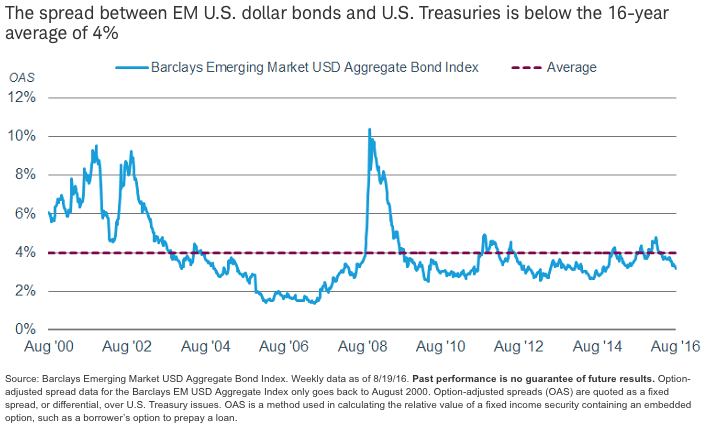

That doesn’t appear to be the case now. The current yield spread between U.S. dollar-denominated EM government bonds and U.S. Treasuries of comparable maturity is 3.15%—well below the 16-year average of 4%.3 The spread between local currency EM bonds and U.S. corporate bonds of similar maturity is 2.4%, which is right in line with the long-term average spread.

Given these conditions, we would caution investors about adding to the EM bond holdings in the hope of reaping more of the returns we’ve seen so far this year, especially with the potential for the Fed to raise interest rates later this year. The risks of currency losses and/or corporate defaults appear to be rising.

We suggest limiting the holdings of EM bonds to no more than the strategic allocation level. Investors in more aggressive areas of the fixed income markets, including EM bonds, should have a long time horizon if they want the diversification benefits. They should also avoid trying to time the market.

1As of August 19, 2016.

2 “Emerging Markets’ Bills are Coming Due,” Wall Street Journal, August 19. 2016.

3Option-adjusted spread data for the Barclays EM USD Aggregate Index only goes back to August 2000. Option-adjusted spreads (OAS) are quoted as a fixed spread, or differential, over U.S. Treasury issues. OAS is a method used in calculating the relative value of a fixed income security containing an embedded option, such as a borrower’s option to prepay a loan.

Kathy A. Jones is senior vice president and chief fixed income strategist at Schwab Center for Financial Research.