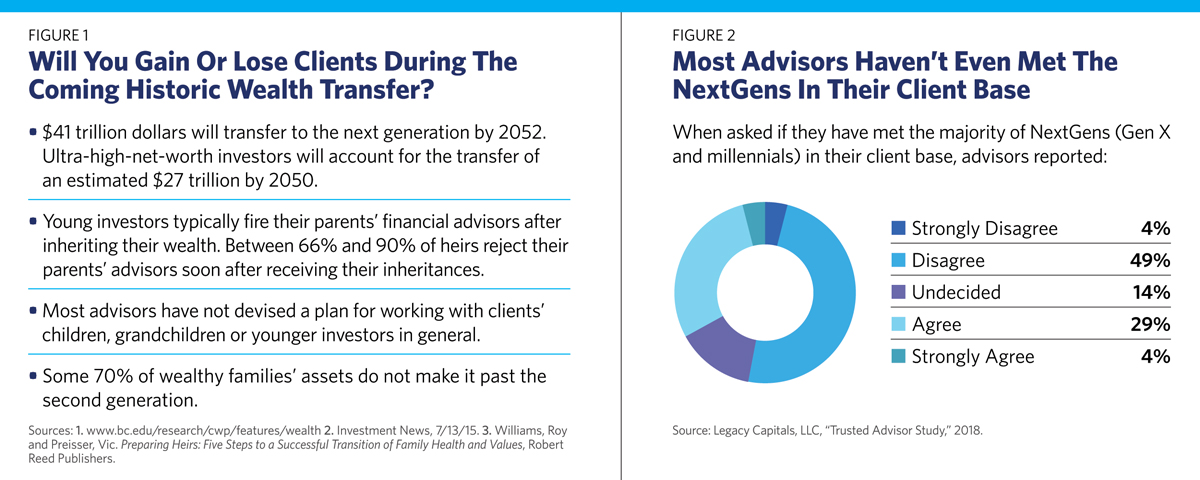

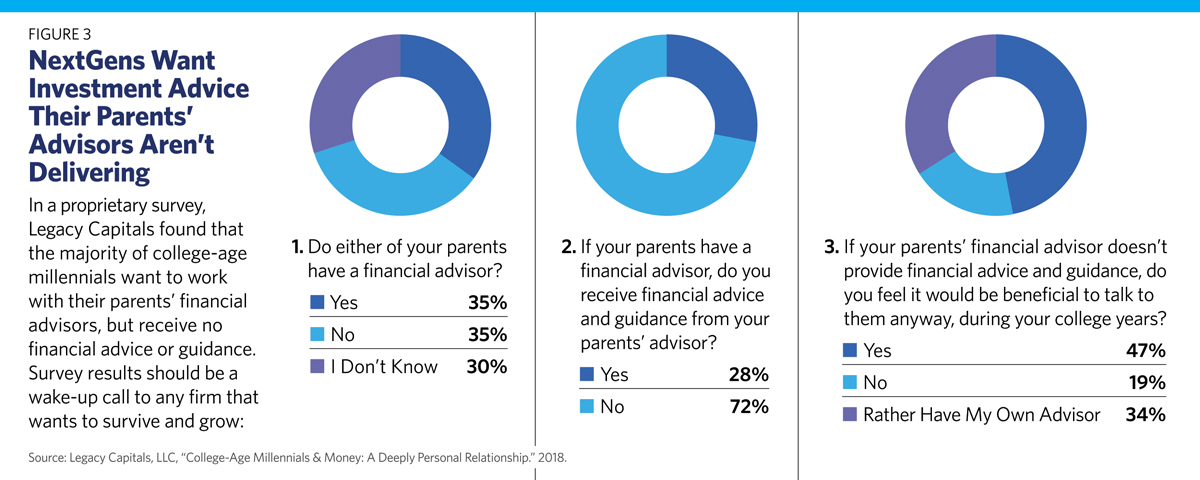

Many Legacy clients are brokerage firms, trust companies and banks, most of whom have more client relationships than RIAs. Many hybrid brokerage relationships tend to be transactional with less involvement in clients’ overall financial lives; Legacy works to change that. With its more holistic approach to financial planning, the RIA profession probably is better positioned to retain a larger proportion of clients’ children. But even here the record is spotty. Most RIAs try to consult with both spouses and discuss the offspring when creating financial plans. Some meet occasionally with clients’ children, but many do not, as both the FA and Legacy surveys reveal.

A former advisor himself, Orlando has spent the past two decades coaching advisors to engage affluent clients and heirs in values-based, multi-generational planning that involves the whole family, not just the one client. “While advisory firms prepare assets for clients, our job is to prepare families for their assets,” says Orlando, who has conducted 25 workshops around the country for more than 600 advisors and brokers in the past two years. Sponsored by OppenheimerFunds, the one-day workshops are designed to help advisors with affluent clients re-engineer their firms to engage multiple generations and retain and grow assets. “We help them build acquisition and growth strategies,” Orlando says.

“The powerful outcome is incredible for the family and quite remarkable for the advisor, giving them the tools to bend the curve on what happens when a client passes away,” says Ned Dane, senior vice president and head of the Private Client Group at OppenheimerFunds. “As an industry, we don’t have a very good batting average in keeping that money.

“If you have this information on each family member, it helps you understand how they think and where they want to head in terms of money, values and philanthropy,” Dane adds. “It’s a powerful discovery process for advisors.”

Sometimes advisor interactions with clients’ children can be adversarial. Sadly, the biggest obstacle to a comfortable retirement for many upper-middle-class boomers is grown-up children who require financial support well into adulthood. As fiduciaries, many RIAs have found that their most thankless tasks can be persuading clients to cut the financial cord for dependent 30- or 40-somethings and send them packing on the road to financial independence, often against the children’s will.

One prominent advisor has even developed a process he calls “the exit interview” in which he and his partners sit down with clients and explain to their children why funds are being cut off. While it’s questionable whether many advisors would want these individuals as clients, the feeling can no doubt be mutual.

That said, a growing number of millennials who experienced the Great Recession are valuing financial independence even more than their parents did in their 30s. But they look at money differently, and advisors trying to create a multi-generational business need to take these attitude differences into account. Gail Graham, the former CMO of United Capital and founder of Graham Strategy, says: “Advisors who have the will to reshape their practice into a firm that serves multiple generations can move from strategy to action in about a year. But wishful thinking is not a strategy; you need a plan.”

Graham just helped an RIA firm rebrand, change its service offerings and hire younger staff in order to retain and grow its next-generation client base. “About 50% of firms have a conscious and deliberate strategy, and the other 50% don’t,” Graham says. “They’re resting on their laurels on their path to retirement.”