advisor and the firm’s brand. When advisors leave and consumers are asked to choose between them and the firm, many elect to leave the relationship entirely.

Still, many consumers who have left may be willing to find someone else. Only 12.1% of the “disappointed” say there is no event or circumstance under which they would seek the help of a financial advisor again.

The Available

While “the available” group of consumers, those currently without an advisor, are not as rich, they do have wealth—11.2% hold investable assets worth more than $1 million. This group is a bit younger and more likely to be female. Women represent 52.3% of respondents without an advisor, while they make up 45.5% of respondents who do have one. The group of available consumers can also be high earners: 18.6% have household income of more than $200,000.

When asked why they don’t have an advisor, 21.7% of those in this group say that most of all they lack the time and knowledge required to select one. That represents a great opportunity for the industry. Some of the customers in the “available” category are also worried about the cost of engaging an advisor (a problem named by 16.7% of them), while others worry about fraud and the risk of bad advice (cited by 14.7% of this group). Again, these problems present great opportunities for outreach.

As many as 15.1% of available consumers have some interest in seeking an advisor in the next 12 months. That said, these consumers are not exactly low-hanging fruit. Only 5.0% believe they are “very likely” or “most likely” to seek advice.

No Pied Piper

Though most people don’t have advisors, there is no Pied Piper strategy for leading them into a professional advisory engagement. People have diverse needs, and many things drive their behavior. Still, the opportunity for advisors to double in size is there to be had, and the fundamental principles of success hold true: invest in your existing client relationships and your brand, and broaden your reach to capture consumers who are female, younger and perhaps not quite wealthy yet.

Philip Palaveev is the CEO of the Ensemble Practice LLC. He’s an industry consultant, author of the books G2: Building the Next Generation and The Ensemble Practice and the lead faculty member for the G2 Leadership Institute.