• We believe the path to higher rates will continue to be slow and measured.

• China growth concerns have receded along with expectations for interest rate cuts.

Even though the recent uptick in market volatility is fresh in our minds, it has so far been noticeably more limited than the market downturns earlier this year. The catalyst for this increase in risk aversion was a somewhat nebulous concern about the path of global monetary policy, which we expect to abate over time. The early year selloff was tied to concerns about global economic growth, which has proven unwarranted. The Brexit-related selloff in June also proved to be passing, as the timing of the exit process will be measured in years and the economic impact has been limited so far. These developments comport well with two of our key tactical themes: constrained channel growth and trapped monetary policy.

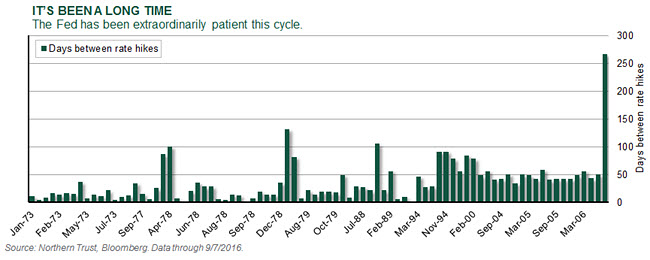

We see global growth as “constrained in a channel” as slow demand limits upside risk, while a lack of economic excess and monetary policy accommodation limit the downside. This is playing out in the global economy, as recent weaker data in the United States is offset by somewhat stronger data in Europe. As the markets have had occasional growth tantrums, this theme has helped us stay fully invested because we’ve expected growth to “stay in the channel.” Our “trapped monetary policy” theme highlights our view that the Fed will find it difficult to tighten monetary policy given global pressures. Committing to this theme has helped us avoid overreacting to monetary policy tantrums, as recently demonstrated. As we highlighted in our U.S. Fixed Income commentary, we’ve now gone longer between interest rate hikes during this cycle than any cycle during the last 60 years!

• The Fed’s desire to hike rates continues to be hampered by soft fundamentals.

Despite numerous members of the Fed stating that a rate hike at the September meeting is on the table, the markets (and we) remain skeptical. Fed Funds futures, a good gauge of the probability investors assign to the Fed raising rates, signal a probability of around 30% toward a September hike. With the number of days between interest rate increases already 200 days longer than in any other tightening cycle during the past 60 years, this cycle is certainly different. As growth in the United States remains mediocre and inflation muted, we continue to believe the Fed will move at a slow and measured pace. Investors should focus on the projected path of Fed Funds and not the specific timing of Fed activity.

EUROPEAN FIXED INCOME

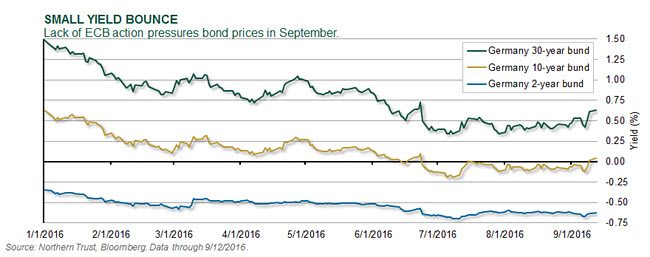

• The ECB disappointed markets by holding monetary policy steady.

• Brexit concerns have faded as economic data remains resilient.

Investors expecting the European Central Bank (ECB) to announce further measures in September were left disappointed. Although ECB President Mario Draghi confirmed the bank’s easing bias with a focus on evaluating stimulus options, he indicated no discussion for an extension of asset purchases, and the bank’s official forecasts for growth and inflation were largely unchanged. European government bonds sold off sharply following the news, however yields are expected to stay low as the ECB continues its purchases in the bond markets. Markets appear to have brushed off any Brexit concerns as longer-dated Gilt yields approach their highest levels since June. Although the risks remain skewed to the downside, economic data appears resilient, which may warrant the Bank of England to be more patient with regards to monetary policy accommodation.

ASIA-PACIFIC FIXED INCOME

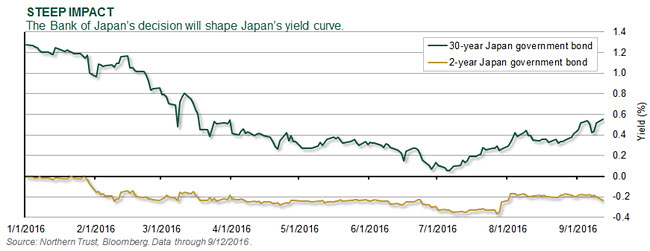

• The Japan government bond yield curve steepens as markets contemplate BOJ action.

The BOJ has dominated headlines with a notable increase in market communications, including the announcement of a “comprehensive” review of its policies in September. This is leading markets to expect further policy adjustments, and the pressure persists with second-quarter gross domestic product growth slowing to a mere 0.2%. As such, the desire for maintaining low short-term rates will remain, although recent rhetoric around the risks of negative long-term yields may signal a change in direction from the BOJ. Chinese concerns have receded, corroborated by a rise in the manufacturing purchasing managers’ index (PMI) to its highest level in almost two years. With signs of an emerging credit bubble, this will be welcomed by the People’s Bank of China as it may give it room to consider nonstandard measures in its pursuit for economic rebalancing.

CONCLUSION

September Market Outlook Update

September 15, 2016

« Previous Article

| Next Article »

Login in order to post a comment