Many investors have heard of the “value premium”—the idea that cheaper stocks have outperformed growth stocks over time. But over the last 10 years, value stocks have underperformed growth stocks by an average of 2.5% annually. Experts attribute the superior performance of the latter to the increased investor appetite for risk and a demand for strong earnings in the face of sluggish economic growth.

At the beginning of 2016, value began making a modest comeback, with the market rotating away from high-growth, momentum names toward defensive, high-dividend-yielding and deep-value cyclical companies. As of mid-May, the growth component of the Russell 1000 index was up 0.13%, while the value component had risen 2.67%.

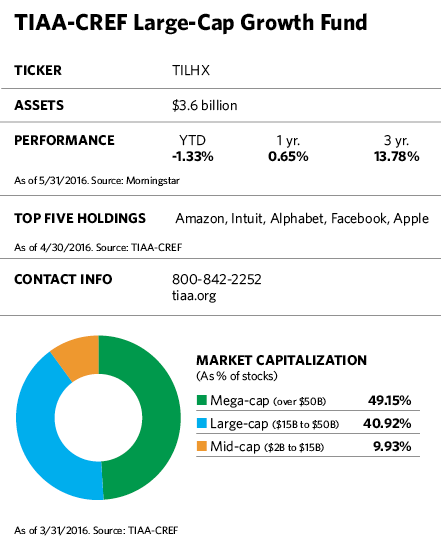

Susan Hirsch, manager of the TIAA-CREF Large-Cap Growth Fund, believes that value stock outperformance earlier in the year was a matter of playing catch-up after such a long performance drought. While growth stocks may underperform over the near term for that reason, she expects that a continuation of sluggish global growth will support long-term bullishness on growth stocks. “In a slow-growth world, growth works,” she says.

Nonetheless, growth stocks are notorious for big moves up or down depending on how well companies meet earnings expectations. A disappointing quarter can easily send a stock plummeting 10% or more, while a better-than-expected quarter often puts a big bounce in a stock’s step.

Hirsch, who has been managing the 10-year-old fund since 2006, often buys stocks of well-run companies that are having a temporary earnings disappointment or some other short-term problem. She typically follows companies for years before moving in. She puts a lot of emphasis on strong management, a characteristic she believes is particularly important in the growth space.

The fund’s buy-on-bad-news strategy came into clear focus earlier this year when Hirsch established a small position in Mexican fast-casual restaurant Chipotle not long after an E. coli scare sent 22 customers to the hospital and crushed earnings. She saw a good company with solid leadership that was having a temporary but solvable problem and selling at an attractive price. “Here in New York, there are lines out the door at Chipotle during lunch,” she says. “The restaurant’s concept and brand still resonates well.”

Hirsch says she typically adjusts positions rather than makes sweeping changes as events unfold. When things look a little frothy with a stock, she may trim its position. When a temporary problem emerges and sends a stock south, she may add to a holding or initiate a new position.

Lately, she’s been tamping down on portfolio risk a bit, trimming positions in a stock if investors’ high expectations about it are already built into its price. Such positions, she says, have more to lose from bad earnings news than they have to gain from positive surprises.