Other positive factors include:

· Companies continue to display great cost efficiency, keeping margins near record highs, excluding the energy sector.

· The U.S. dollar has stabilized in a lower range in recent months, despite the sharp drop in the British pound, and may have little or no impact on earnings over the next six months after being a significant drag over the past year.

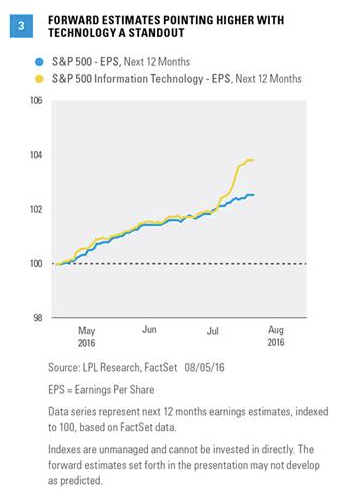

· Estimates for the second half of 2016 and first half of 2017 have only come down 0.8% since earnings season began, better than average and a positive sign. Figure 3 shows forward estimates rising because July 2016 results have rolled off and have been replaced by higher estimates in July 2017.

· The ratio of negative-to-positive pre-announcements, at 2.4, is slightly better than the long-term average of 2.7, though a bit worse than last quarter’s 2.1.

One potential fly in the ointment is oil. After oil prices roughly doubled from the February 2016 lows in the mid-$20s to over $51 in early June, the commodity has since entered a bear market with a 20% decline. After closing below $40 on August 2, oil has moved higher over the past three trading days to close at $41.80 on Friday. Should oil remain at current levels, or fall, energy sector estimates for the next two quarters may be difficult to achieve and the energy-oriented segments of the industrials sector may see some incremental weakness.

Brexit also remains a risk and may have more impact on results once the U.K. begins the actual process of exiting the EU. All in all, we see the potential for a rebound to mid-single-digit earnings growth for the S&P 500 by year-end.*

*As noted in our Midyear Outlook 2016 publication, we continue to expect mid-single-digit returns for the S&P 500 in 2016, consistent with historical mid-to-late economic cycle performance. We expect those gains to be derived from mid- to high-single-digit earnings growth over the second half of 2016, supported by steady U.S. economic growth and stability in oil prices and the U.S. dollar. A slight increase in price-to-earnings ratios (PE) above 16.6 is possible as market participants gain greater clarity on the U.S. election and the U.K.’s relationship with Europe.

CONCLUSION

Second quarter earnings season has been better than some had feared, but we had hoped for more. Still, there have been encouraging signs. The technology sector has produced solid results and forward estimates have been resilient. We continue to expect a second half earnings rebound. Look for more on earnings from us in the weeks ahead with our Corporate Beige Book barometer, an analysis of the topics covered in companies’ earnings conference calls.