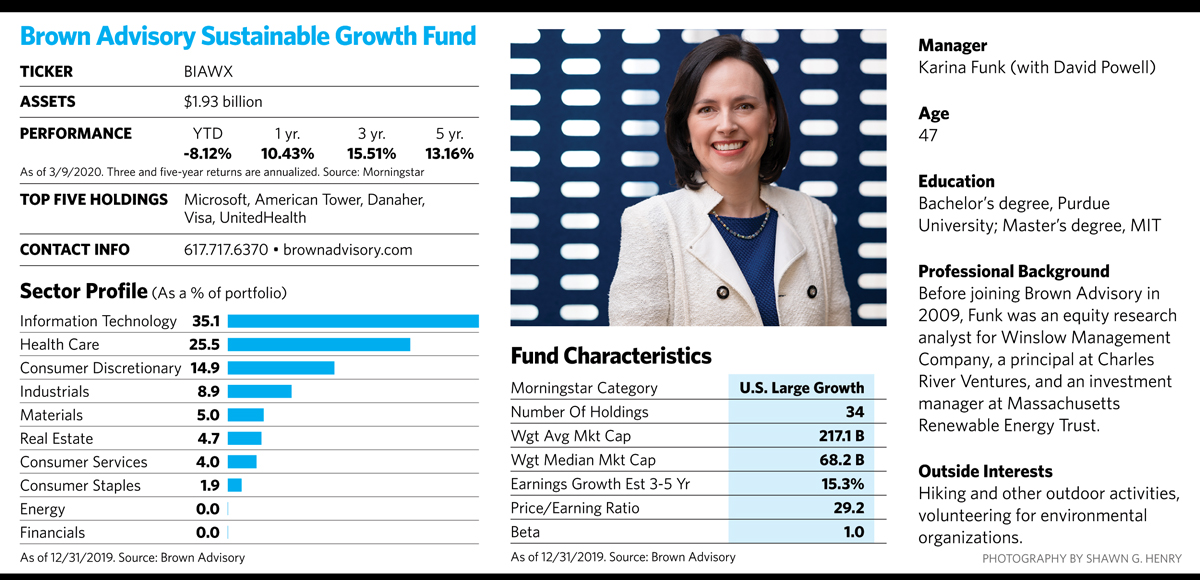

Karina Funk remembers when the concept of a connection between profits and responsible corporate practices was just beginning to take shape. “Early in my investment career I heard more than once that you can either make money with stocks or save the planet, but you couldn’t do both,” says the 47-year-old manager of the Brown Advisory Sustainable Growth Fund.

Today, with many investors in the U.S. and abroad integrating sustainability into investment decisions, that opinion has largely been shelved. In 2019, the estimated net flows into open-end and exchange-traded sustainable funds available to U.S. investors totaled $21.4 billion for the year, according to Morningstar. That’s nearly four times the previous annual record for net flows set in 2018.

“With growing investor interest in sustainable investing, especially among younger investors, 2019’s flows may be the leading edge of a huge wave of assets to come,” noted Morningstar analyst Jon Hale in a recent report.

To be clear, sustainable investing isn’t just about screening out “sin stocks” or investing heavily in alternative energy companies. It’s a more encompassing approach that looks for positive environmental, social and governance (ESG) practices among a wide variety of companies throughout the economy. Proponents believe such characteristics help companies control risk because they can avoid penalties for environmental missteps and other infractions, and they can also eliminate or reduce expensive inefficiencies.

Leveraging superior ESG practices in a business can help raise revenues, cut costs and increase competitiveness. “We like to see companies that are using good ESG practices to control risk as well as create business opportunities,” says Funk, who has mined this space for well over a decade.

Like the broader universe of investment managers that highlight sustainability practices, Brown Advisory has seen ample inflows over the last 18 months into its large-cap growth portfolio. Funk says about half of the money coming in is from investors with a sustainability mandate in mind. The remainder is from those just looking for a solid large-cap growth strategy with strong performance from a diversified portfolio of high-quality companies. Sustainability should not be pit against business fundamentals, she says. “For us, a sustainability strategy needs to go hand in hand with having strong fundamentals and adding shareholder value.”

American Tower Over Apple

The fund’s concentrated portfolio of just 34 stocks differs from the benchmark in a number of respects. Its weighted median market capitalization is $68 billion, whereas the figure is $141 billion in the Russell 1000 Growth Index, demonstrating the managers’ willingness to dip into less familiar names: Several high-profile companies that dominate the market-cap-weighted benchmark are either absent from the fund or have a much smaller weighting.

That weighting, however, hurt the fund’s performance in the last three months of 2019, when Apple, which has a nearly 9% weighting in the index but no presence in the Brown Advisory fund, rebounded sharply.

Funk says the fund swapped out of Apple in the fall of 2015 to upgrade into American Tower, the second-largest wireless tower operator in the U.S. At the time, Apple was just entering the iPhone 6s and iPad Pro product cycles, and given the number of variables driving the company’s growth, there were a wide range of outcomes for the company both on the upside and downside. Meanwhile, American Tower had a clearer path forward because of its long-term service contracts and other factors. It is the only tower operator to offer shared backup power-generating capacity for multiple carriers on its towers, and has been aggressively reducing its use of fossil fuels. While both stocks have done well since then, American Tower has experienced much less volatility.

So even with fewer of the mega-stocks that often drive performance, the fund has benefited from being different, beating the benchmark performance over the long term with less volatility. From its inception in June 2012 through last year, the fund’s Investor class shares saw an average annual return of 16.87%, while the benchmark saw 16.4%. The fund also beat the bogey’s annualized return by 1.2% over three years, and 1.87% over five years.