"Go Where the Growth Is ... And Where The Debt Isn't"

Our roadmap for assessing where opportunities abound-and risks lurk-was neatly summarized by a member of Atlantic Trust's asset allocation

committee: "Go where the growth is ...and where the debt isn't."

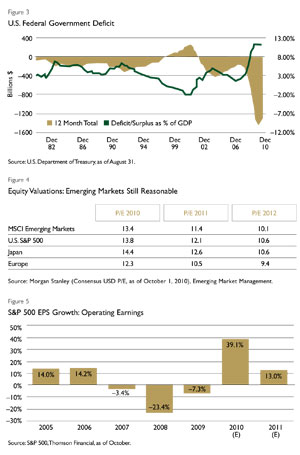

Excessive debt was the weakest link in a chain of events that caused the worst global recession and bear market since the Great Depression. Economies highly dependent on debt-fueled policies suffered the most. Those governments, in turn, combated the bursting of the credit bubble with a flood of public spending to avert further economic chaos, driving governments deeper into debt. After more than two years, this strategy has worked to stabilize the global economy. But the recovery has been uneven and has left certain countries and investment strategies in a better place than others. Atlantic Trust's major asset allocation themes have been developed from this perspective: emphasizing opportunities with organic growth and minimizing exposure to investments weighed down by debt.

The Emerging Market Engine

The developed markets of Europe continue to struggle with sovereign debt problems.

While growth in the core economies of Germany and France has been better than expected, impending austerity measures foreshadow anemic growth in 2011. Meanwhile, Japan remains in its 20-year funk.

Emerging market equities have experienced a strong period of growth since bottoming in early 2009, so much so that some investors are speculating whether these markets have gotten ahead of themselves. We believe that the case remains strong for continuing to allocate capital to these faster-growing economies. The massive transition from agriculture-based economies to manufacturing and service economies is a long-term phenomenon that will ultimately dominate shorter-term peaks and valleys in equity market performance. Macroeconomic and political changes in these countries have substantially reduced the potential for future, fundamentally based crises.

In the midst of 2008's financial crisis and the two years that have followed, China and other economies have demonstrated remarkable resilience. They will continue to be the growth engines of the global economy. (See Figure 4.)

U.S. Equity: A Stock Picker's Market

Despite recovery years in 2009 and 2010, the S&P 500 Index remains about 25% below its October 2007 peak (as of November 30). We believe that some progress toward regaining the old high can be achieved in 2011, but with muted investor expectations. Risk of the dreaded double-dip recession is low, but the outlook for economic growth is dreary. Equity valuations are reasonable in the context of low interest rates, but earnings growth in 2011 will substantially decelerate from the torrid pace of the last six quarters. We envision a market with continued volatility that progresses in two steps forward, one step back fashion. (See Figure 5.)

This scenario sounds a lot like 2010. However, we expect at least one major difference: There will be much higher disparity in individual stock returns. The 2010 market was notable for its very high correlation of returns, with little distinctions based on quality or valuations. An unusually high percentage of trading strategies were driven by macroeconomic calls on the overall market's direction. With this mindset, many investors' assessment of the stock market might be described as Jeffersonian-as if all stocks are created equal. They are not, of course. In time, we think investors will realize that the outlook is actually fairly certain-slow growth for a long time. When this occurs, more security-specific differentiation is likely, which will create a far more hospitable environment for active managers. Large-cap multinationals with strong balance sheets and above-average dividend growth should be the sweet spot for U.S. equities in 2011.