David Shepherd Jr. Typically relies on exchange-traded funds when he's investing in equities. But when it comes to fixed income, Shepherd, a financial advisor with Retirement Financial Services in Tucson, Ariz., often splits the pie between mutual funds and ETFs.

He gives bond mutual funds the nod for his core positions because they offer more diversity than ETFs, which typically track narrower indexes. "A number of multi-sector mutual funds provide government, corporate high-yield and foreign exposure," he says. "There's really nothing like that in the ETF world."

At the same time, he views ETFs as a good way to capture returns from specific slices of the market such as high-yield corporate or foreign bonds at a much lower cost than they would be with mutual funds. "I also like the ability to place stop orders, which I can't do with mutual funds," he says.

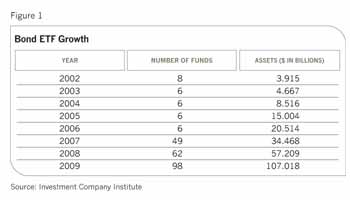

A growing number of advisors like Shepherd believe that even though bond mutual funds and ETFs differ in a number of key ways, they can complement each other well in client portfolios. And with the expanding roster of bond ETFs, there are more ways than ever to add them to the mix. By the beginning of 2010, there were 98 bond exchange-traded funds worth $107 billion on the market, up from 62 ETFs worth $57 billion the previous year, according to the Investment Company Institute.

While that's a fraction of the assets held by bond mutual funds, the new product launches by marquee names in the last year suggest that ETFs are emerging as formidable competition. In June, Pacific Investment Management Company (PIMCO) launched its first ETF and quickly followed up with nine others. In November, Vanguard expanded its stable of fixed-income ETFs from seven to 12. Barclays, State Street Global Advisors and PowerShares are among the other sponsors tapping into the growing investor appetite for bond investments.

As bond ETFs become increasingly popular, investors are learning about features that make them very different from either mutual funds or individual securities. On the plus side, they offer more variety for index investors by covering virtually every corner of the bond universe. Vanguard, a name that's synonymous with indexing, has only four bond index funds, while its equity index offerings number 24.

The handful of funds from other sponsors all use broad-based indexes. By contrast, the more expansive ETF universe spans nearly 100 offerings that follow myriad indexes, either those already in existence or new ones devised by the companies. Diversified portfolios, Treasurys, municipals, inflation-protected securities, high-yield securities and international bonds are all available as investment options.

Active management is an up-and-coming area, and the last five active ETFs to hit the market have been fixed-income offerings from Grail Advisors and PIMCO. The largest of the three PIMCO entrants, the PIMCO Enhanced Short Maturity Strategy Fund, has $122 million in assets and an expense ratio of 0.35%, well below the 1.07% charged by the average actively managed bond mutual fund.

Still, despite the exchange-traded fund's enticements, mutual funds have an overwhelming advantage in the breadth of their actively managed offerings. That's why they are typically more expensive than passive index ETFs, whose annual expense ratios range from 0.09% to 0.50% for more exotic investments such as high-yield bonds. The keenest competition on the expense front comes from Vanguard's no-load bond index mutual funds, which have expense ratios similar to those of bond ETFs. Mutual funds also allow investors to dollar cost average without paying brokerage commissions, which makes them a better deal for those clients with smaller amounts to invest over a longer period.