Today, overall inflation remains in check, but commodity/goods inflation may be poised to make a comeback (as we discussed in our Weekly Economic Commentary, “Too Soon for March Madness?”). Over the past two years, prices of services in the economy (as measured by the CPI for services, representing two-thirds of overall CPI) have settled into a range of 2–2.5%.

But the CPI for goods (prices of oil and other commodities purchased by consumers, accounting for one-third of overall CPI) sank along with oil prices from mid-2014 through early 2016. As a result, by January 2016 the overall CPI was just 1.4%, after dipping as low as -0.2% in mid-2015. Looking ahead to the remainder of 2016, if oil prices rise as we expect, the goods portion of CPI may increase by 2–3%; and if the pace of service sector inflation remains between 2% and 2.5%, overall CPI could accelerate quickly to well over 2.0% by year-end.

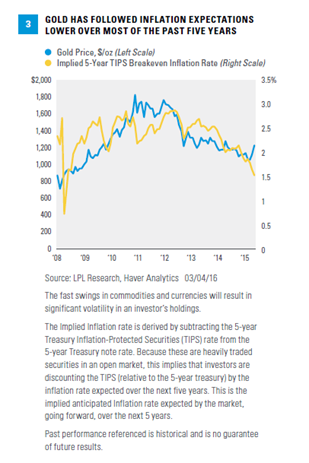

This possible inflation upside surprise for the market may provide a boost for gold. Since the Great Recession, gold has responded to changing inflation expectations, including declines during most of the past five years [Figure 3]. The latest rally in gold prices may be an early indication of a regime shift to a more gold-friendly, rising inflation environment (note that a falling dollar and demand from emerging market countries were bigger drivers during the strong 2003–08 period for gold than inflation expectations). Even though U.S. monetary policy is tightening, market-based measures of inflation expectations are probably too low given the aging business cycle and potential for oil prices to rise.

Gold As A Potential Safe Haven

Gold has traditionally played the role of a potential safe haven, which may be its most appealing quality in the current market environment.

U.S. Treasuries have historically been the first place investors go when financial conditions deteriorate. But with interest rates so low (the 10-year Treasury yield is at 1.88% and many countries are much lower than that), gold may be a relatively more attractive alternative. Some of the best periods for gold in recent years have come at lower interest rate levels, corresponding with the market’s increased risk aversion. For example, in 2012 at the interest rate lows of the current economic cycle, when the 10-year yield briefly dipped below 1.5% and the S&P 500 experienced a 10% correction, gold jumped 17% between May 16 and October 4, 2012. January 2016 provides a more recent example, when gold jumped 5%, the 10-year Treasury yield fell 35 basis points to below 2%, and the S&P 500 fell by 5%.

This competition with bonds as a potential safe haven is one of the reasons why gold has historically performed better when short-term real (adjusted for inflation) interest rates have been low. Gold does not have any yield, so there is an opportunity cost to hold it. We measure that cost via short-term real yields, measured by 3-month T-bill yields adjusted for inflation based on annual CPI changes. Gold has historically performed better at low (including negative) short-term real interest rates [Figure 4]. During the past 40 years, gold has risen 10%, on average, over rolling 12-months periods when short-term real interest rates were below zero, compared to an average 2% gain when real interest rates were positive.

Gold may also benefit from safe haven demand related to policy risks. Two broad policy risks stand out that could be potential catalysts for safe haven demand for gold: the possibility of a mistake by the Fed, and policy risks related to the election, especially related to trade policy. Looking at the Fed, with the job market strengthening and inflation beginning to normalize, the potential for a policy mistake has increased, even if the odds remain low. On the political front, more protectionist rhetoric coming from the leading candidates of both parties (and one in particular) increases the odds, even if low, of a trade war that could benefit gold. Additionally, given stock investors’ dislike for uncertainty, gold may be well supported until the nominees are set. Finally, a policy mistake could also be made by China, the U.K. (“Brexit”), Russia, or a number of other foreign countries that could have ripple effects in the U.S. and drive safe haven gold purchases.