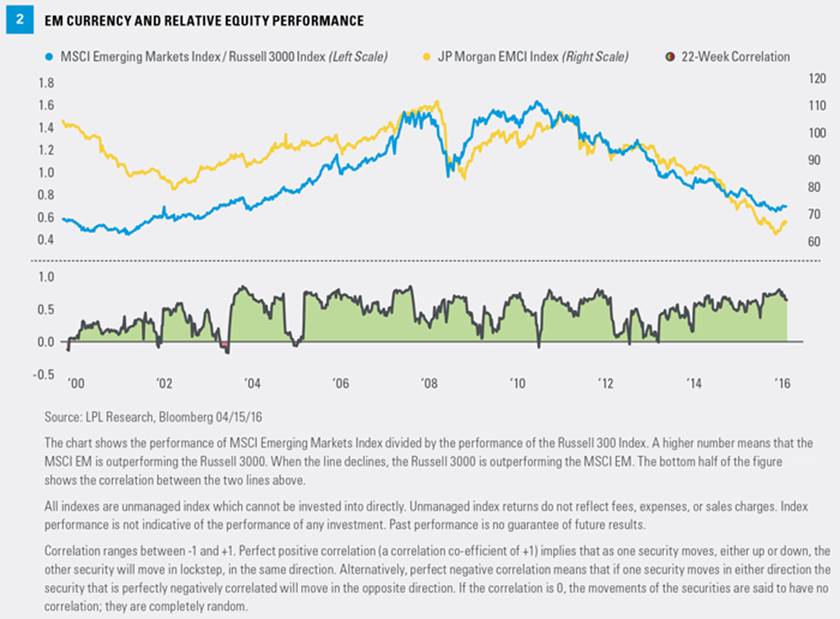

If a picture is worth a thousand words, Figure 2 is a novel. The top half of the chart shows the performance of the JP Morgan Emerging Market Currency Index, and also the performance of the MSCI Emerging Markets Index relative to the Russell 3000 Index. They rise and fall together fairly consistently. The bottom piece of the chart shows the rolling correlation between the two, which, on average, is 0.44—a noteworthy correlation. A closer look at the bottom half of Figure 2 reveals additional insights into the relationship of the data. Notice that the pattern is somewhat saw-toothed, with periods of high correlation, over 0.7, and periods where the correlation is nonexistent, near 0. However, the relationship is almost never negative, and when it is negative, it is only modestly so for a brief period of time. This suggests that while EM equities may not always outperform when their currencies are strong, historically it is rare that they outperform when their currencies are declining.

What caused the multiyear decline in EM currencies, and what may be causing their recent rebound? This is a complex problem, but there are some points of agreement. It is hard to ignore the impact of reduced capital flows into, and eventual capital flows out of, EM countries generally. Many EM countries are experiencing an economic slowdown, making their currencies less attractive and less in demand around the world. This may be especially true for commodity-oriented countries that have been hurt by the price decline in their primary source of trade. Fear of instability across EM countries is another contributing factor to currency declines.

By definition, currencies are priced on a relative basis, usually against the U.S. dollar. Recently, the dollar has been strong against all currencies, in both developed and emerging markets. Support for the dollar has come from many sources, including the belief that the Federal Reserve (Fed) would begin to raise interest rates in 2015 and that there would be as many as four rate hikes in 2016. As the Fed delayed the start of its rate hike campaign until December 2015, and as predictions for the number of further increases has declined, the dollar has reversed course against most EM currencies. Figure 2 suggests that should the recent trend of EM currency strength continue, it could last for an extended period.

What’s the play: EM stocks or bonds?

Investors looking for a rebound in EM currencies may reasonably ask, should we use stocks or bonds as the vehicle? For reasons we stated in last week’s Weekly Market Commentary, “Emerging Market Earnings: Is the Tide Turning?” EM equities appear reasonably valued, and even cheap relative to developed market equities, provided earnings come in close to expectations. Stronger currencies relative to the dollar are generally not considered a positive for earnings. However, EM companies operate around the world, and increasingly with each other; strength against the dollar should only be one consideration.

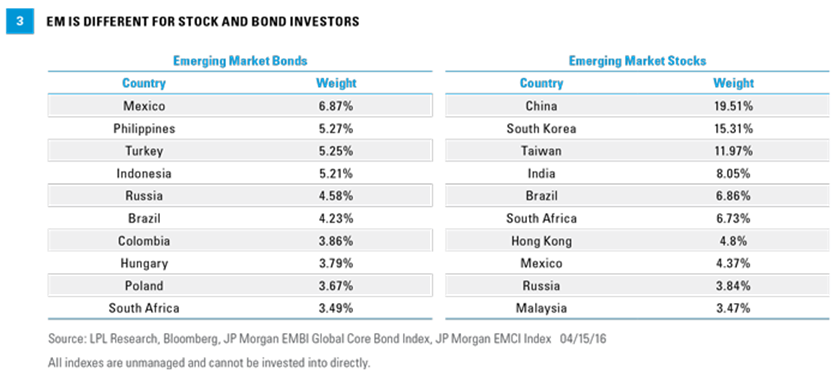

The term “emerging markets” is repeated often, but it means different things depending on context. EM equities are issued by companies, many of which were state owned and then privatized. Most EM debt issues, on the other hand, are sovereign debt, meaning the bonds are issued by the government. Therefore, the universe of available stocks and bonds are very different from each other in terms of country of issue, which impacts the degree of currency, liquidity, and other risks. Just because both are labeled as “emerging markets” does not mean they are the same asset class. Figure 3 shows the top 10 countries in both the primary EM debt and EM equity indexes.

Conclusion

Though many factors impact investor returns on EM investments, capital flows and, by extension, currency movements are two important elements in the performance of these asset classes. There are early signs of strength for EM currencies, and therefore, in EM stock and bond markets, though the composition of these markets is very different from each other. By their nature, these markets have a higher risk profile, but have the potential to positively impact portfolios should the most recent trends continue.