The fact that a sizable proportion of the wealthy are philanthropic translates into significant revenues for wealth managers and the aligned providers from trust companies to administrators. Some lawyers and accountants are also regularly part of the process. Most importantly, when professionals can help the wealthy most capably support the causes that matter to them, the biggest winners are the clients and the charities, followed closely by the professionals involved.

This is all good. However, there is a flaw. Many wealth managers are not doing a very good job of helping their wealthy clients be philanthropical in ways that matter most to them. The result is the wealthy are poorly served, charities are supported at a lower level and wealth managers miss meaningful business opportunities.

Philanthropic Wealthy Investors

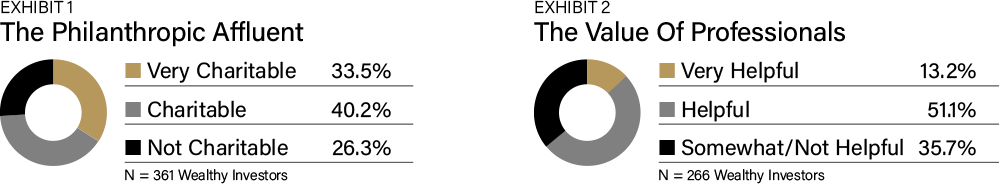

For various reasons, wealthy investors are philanthropic, defined as having $10 million or more in investable assets. They are concerned and supportive of different charitable causes. In combining the empirical results of 167 wealthy investors conducted in 2011 with a similar survey of 194 wealthy investors undertaken in 2017, we find that a third say they are very charitable, another two-fifths identify themselves as charitable, and about a quarter say they are not currently charitable. Even those wealthy investors who did not say they were charitable reported giving to charities because of circumstances.

Of the 266 wealthy investors who reported being very charitable or charitable, half said the professionals they worked with were helpful (Exhibit 2). Meanwhile, 35% reported the professional being somewhat or not helpful, and only 13% said they were very helpful.

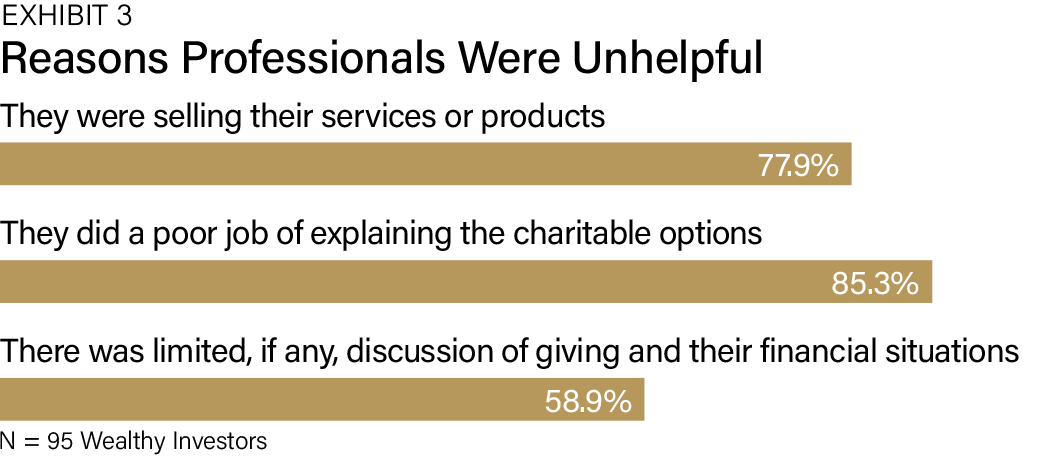

The reason wealth managers were somewhat or not helpful was because they did a poor job of making wealthy investors central to the process (Exhibit 3). Three-quarters of these wealth managers were seen as selling their services or products. This correlates highly with their poor explanation of the various available charitable options. Also, much of these discussions were done in a vacuum as they failed to consider their wealthy investors’ more extensive financial situations.

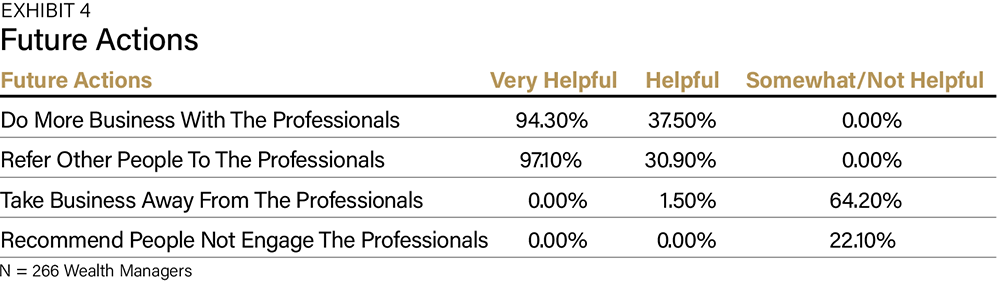

For wealth managers looking to grow their businesses, there is a stark difference between those who were characterized as very helpful and those who were not (Exhibit 4). Wealthy investors have or will do more business and likely refer clients to their wealthy managers when they see them as very helpful. Meanwhile, helpful wealth managers will not get the same business development efforts from their wealthy philanthropic investors. For those that are somewhat or not helpful, their wealthy investors will likely pull business away and speak poorly of them to others.

The data could be more current, and a larger sample would also be helpful. Still, the consistency of these research findings, coupled with extensive experience in the trenches, means that the conclusions are relevant today.

Wealth Managers And Their Philanthropic Clients

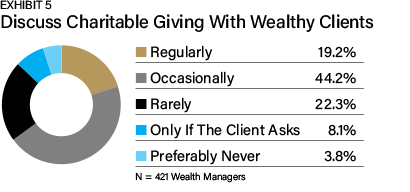

In a 2023 survey of 421 wealth managers, 20% say they regularly bring up charitable giving with their wealthy clients (Exhibit 5). Another 45% will discuss charitable giving occasionally. A quarter will do so rarely. Eight percent will only do so if the wealthy client brings up the matter, while half that number avoids the topic.

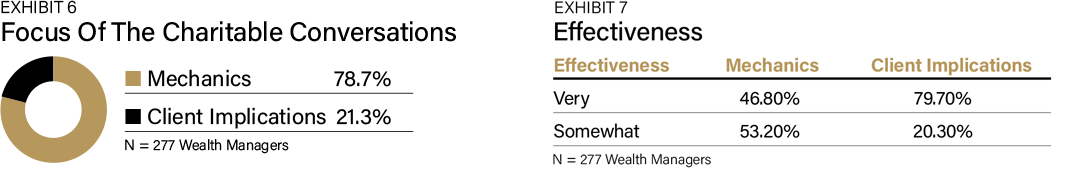

It is possible to statistically segment the wealth managers who discuss charitable giving regularly and occasionally into those who focus on the mechanics—how the philanthropic gifts work—and those who focus on client implications—how the charitable gifts might fit into the lives of the wealthy investors (Exhibit 6). There are four times more wealth managers in the mechanics segment than in the client implications segment.

Based on self-report measures, the wealth managers in the client implications segments are significantly more effective than those in the mechanics segment. Many factors can account for the difference, but the research suggests that concentrating on what matters to clients instead of their technical proficiencies is consequential. This distinction has been repeatedly shown to separate the most successful wealth managers from the rest of the industry.

Implications For Wealth Managers

Wealth managers and their teams must know the mechanics of the various charitable strategies and products. For example, they must know how donor-advised funds differ from private foundations. They must know the way the different charitable trusts operate. Without question, wealth managers and their teams must be technically proficient. However, based on these findings, technical proficiency is unlikely enough to capitalize on the expanding opportunity to help the wealthy support the charities and causes that matter to them.

The most effective approach to working with the wealthy, and even more so the ultra-wealthy, is to help them make smart decisions. This means concentrating on client implications. From a position of expertise, wealth managers must empower their wealthy philanthropic clients by working through the possibilities in the context of the charitable outcomes they aim for and their financial circumstances. For example, there is a robust 4-point process for uncovering charitable intent, objectives and limitations and crafting narratives that best resonate with wealthy philanthropic investors.

For wealth managers, there are a growing number of resources they can use to help wealthy, philanthropic investors make smart decisions. Many of these resources will come from providers such as trust companies and technology platforms that administer and support charitable gifts. The providers aim to foster philanthropy and make money by winning the wealth managers' business.

Jerry D. Prince is the director of Integrated Academy, part of Integrated Partners, a leading financial advisor firm. Russ Alan Prince is the executive director of Private Wealth and a strategist for family offices and the ultra-wealthy. He has co-authored 70 books in the field, including Making Smart Decisions: How Ultra-Wealthy Families Get Superior Wealth Planning Results.