Currency strength - Despite low interest rates, the yen has appreciated by more than 10% this year, climbing to 109 per dollar as of May 13 from over 120 at the end of 2015. According to the BOJ’s March Tankan business survey, large Japanese manufacturing companies had expected the yen to average just over 117 in 2016. The rise in the yen has reduced the value of overseas sales and makes goods more expensive in overseas markets. The strength in the yen means many multinational companies have to revise down their earnings forecasts. Policymakers in Japan have been struggling to keep its currency from strengthening and deflation from reemerging. As you can see in the chart below, Japan’s stock market has been suffering in lock step with the rise in the yen (a strengthening yen means a falling orange line in the chart since fewer yen per dollar means a stronger yen).

Limited policy effectiveness - The BOJ is trying to push harder to boost consumer borrowing despite demographics working against them Attempts to make it attractive to businesses to borrow and invest are limited by the fact that Japanese business are flush with cash, as you can see in the chart below. Borrowing conditions don’t appear to be a constraint on business spending.

Potential positives

Fiscal policy – Japan’s government is increasingly expected to announce a fiscal stimulus package around the G7 summit at the end of May, ahead of the July Upper House elections. The package could include spending for immediate relief for areas hit by the Kumamoto earthquakes as well as other broader measures. The G7 timing seems likely given the increasing calls on legislators of many countries to implement fiscal policy to support monetary stimulus and the fact that Japan’s Prime Minster, Shinzo Abe, will chair the G7 Summit.

China’s slowdown – Exports to China, Japan’s largest trading partner, have been falling sharply. Japan derives about 18% of GDP from exports so this weakness acts as a significant drag.

Declining demographics – Japan’s population is declining by a million people every year, according to the Ministry of Health, Labor and Welfare. Disposable personal income has been stagnating. While many are retiring even those of working-age are concerned about the risks of outliving their retirement savings and of future cuts to benefits, motivating them to reduce spending and boost savings.

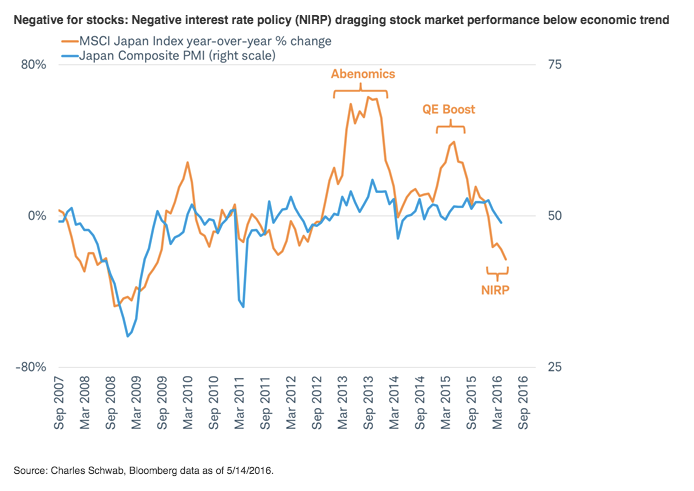

Negative interest rate policy - The effectiveness of the BOJ’s negative interest rate policy is far from assured and increasingly negative interest rates may weigh heavily on the stock market and on drivers of economic growth. The performance of Japan’s stock market has slumped below the trend in the Japanese economy depicted by the composite purchasing managers index (PMI), as you can see in the chart below.

Yet, optimism for Japan remains high and not only by economists: Japan’s Nikkei 225 Index is down only -4% this year, measured in US dollars. This optimism seems to be based on: stabilization in the dollar relieving upward pressure on the yen, stabilization in China’s growth trajectory, women entering the workforce, and an economic boost from fiscal policy this summer.

Stabilization in the dollar - A weaker yen is one of Japan’s biggest hopes for an intermediate improvement in its stock market and economy. A weaker yen helps fuel exports and inflation. Also, it boosts overseas income for Japanese multinationals. It may also boost confidence that Abenomics is working.

Stabilization in China – China applied stimulus earlier this year that appeared to work to stabilize the pace of growth after a more rapid than expected dip in a variety of economic indicators. How long this effect is sustained is an open question. Already it appears China is pulling back on some of the stimulus for fear of backtracking on progress in economic diversification.

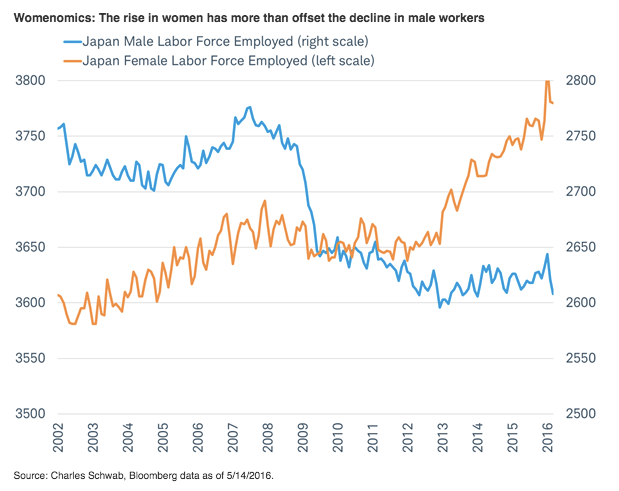

Women entering workforce –Although Japan is in demographic decline the efforts to get more women to join the workforce has softened the economic impact. Over the past five years, the rise in women has more than offset the decline in male workers, as you can see in the chart below. This has helped to stabilize the number of Japanese workers and support household incomes. However, with 66% of women now participating in the labor force, the growth rate may begin to slow as it reaches the 67% seen in the United States. It stands well above the 57% of Asian neighbor South Korea.

Although Japanese stocks may see some relief if the yen stabilizes or reverses recent strength, we see the hefty headwinds offsetting the potential positives. Disappointment may be in store for those hoping for a sharp rebound in Japan’s economic growth this year.

Jeffrey Kleintop is senior vice president and chief global investment strategist at Charles Schwab & Co.