Have we finally reached peak credit markets?

It’s a question that big names like BlackRock, DoubleLine and Pimco have been asking during this seemingly endless summer of debt.

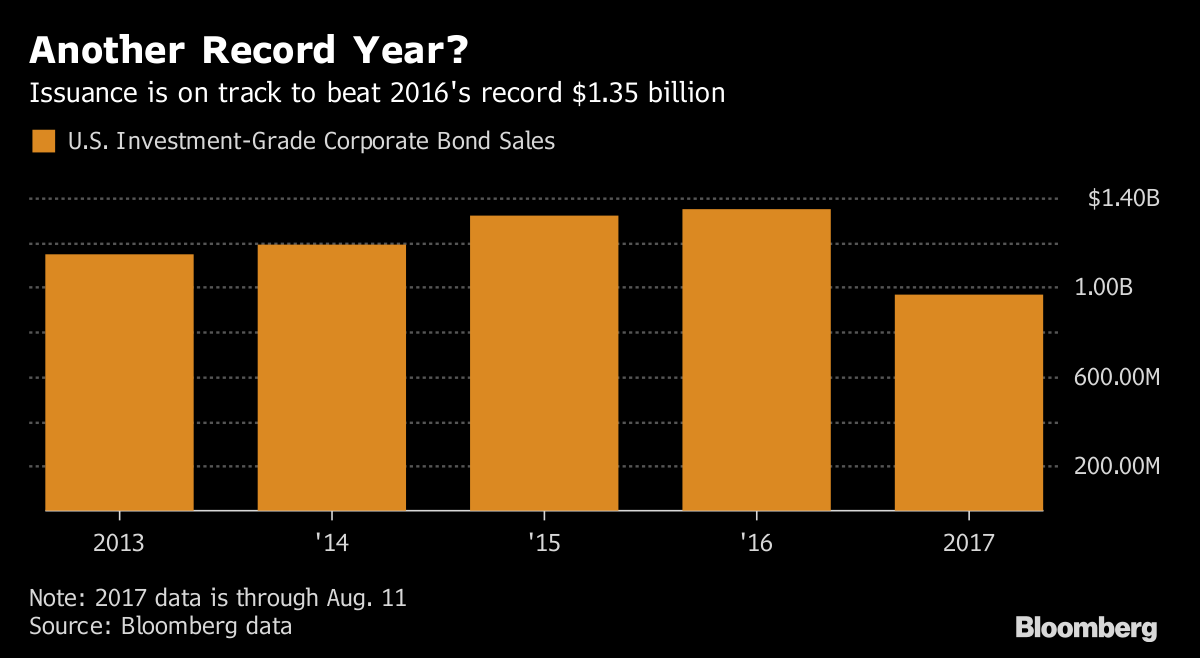

Signs of froth are everywhere. U.S. high-grade companies, which have already sold almost $1 trillion of bonds this year, are on track to break old issuance records. By some measures, corporate America is deeper in debt than ever before. Junk bonds, yielding on average just 5.8 percent, have fallen close to post-crisis lows.

And on Friday, investors lined up in droves to provide $1.8 billion in financing to Elon Musk’s unprofitable electric carmaker, Tesla Inc. -- and at interest rates that few could have envisioned a couple of years ago.

For Eaton Vance’s Kathleen Gaffney, it adds up to a market with all the hallmarks of a mishap waiting to happen.

“It can be hard to know the exact moment of a top but the signs are clearly there,” said Gaffney, who’s been buying and selling bonds for more than three decades, after starting her career at Loomis Sales & Co. “People are ignoring the fundamentals and taking a big leap of faith.”

Last week, there were indications that the 18-month long rally in junk bonds may finally be starting to end. Triggered by mounting tensions between the U.S. and North Korea, the notes slumped to their weakest level since April as Morgan Stanley flagged the beginnings of a correction.

The cost to protect the securities from default climbed to its highest level in about a month. BlackRock Inc., DoubleLine Capital and Pacific Investment Management Co., among others, have warned investors to pare back risk by reducing holdings of assets such as high-yield bonds and U.S. stocks.

Overlooking Flaws?

Granted, there have been plenty of instances over the past months when it seemed like the corporate bond market would finally come back to Earth. Yet time and again, demand has bounced back, as ultra-low interest rates around the world left bond investors with few higher-yielding options. Junk-debt investors are getting only about 3.9 percentage points of extra compensation compared with risk-free government debt, close to a post-crisis low.