The Value Of Loyalty

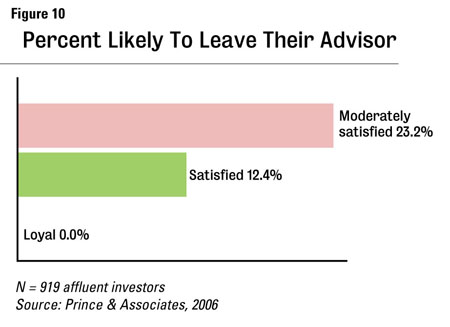

Our research has shown us that clients generally understand that it's impossible for an advisor to constantly and unfailingly deliver exceptional portfolio performance. However, they do hold their investment advisor responsible for what they can control-that is to deliver, without fail, an exceptional experience. This experience helps produce loyal clients, and loyal clients are the building blocks to an extremely successful investment advisory practice.

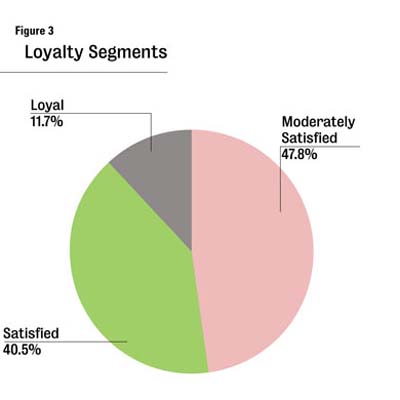

Based on a

proprietary empirical methodology developed by Prince & Associates,

the 919 affluent investors in our sample were divided into three

segments (Figure 3).

It is important to note that only about 12% of these affluent investors can be defined as loyal. Also, the majority-nearly half-are only moderately satisfied.

Five Drivers Of Five-Star Service

The survey identified five primary areas that affluent investors cited as crucial to an exceptional advisor-client relationship.

Investment approach.

The strategy advisors use in an attempt to achieve their clients'

financial goals is clearly critical. More important, investors in our

survey who understood and could easily articulate their advisor's

approach proved to be the most loyal. This helps create a higher degree

of comfort with the advisor and may increase the likelihood the client

will be able to provide better referrals. (Figure 5)

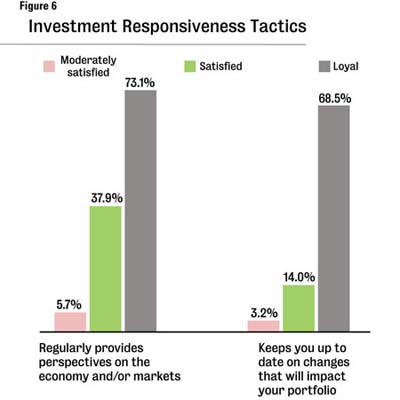

Investment responsiveness. The survey found that it is critical to keep clients up to date on developments in the financial markets or economy that could affect their long-term financial plans. It helps to have a plan in place for communicating major market or economic changes to clients. (Figure 6)

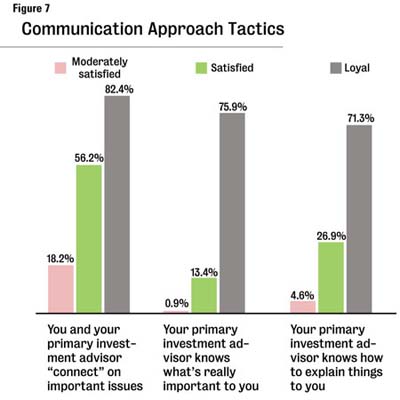

Rapport. The survey found that empathy, insight and approach were the most important qualities in building a relationship between an advisor and a client. If you are unaware of what really matters to your clients, develop your own client-discovery process to identify both their personal and investment goals. Pay attention to your clients' personality cues and tailor your communication style accordingly. (Figure 7)

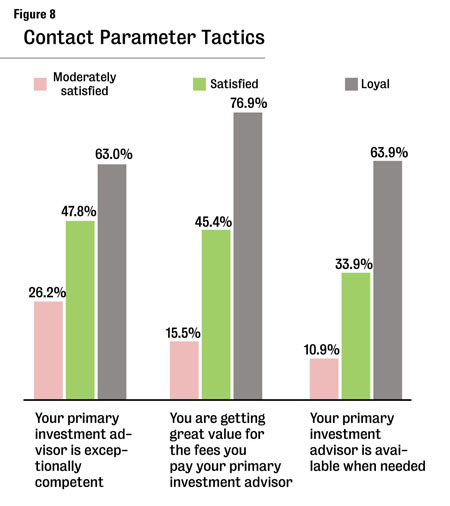

Professionalism. The survey identified five factors that influenced whether an advisor is perceived as skilled and competent. The factors are technical expertise, cost/value, integrity, responsiveness and contact parameters. The perception of advisor competence obviously is critical to building client loyalty. It is also important to contact your affluent clients on a regular basis. Advisors who sought both regular and ad hoc opportunities to communicate with their clients often saw a significant increase in loyalty. In fact, loyal clients report more than 10 times as many contacts over a 12-month period than moderately satisfied clients. (Figure 8)

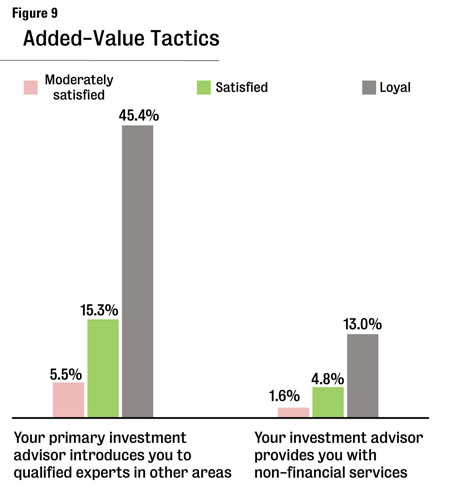

Added Value. Providing non-investment offerings and referrals helps create deeper and more meaningful bonds between advisors and affluent clients. The investors in our survey expressed interest in areas such as income tax planning, estate planning, charitable giving and succession planning. Even if you're not an expert in these areas, you can look for opportunities to introduce clients to other qualified experts. As an added benefit, this leads to the establishment of a referral network with professionals in other fields. (Figure 9)

Moving The Needle In Your Practice