Chances are, asset management is the core of your businesses—even if you go well beyond investments by creating teams of experts in other wealth management disciplines and building a virtual family office.

And much like a personal trainer might implore you to strengthen your physical core, we believe it’s vital to ensure the business core of your practice is in great shape.

With that in mind, we recently surveyed 1,276 investors about their attitudes toward investment returns, their reasons for investing and the factors influencing their investment decision-making (including their opinions about their current financial advisors). Armed with these insights, you can take steps to help clients better navigate their investment journey—and, in doing so, build a stronger practice for yourself and your team.

Why Your Clients Invest

The most important reason why over two-thirds of investors (67.7%) save and invest is—not surprisingly—to have income for their future or ongoing retirement. Their second most common driver of investing is to maintain their current standard of living (cited by 27.4% as their second top reason)—followed very closely by having financial security in the event of a setback (26.7%).

In pursuit of those goals, 46% of investors overall have a target rate of investment return—and nearly six in 10 millennials are targeting a particular investment return. The most common return sought is 6%, followed by 5%.

Perhaps most striking: Nearly one-quarter (23.4%) of Gen X investors have a target rate of investment return of 10% or more.

Who Influences Investors?

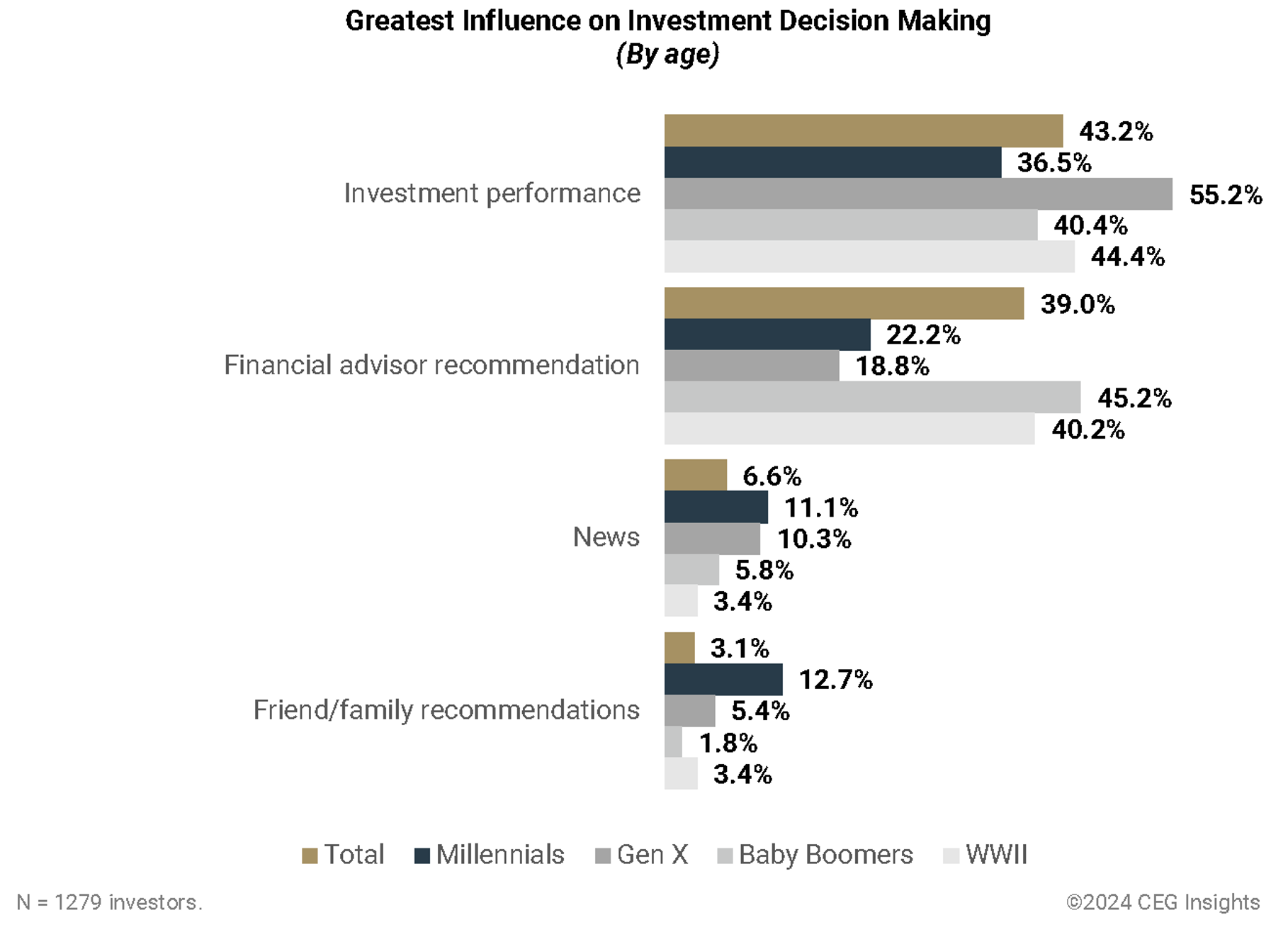

Overall, as seen in Exhibit 1, performance has the greatest influence on investors’ decision-making about their investments (43.2%)—closely followed by recommendations from financial advisors (39.0%).

Exhibit 1: Greatest Influence On Investment Decision Making

That said, important generational differences come into play here. For example:

• Millennials and Gen X-ers are significantly less likely than older generations to value their financial advisor’s recommendations for investment decision-making.

• More than 10% of millennials say investment recommendations from friends/family members have the biggest influence on their investment decision making—significantly higher than all the other demographic groups.

What Prompts Investors To Reallocate Assets?

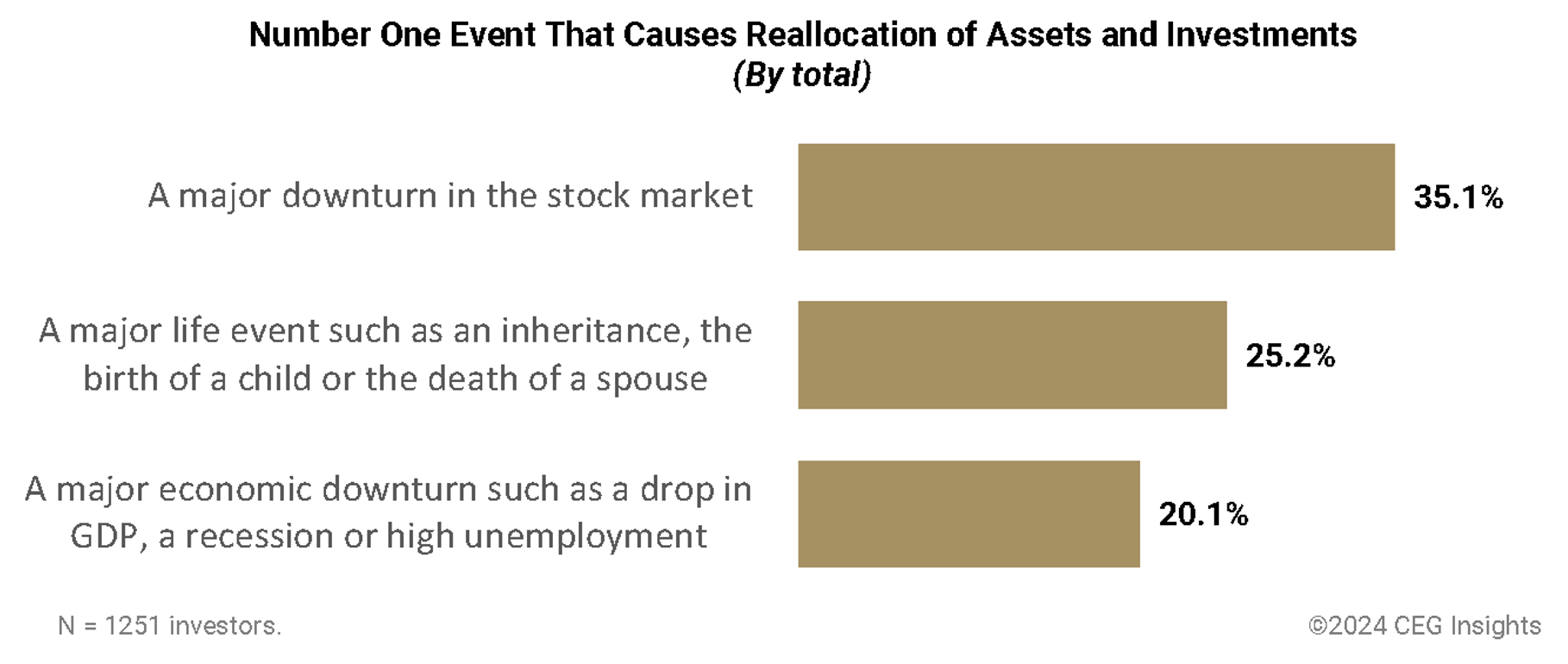

Over one-third of investors (35.1%) identify a major stock market downturn as the key event that would cause them to reallocate their assets and investments. In addition, one-quarter of them feel the top cause would be a major life event—such as an inheritance, the birth of a child or the death of a spouse—while 20.1% see a major economic downturn as the main reason to reallocate.

Exhibit 2: Top Event That Causes Reallocation Of Investments And Assets

Clients’ Feelings About Their Advisors

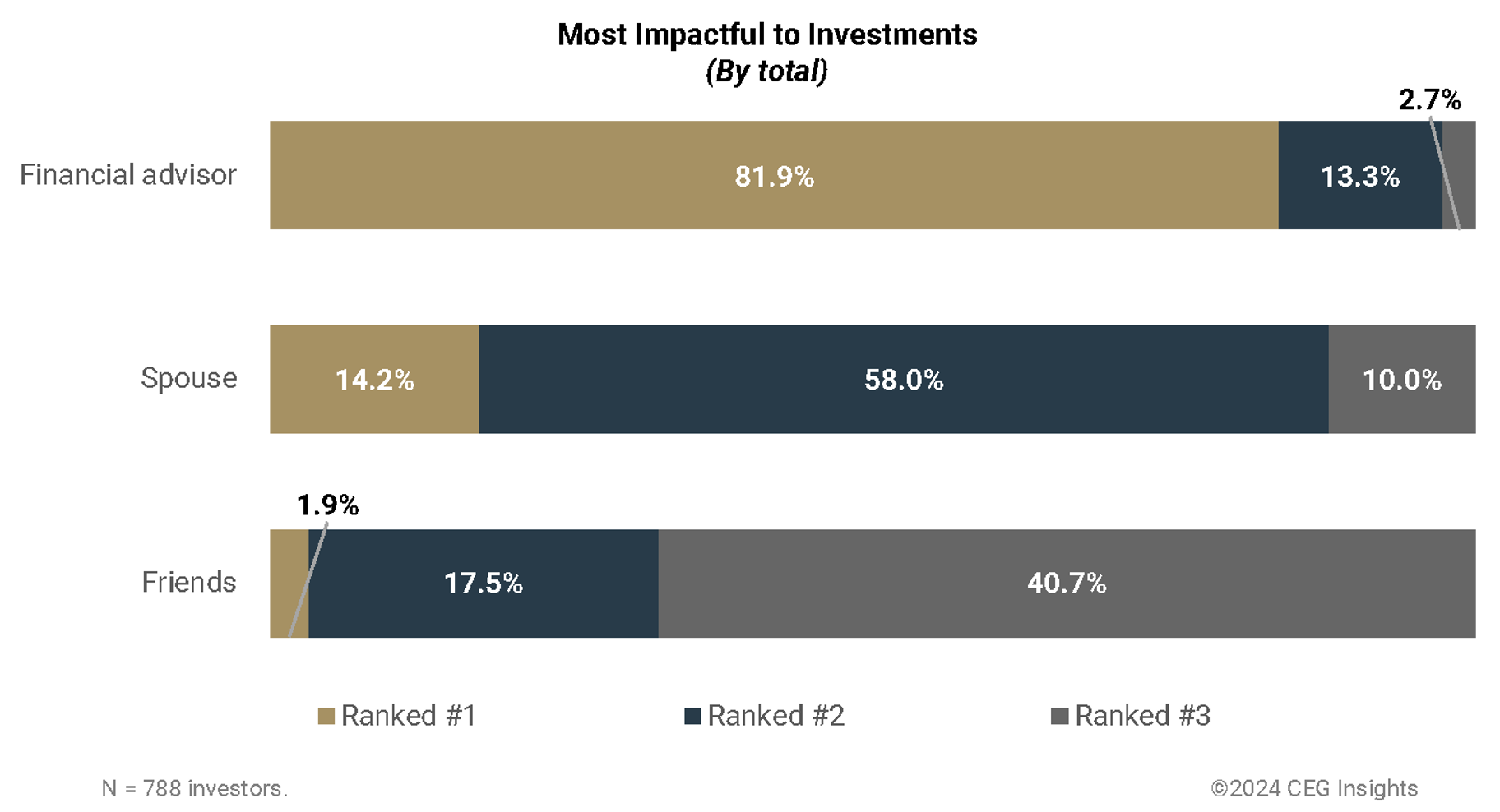

Investors are happy with their relationships with their advisors in a few key areas. Example: When asked who in their lives is most impactful to their investing, the vast majority (81.9%) of investors identified their financial advisor (see Exhibit 3). Even 75.5% of Gen-Xers (who, as noted, are less likely to value their advisors’ recommendations) agreed.

That said, Millennials were far less likely to say their advisor is most impactful to their investments (just 51.6%). On the plus side, Millennials still identify financial advisors as having a bigger impact on their investments than any other person in their lives (including their spouse, friends and co-workers).

Exhibit 3: Person Most Impactful To Investments

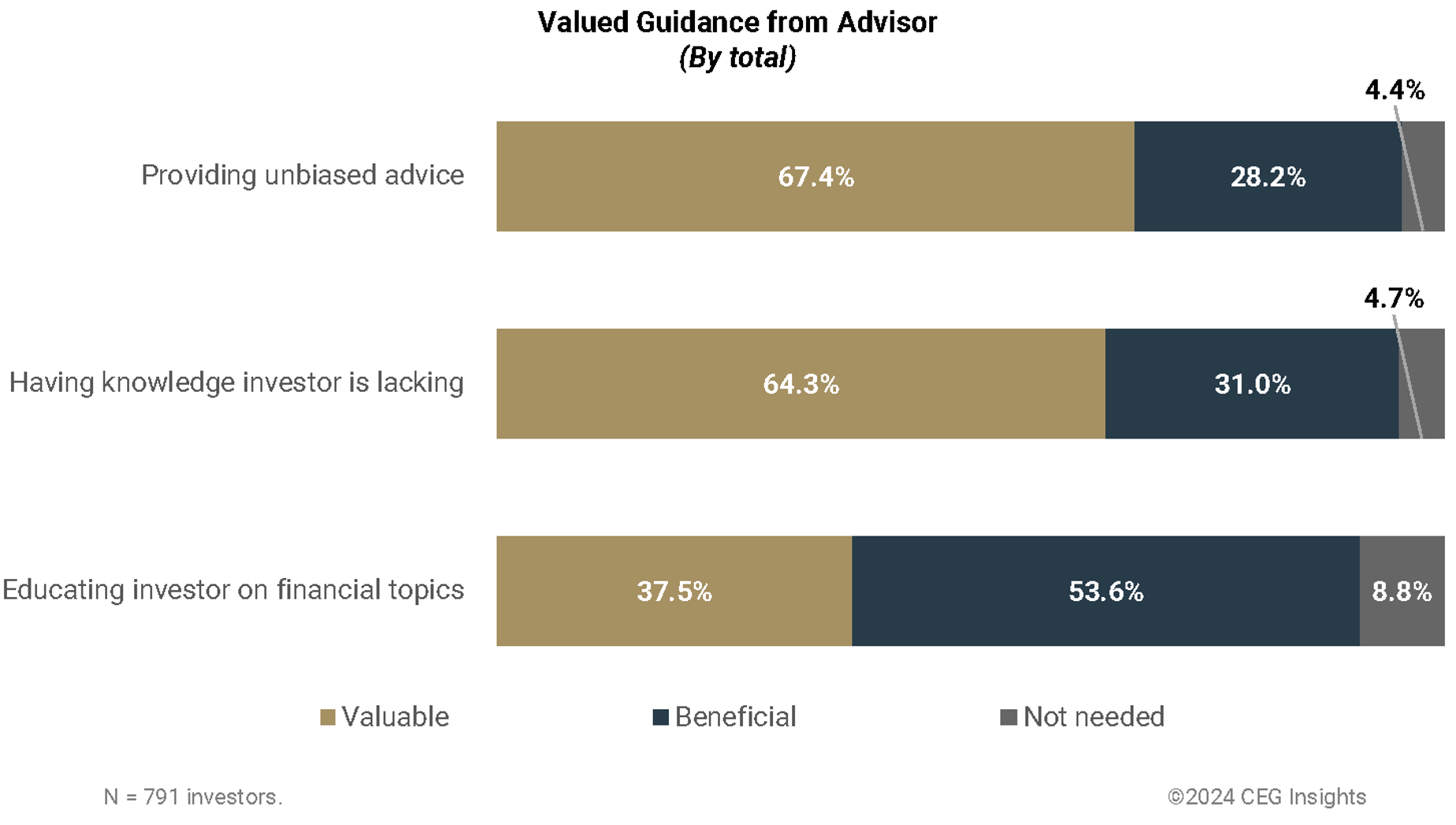

Given advisors’ importance in their clients’ investment journey, it’s helpful to understand why clients value your role. Although there are multiple factors, our research suggests that three key drivers of advisor-client value stand out (see Exhibit 4):

1. Providing unbiased advice. A full 95.6% of investors called advisors’ unbiased advice either valuable or beneficial to their lives.

2. Having knowledge the investor lacks. Specialized expertise was deemed valuable or beneficial by 95.3% of investors.

3. Educating investors on financial topics. Using your expertise to make investors better informed about their wealth and the factors impacting was valuable or beneficial to 91.1% of investors.

Exhibit 4: Valued Guidance From Advisor

Ultimately, it appears that the majority of clients believe such value is worth the cost. Consider that over two-thirds (67.5%) of investors are satisfied with the amount of fees they pay to their primary financial advisor, while 73.6% are happy with their advisor’s explanation and communication of the fees they charge. What’s more, satisfaction with the amount of fees increases as age and wealth increase.

Action Steps

CEG Insight’s findings on clients’ investment-related attitudes and motivations—as well as their views of their financial advisors—suggest that there are several action steps advisors should consider taking, including:

1. Manage your clients’ return expectations. While some clients may have carefully considered their return expectations, others may have simply picked a number that feels good on an emotional level. By knowing what your clients expect, and why, you can help manage their expectations—particularly if they become untethered from reality—and approach their investing more realistically and more successfully.

2. Discover what investment success means to your clients. Many clients want their investing to help them pursue goals like retirement or staying financially secure if they suffer a setback. Knowing what investment success looks like to your clients can help you tailor your solutions to better attract, serve and retain ideal clients.

3. Be proactive when reallocation moments occur. Life events—the birth of a child, a death in the family or the loss of a spouse—as well as major market or economic downturns often spark investors’ desire to make changes to their portfolios. Guiding clients through these events will demonstrate your responsiveness and strategic foresight, helping you attract and retain affluent individuals and families seeking proactive financial management.

4. Leverage your value. We see that clients value your unbiased advice, your expertise and your ability to help them make sense of an often-confusing investment universe. Leverage that by positioning yourself as the go-to advocate for your clients, providing key insights and information that can empower them to make smart financial decisions. For example, harness thought leadership to show your professionalism and fill in clients’ knowledge gaps.

Foundation For The future

Understanding clients’ attitudes toward their investing—and your role in it—is crucial for building and maintaining robust advisor-client relationships. Keeping this core piece of your business strong will provide the foundation for strong organic growth in the months and years to come.

George Walper and Catherine McBreen are managing principals with CEG Insights (formerly Spectrem Group), leading innovators in wealth management research. Dive into our exclusive insights and strategies with our latest "Play to Win" Report. Unlock Your Path to Success – Download Now!