This post originally appeared last spring and is part 3 of a series on what happens when interest rates start to rise.

As this is the final post in my series on interest rates, it’s time to talk about what everyone is probably thinking: What happens to investments when interest rates rise? This question is especially pertinent given yesterday’s decision by the Federal Reserve on a rate hike.

Effect on the stock market

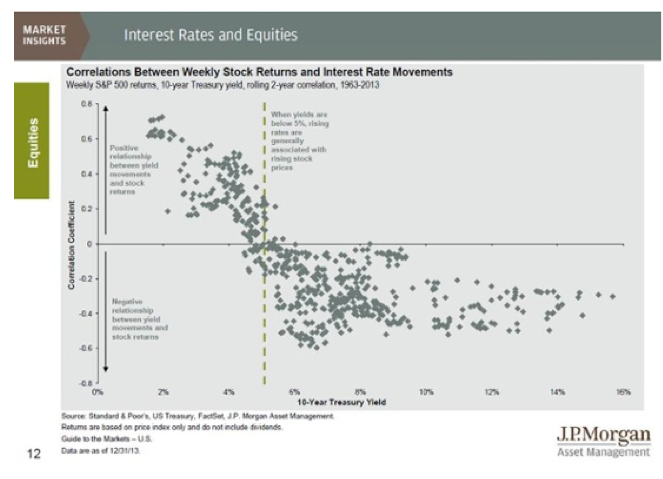

At this point, rising rates actually look like a positive for the stock market, as they reflect a healthier, more normal economy. This chart, which I’ve posted before, shows that stocks have historically performed well during periods of rising rates, as long as rates are below about 5 percent—which, by no accident, is the natural level we identified in part 1.

In theory, stocks should be worth less as rates rise, as the future stream of dividends will be discounted more heavily. Per the Yogi Berra theorem, though, theory and practice are different in practice; the prospect of an improved economy, shown by rising rates, more than offsets this discounting effect. If anything, rising rates may be a positive, at least for the medium term.

Short answer: There are many reasons to worry about the stock market, but rising rates aren’t one of them right now.

Managing risk for bonds

Bonds are the securities most exposed to interest rate changes. Coupon payments are generally fixed, so they’re hit directly by the higher level of future discounting that comes with higher rates. Simply stated, when rates go up, bond prices go down, with bonds that mature later getting hit harder than those that mature sooner. Long is bad when rates rise, if you sell.

That last sentence highlights the two major ways to manage the rate risk a bond owner faces: