It’s no secret that successful business owners ARE AN extremely attractive group of clients for advisors. After all, if your goal is to manage wealth, why not court the people who spend their lives generating it through the economic engine of entrepreneurship?

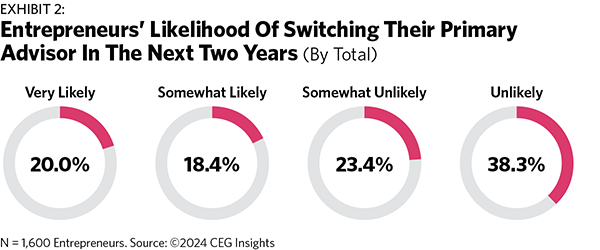

And our latest study from CEG Insights suggests that now could be an ideal time to pursue this market: 20% of the 2,049 entrepreneurs we analyzed, who held on average $15.6 million in assets, are poised to change their financial advisors within two years. That means new advisors could find a prime opportunity to cater to these entrepreneurs’ dynamic needs and aspirations, opening avenues for profound influence and success.

My dedication to entrepreneurs stems from witnessing the downturn of my family’s foundry in a small upstate New York town, a critical local employer led by my father and uncle, which stumbled during my college years. This pivotal moment solidified my belief in the transformative power of financial advisors. Our family business could have overcome its challenges and flourished with the right advisor. Such partnerships can drastically alter the economic trajectory for entrepreneurs and their wider communities, making lasting impacts and fostering enduring success.

This article discusses what’s at stake for advisors who pursue affluent entrepreneurs and the key steps they can take to unlock the door to this historic opportunity. It also offers strategic insights so that you can align your interests and success with those of the entrepreneurs by meeting their needs.

A Growth Market

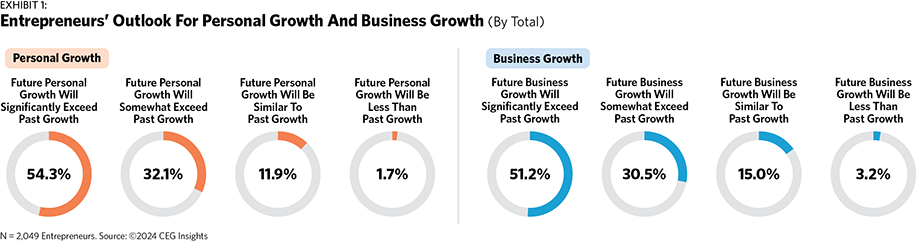

The advisors we surveyed hold a total of $32 billion in assets, and come primarily from the Gen X, millennial and baby boomer generations. They all share optimism about their future success (see Exhibit 1).

• 86.4% of them think they will significantly exceed or somewhat exceed their past personal wealth growth in the future.

• 81.7% think they will exceed their previous business growth.

• A mere 1.7% of them expect a downturn in personal wealth growth, while just 3.2% foresee a decline in business growth.

Our research suggests there’s a rich landscape for wealth management experts looking to engage with this expanding sector, so you have a good opportunity to tap into this optimism, providing targeted strategies to support these business owners’ growth ambitions and secure their financial future.

Pivoting To New Talent

The other big news for advisors in CEG’s findings is that many of these entrepreneurs say they’re underserved by their current advisors, signaling a substantial opening for new advisory relationships:

• 20% of entrepreneurs are very likely to switch their primary financial advisor within the next two years.

• Another 18.4% say they’re somewhat likely to make that switch.

Of those we surveyed, 38.4% said they’re open to working with new advisors. That’s an urgent call for you to position yourself with the services, solutions and overall experience they want.

Redefining Wealth Management For Entrepreneurs

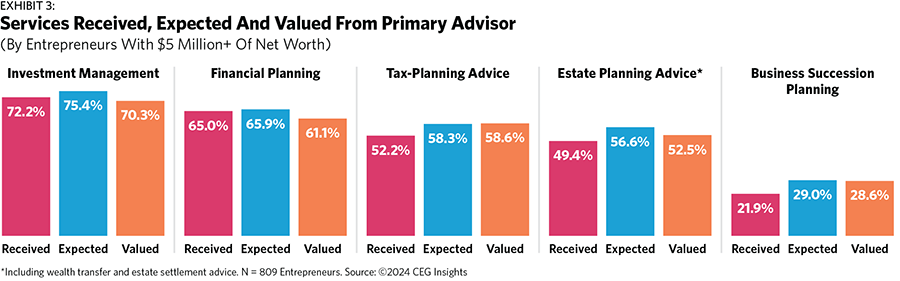

Entrepreneurs with more than $5 million in assets are searching for more than the usual wealth management services, which means advisors must improve their offerings. Entrepreneurs and wealthy people in general harbor a fear of missing out when it comes to the most cutting-edge financial strategies (see Exhibit 3).

• While 72.2% of them said they receive investment management services, 75.4% of them said they wanted more than the status quo when it comes to investment opportunities, so advisors must go above and beyond and tailor opportunities to these clients.

• Wealthy business owners are also looking for innovative tax solutions, but while 52.2% say they’re getting it, a higher number, 58.3%, say they want it. That’s a gap advisors can take advantage of by introducing proactive and creative tax strategies to improve outcomes.

• Wealthy business owners also fear missing out on sophisticated estate planning techniques (only 49.4% of them say they receive advice in this area, yet more of them, 56.6%, expect it). Again, advisors can fill the gap by crafting tailored estate plans.

• There’s yet another expectation gap when it comes to succession planning: only 21.9% receive advice for this, while 29% of those surveyed say they expect succession strategies, which they require to fortify their business legacies and continue serving their markets.

Integrating Expert Advice Across All Fronts

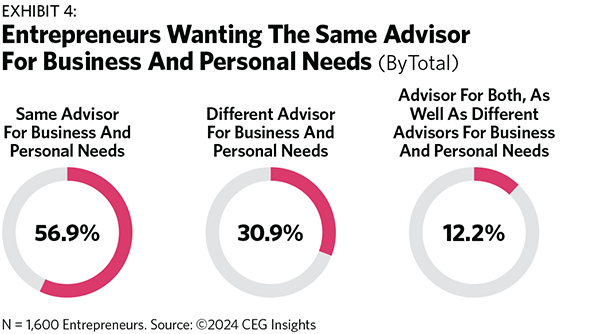

About half of the entrepreneurs surveyed (56.9%) said they wanted a single advisor who could handle both the business and personal side of their lives. (see Exhibit 4).

The upshot is that the advisors who can do both will have an advantage: They must be able to show expertise in both a client’s business concerns and personal wealth and build a bridge between a client’s personal and family wealth and their business dealings. Such a holistic approach means the advisor can optimize a client’s tax efficiency, manage risks and align business growth with personal wealth objectives.

However, advisors should know their boundaries—understand the limits of their own knowledge about their clients’ businesses and the advisory work that can be done better by specialists (which gets us into the team approach we discuss next).

Strategic Coordination: The New Frontier For Financial Advisors

Advisors who want to bring that holistic approach must become strategic general managers who can draw together a team of professionals—akin to franchise players—each an expert in their domain, whether it’s legal, accounting or insurance. This assembly of talents will allow you to synchronize your efforts across all fronts of your clients’ financial affairs—and it will make you indispensable to them.

Virtual Family Offices

The best business model for this approach is the virtual family office, a model that advisors can use to differentiate themselves in the eyes of the wealthiest business owners.

These offices offer something similar to the full-service approaches of traditional single-family offices, catering to the world’s most affluent families by managing their comprehensive financial and lifestyle needs. Virtual family offices extend these high-caliber services—such as investment oversight, estate and tax planning, succession strategies, and more—to a broader clientele, ensuring the offerings are adapted to each client’s financial situation. Importantly, these offices are designed with longevity in mind, ensuring that the wealth management strategies implemented today will support clients and their families for generations to come, preserving and growing their legacy over the long term.

Virtual family offices use cutting-edge technology to facilitate seamless remote collaboration among a diverse team of specialists, from financial advisors to legal experts. Ultimately, the model addresses problems affluent entrepreneurs have with their current advisors—such as the need for better overall performance, improved communication and more comprehensive services, and thus gives financial advisors using this model a competitive edge. The approach attracts discerning entrepreneurs and fosters long-term relationships, positioning advisors as crucial partners in their clients’ economic success.

Sourcing High-Net-Worth Entrepreneurs

But before you can show off the advantages of your family office, you’ll need to connect with entrepreneurs in the first place. CEG Insights research points to some essential best practices for finding prospective clients.

1. Broaden your referral network. Not surprisingly, given the importance of relationships in the business world, personal referrals are pivotal in connecting financial advisors with entrepreneurs—particularly those with a net worth of $5 million or more, 44% of whom listed referrals as the primary way of finding their advisors. This shows the importance of building robust relationships based on the trust clients have in you (and your stellar reputation).

2. Engage with leadership groups. More than half of entrepreneurs (51%) said they participate in executive leadership/mastermind groups—and nearly all of these business owners (98.2%) find significant value in them. So these platforms offer a golden opportunity for advisors. Active involvement in these groups allows you to showcase your expertise and thought leadership in areas directly relevant to business owners. Here, you can offer insight and raise your standing as an authoritative figure in the community of entrepreneurs.

3. Develop an area of expertise and demonstrate it to business owners. Among wealthy entrepreneurs, 60.4% favor financial advisors who are known for possessing deep expertise and specialized knowledge in areas these business owners find essential (such as investment planning, risk assessment and tax strategies) and who can deliver bespoke solutions that cater to each client’s specific needs. That includes advisors who offer innovative tax planning. You must show off such expertise in your one-on-one discussions with clients, as well as through your presentations and written content.

Redefining The Benchmark Of Excellence

Successful entrepreneurs are one of the best growth markets for financial advisors today. They possess sizable amounts of wealth and are optimistic that it will only increase.

If, as we said earlier, they are unhappy with their current advisors and looking to you, you’ll need to make some crucial decisions to win them over. First, you must play to win. You’ll need to build a business model that lets you deliver the type of comprehensive, customized wealth management experience that business owners want—one that combines the personal and the professional. By offering this distinguished clientele personalized, innovative and strategically coordinated wealth management solutions, you can solidify your role as an indispensable ally.

John J. Bowen Jr. is the CEO and founder of CEG Worldwide and CEG Insights.