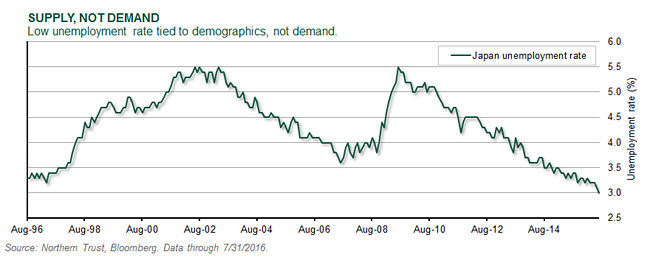

• We don’t believe the low unemployment rate is a precursor to wage and price inflation.

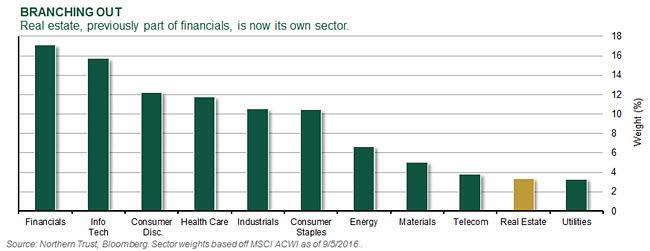

• Expectations that the new real estate sector will generate new investor interest seem overstated.

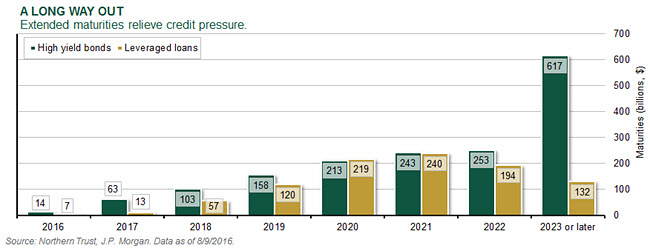

U.S. HIGH YIELD

• Japan’s 3% unemployment rate is the lowest in the last 20 years.

Although a low unemployment rate is usually the sign of strong demand for labor, we believe it’s more likely to be demographics driving it in Japan. Wage inflation hasn’t increased significantly despite the fact that the unemployment rate surpassed its previous highs back in 2013. We would expect that wage inflation would be higher if the low unemployment rate were driven by corporate demand for skilled labor. Lower wage growth has been a boon to Japanese companies with high levels of domestic labor expense, allowing them to keep costs under control. With recent inflation data the weakest of Bank of Japan (BOJ) Governor Haruhiko Kuroda’s tenure, there’s still considerable pressure on policymakers to improve the growth and inflation outlooks.

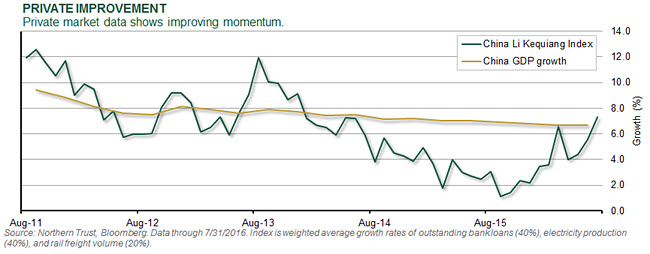

EMERGING-MARKET EQUITY

• China’s official economic statistics haven’t shown much rebound.

• Private measures of economic activity show some signs of improvement.

The low volatility in official Chinese economic statistics has both baffled and amused analysts for years. The Li Keqiang Index, named after the People’s Republic of China’s current premier, comprises the three statistics he has said provide a much better read on economic growth: bank lending, electricity production and rail freight volume. As seen in the accompanying chart, this measure of economic activity slowed significantly from August 2013 through August 2015, and has been steadily improving since. In fact, the index reached a low of 1.2% growth in September 2015 and leapt to 7.3% in July. While relying on just three statistics to measure the growth of an economy the size of China’s has its limits, this improvement does match up with the commentary suggesting that Chinese efforts to avoid a hard landing are working.

REAL ASSETS

• The new real estate sector represents approximately 3% of global equities.

The Global Industry Classification Standard (GICS) — used by major equity index providers such as Standard & Poor’s and MSCI — has now moved most real estate companies into their own sector (mortgage REITs will remain in financials). Some are heralding this as a “coming of age” for real estate stocks that will result in a flood of new investor money pushing up stock prices. We aren’t convinced. Real estate companies aren’t being newly added to market indexes such as the S&P 500; they were always there, tucked into the financials sector. In fact, this specification may only make it easier for active strategies to manage to an “ex-real estate” benchmark. That said, we believe real estate stocks can stand on fundamental merits, providing income and diversified risk exposures to the investment portfolio.

• The U.S. high yield default rate has increased from 2.3% to 5.7% during the last year.

• A supportive maturity profile will moderate the overall rate.

As expected, the Moody’s U.S. high yield default rate continues to increase from the low levels of the past several years, and is expected to reach 6.2% by year end. The increase has been driven by the commodity sectors, with metals and mining expected to reach an 8.3% default rate while the energy default rate is expected to be 6.4%. Even though defaults are increasing, it’s unlikely to become a broad-based issue. The accompanying chart shows the market’s maturity profile during the next several years, and the refinancing requirement is very low through 2018 and modest through 2022. For context, new issue volume has averaged $302 billion a year for the past four years, while the peak refinancing in 2022 is $253 billion. The modest maturity profile is supportive of the market going forward.

U.S FIXED INCOME

September Market Outlook Update

September 15, 2016

« Previous Article

| Next Article »

Login in order to post a comment