There’s a frequent warning made in recent years to investors seeking to pressure companies to offload their fossil fuel assets: If listed businesses don’t own those mines, they’ll go over to the dark side.

Polluting businesses sold to private equity may continue to “operate under new owners in the shadows,” former U.S. Vice President Al Gore warned in the Financial Times last October. PE firms may be facing “the bonanza of a lifetime” if they invest in coal assets right now, Vale SA executive Luciano Siani Pires wrote in a LinkedIn post this month, saying that such businesses accounted for most of the potential “western” buyers who signed up to look at the books of its Mozambique coking coal assets.

“Precisely because coal-related assets have become toxic for listed companies, private equity firms are hunting thermal coal power plants and coal mining properties across the world at bargain prices,” Siani wrote, “aiming at juicy returns, as they do not have ESG-minded constituencies to attend to.”

It’s hardly surprising if someone selling coal mines claims they’re a great opportunity for buyers, but there’s lots that’s superficially plausible about the theory. Since the middle of last July, the lowest price at which benchmark coal futures at Australia’s Newcastle port have changed hands has been higher than their record in any other period. Glencore Plc’s industrial energy unit—essentially a group of coal pits—will report $4.7 billion of Ebitda in 2021, the second-highest figure in the company’s history, according to Morgan Stanley estimates.

It’s also a useful bogeyman for miners wanting to keep those pesky ESG teams from their shareholders—and, increasingly, lenders—at bay. If listed companies are pushed to sell off their fossil fuel assets, perhaps there’s a sinister pile of private equity money out there that will operate them in a far more nefarious way?

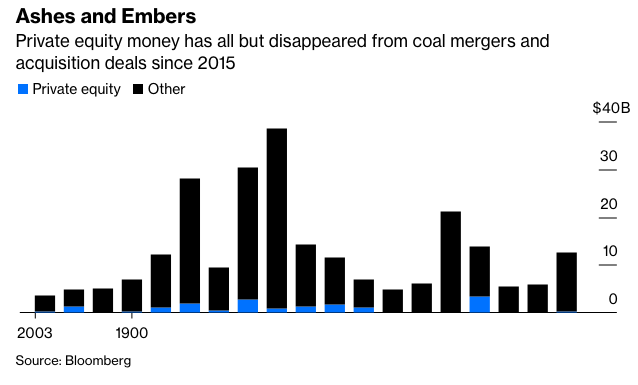

The truth is different. Far from exploding in the five years since big mining companies started selling out of thermal coal, private equity activity in the sector has very nearly ground to a halt. Of the $70 billion of coal deals since the end of 2014 for which Bloomberg has data, PE accounted for just $3.63 billion — nearly two thirds of that amount a single deal for the last of Rio Tinto Group’s coking coal mines.

The abortive second act of one of the coal industry’s most storied dealmakers is instructive. As Chief Executive Officer of Xstrata Plc in the 2000s, Mick Davis spent billions on buying cast-off pits to build the world’s largest coal export business, before selling the lot back to Glencore as part of their 2013 merger and listing. He then launched private equity firm X2 Resources to repeat the trick, as well as looking at other commodities — but despite raising $5.6 billion, the fund closed three years later without spending a cent. Davis’s current venture is looking instead at minerals “essential to the clean energy transition,” according to its website.

PE firms will always want to have a look at potential deals, but it’s not hard to see why they so rarely follow through with solid fuel. While they’d like to get a taste of the ample cashflows that coal businesses are generating right now, most of that money gets eaten up by the bank lenders who provide the leverage that fuels buyout deals.