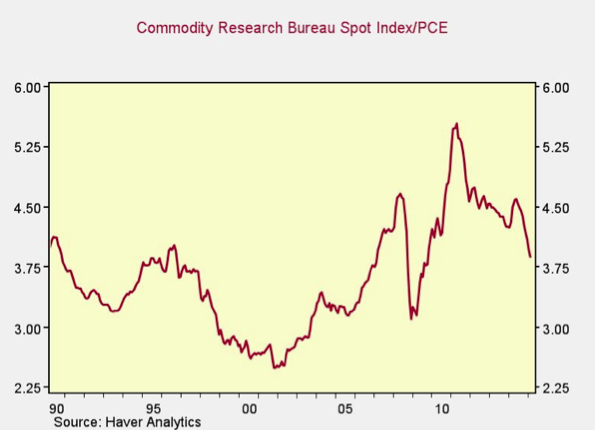

Here, there was more volatility from 1990 to 2005 than in oil (but still a general range in which commodities traded), then run-ups in the late 2000s and early 2010s, followed by a decline back to where prices were in previous decades.

What’s driving this?

The first answer is that it almost doesn’t matter. Prices are what they are, and what we see is that they’re moving back to normal levels.

For the future, though, it does matter, and I would say that two trends were responsible for driving prices higher:

Absent these one-time factors, we are probably moving back to a calmer environment for oil and commodity prices. This should help moderate both inflation and deflation, as well as enable businesses to plan better and more effectively.

What it will not do is substantially change how the economy operates, for better or worse, but simply take us back to a more stable environment—which, come to think of it, should be a force for good.

Brad McMillan is the chief investment officer at Commonwealth Financial Network, the nation’s largest privately held independent broker/dealer-RIA. He is the primary spokesperson for Commonwealth’s investment divisions. This post originally appeared on The Independent Market Observer, a daily blog authored by Brad McMillan.

Oil And Commodity Prices: Back To The Future

April 29, 2015

« Previous Article

| Next Article »

Login in order to post a comment