Key Points

-

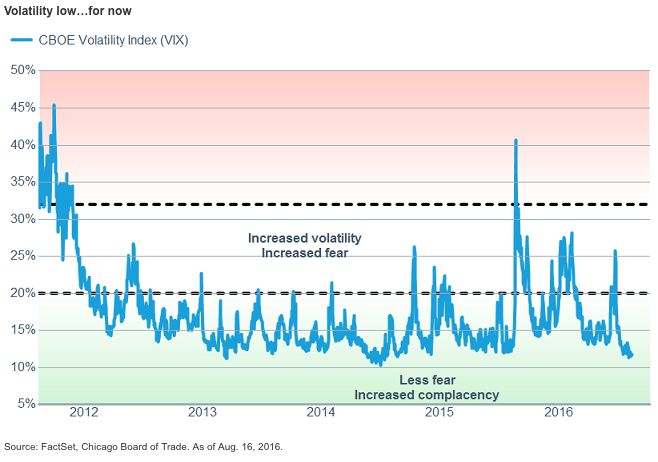

A period of peace has reigned in the market over the past month, but the lull in volatility likely won’t last. However, we do believe the secular bull market has further to run.

-

The third quarter is shaping up to improve on lackluster first half U.S. economic results but weak corporate confidence remains an impediment to stronger growth. Federal Reserve policy uncertainty is likely to heat up heading toward the September Federal Open Market Committee (FOMC) meeting.

-

In contrast to the developed world, emerging markets (Ems) have had an active summer. There are good reasons behind the surge, but it may not last.

Market Calm Unlikely To Last—Be Prepared

Volatility has fallen to near multi-year lows amid the traditionally slow summer vacation season,, Congress is out of session, and much of Europe is on vacation as well But traders will come back to work, politicians and central bankers will return to problems which haven’t gone away, and market action and volume should both ramp up.