Now that the Fed has begun raising rates, there is much discussion regarding how these decisions might affect stock returns. The commonly held belief is that increasing rates hurt stocks. And there is a grain of truth behind this, since rates used for discounting future cashflows are also going up and, in turn, current stock values are going down based on this single variable view of stocks.

The Power Of Growth

What many do not appreciate is that the reason rates are increasing is a strengthening economy, which drives up the cost of money for everyone. But the silver lining of an accelerating economy is faster growth in corporate earnings and cashflows, a positive driver for stock values. So stock returns are the result of a tradeoff between the downside of higher rates and the upside of faster growth. It turns out that the impact of the difficult to envision higher future growth rates far outpaces the in-your-face rate rise.

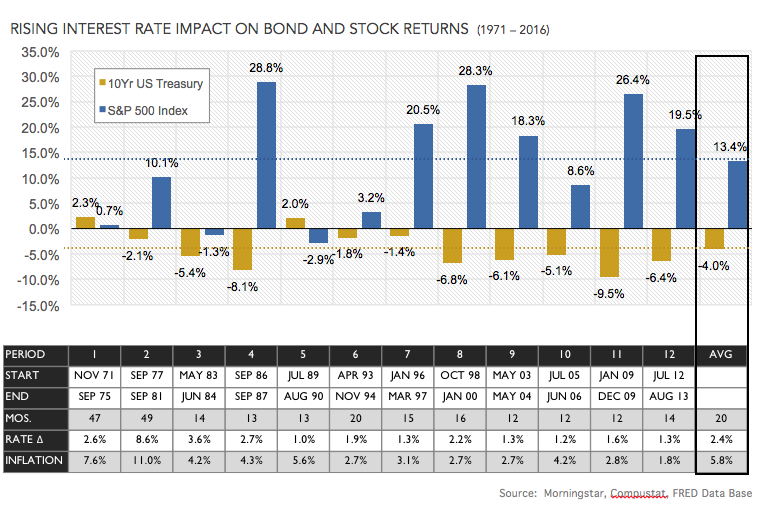

The chart below shows equity returns as represented by the S&P 500 for the dozen times during which the 10-year U.S. Treasury Bond rate increased by more than 1 percent over the last 45 years. The annual S&P 500 return averaged 13.4 percent over these 12 periods, higher than the long-term average of 10 percent, and was positive in nine of the 12 periods.

It makes sense that the 10-year U.S. Treasury Bond lost an average of 4.0 percent annualized as the 10-year rate increased due to the mathematical inverse relationship of bond prices to yield. On the contrary, stocks most often perform well during these periods, which is evidence that the growth positive far outweighs the rate negative. Strikingly, stocks outperform bonds by an average of 17.4 percent during these 12 rate increase periods. This means rising interest rates should be a cause of great excitement rather than foreboding among equity investors.

Since last November, the 10-year U.S. Treasury Bond rate has jumped by 0.60 percent (through March), the Aggregate Bond index lost 2.40 percent, while the S&P 500 raced ahead by 10.2 percent. The market’s increased growth expectations overwhelmed the negative impact of higher rates. This current return pattern mirrors that of the historical relationship among rates, bond returns and stock returns, providing further reassurance for equity investors in today’s market environment.