When the next president of the United States walks into the Oval Office on Saturday, January 22, after the heady experience of Inauguration Day followed by numerous balls, he or she will be confronted with significant economic challenges. This is the fifth and I hope final installment in a series of letters I’ve written to the next president on those challenges. The first three letters in the series dealt mostly with the realities of the economic landscape beyond the the United States. The situations that most of our significant trade partners face dictate that the next US president will have much less room to operate than the candidates have suggested that they’d like to have.

Europe will be struggling not to fall apart. The budgets of most European countries are going to be even more constrained than the US budget will be. China will be lucky to escape a hard landing within the next four years. The same can be said for many other countries that are dependent on global trade in an era when trade is actually slowing.

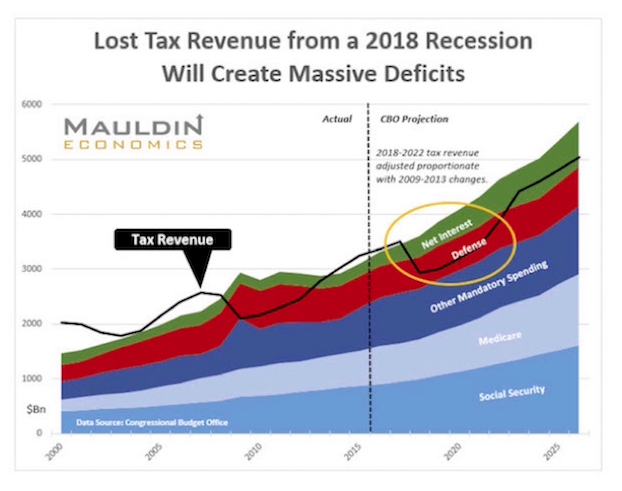

My basic thesis is this: Without significant changes in tax and incentive structures, the US will almost assuredly enter a recession within the next few years. Then, if we lose tax revenues only to the extent we did in the last couple of recessions, we’ll be saddled with a deficit of over $1.3 trillion, and the deficit won’t fall below $1 trillion as far out as the eye can see, according to the nonpartisan Congressional Budget Office (CBO).

It appears to me that the CBO projection understates the real issue; in fact, the CBO may be viewing things through rose-colored glasses. They don’t project a recession for the next 10 years. The above chart depicts my estimate of what would happen if we were to encounter recession two years from now. But it doesn’t include the constant revisions upward to the cost of Medicare and Medicaid and other entitlements. Just this week we learned that one portion of Medicaid is going to cost well over $1 trillion more over the next 10 years than was projected in the current budget. So add another $100 billion dollars of deficit a year. Such revelations are constantly coming at us. My estimate also doesn’t take into account how fragile the lower-income echelons of the US economy are today. They will probably require even more income and healthcare support, meaning larger deficits for the US and extremely constrained state and local budgets.

Unless something is done to counter these trends – and I do not mean tinkering around the margins – this is going to be the reality that you as president will face in the next four years. There are those who have warned for many years of a debt crisis. They have looked like stopped clocks. But like any stopped clock, they are getting ready to be right this once. Paul Krugman and others who pooh-pooh the concept that debt is a problem may soon get to see what it’s like to deal with a true economic crisis. Of course, they will want more quantitative easing by the Fed and federal debt issuance to relieve the suffering; but we know now that QE does little for Main Street. Instead, it simply helps the rich maintain their asset prices, and deficit spending digs us deeper into a fiscal abyss. We could of course monetize the US debt, but that course would bring its own major negative repercussions.

My aim with this series is to present you, as the potential new president, with a series of options that I think will not only help us avoid the next crisis but set us up for a decade or more of true prosperity and put us back on the path of 3% to 4% annual growth for the next 10 years. And one of the few things that Krugman and I can agree on is that the only way to get out of this crisis is to grow our way out.

While this series has been more popular than I expected it to be – and even US senators are tweeting about it – there have been those who question how realistic it is to think that my proposal might win acceptance. And sadly, I think they have a point. Enacting radical proposals along the lines I am suggesting will not be politically easy. So next week – in case we don’t pull our act together in time to avert a crisis – I’m going to outline what we can do if we fall into recession again. I’ll also propose how we can end the dysfunctionality in Washington DC. While I’m not advocating an actual revolution, my proposal is quite revolutionary, and it already has a significant movement supporting it. And, who knows, maybe in the midst of a crisis we’ll make good on what Winston Churchill used to say about us: “You can always count on the Americans to do the right thing – after they have tried everything else.”

But before we get into the heart of the letter, let me give you an update on my Strategic Investment Conference, which will be held in Dallas this coming May 24–27. We have been able to work out some additional space and accommodations with the Hyatt hotel here in Dallas where the event is being held, so we have told all those who were on the waiting list that they can now enroll. We also have a small number of additional spaces available. Since we don’t want to find ourselves with more attendees than we can handle, we are going to continue to employ a waiting list. First-come, first-served.

If you want to attend, I suggest you go to the Strategic Investment Conference website (click on the link) and register to have your name put on the waiting list. I can almost guarantee that the new seats now available will disappear, as there aren’t not that many; so don’t procrastinate. Those who wait until the last month to register are going to be disappointed.