As consensus grows on the prospect of lower asset class returns, investors are taking a fresh look at the potential consequences and solutions.

The potential consequences are stark:

• Public pension funds may not achieve their return targets, making it difficult to meet obligations without future budget sacrifices.

• Corporate defined benefit pension plans relying on excess returns over the liability growth rate to shore up deficits could be on the hook for additional contributions.

• Individual investors facing a steeper challenge in accumulating sufficient assets to live comfortably in retirement may have to lower living standards and save more.

As to potential solutions, investors could raise their expected returns by increasing allocations to riskier asset classes – but this would come with significantly higher risk and shortfall probability.

We believe a better and more efficient approach would be to replace current traditional physical equity exposures with synthetic equity exposure backed by long-duration bonds. This may enable investors to achieve increased long-term expected returns with lower incremental volatility.

TIMES ARE CHANGING

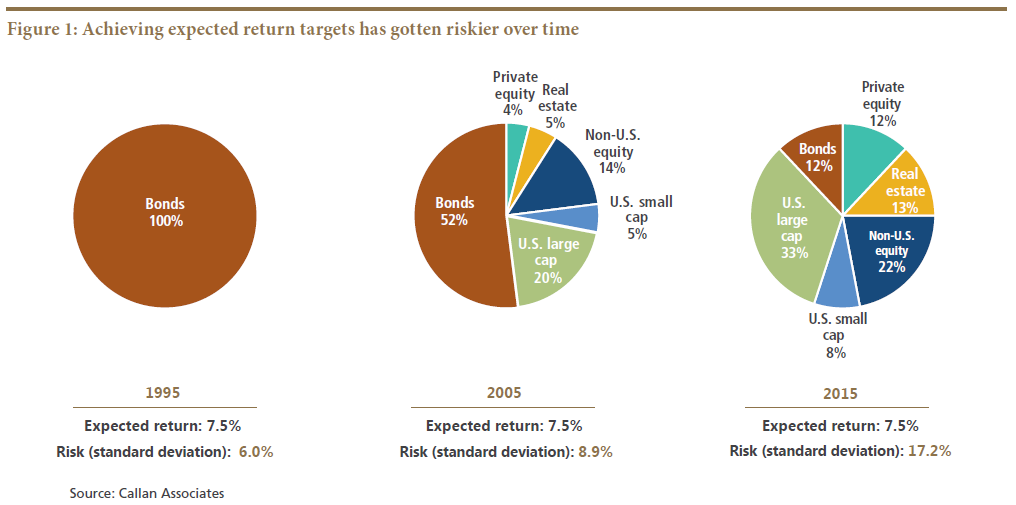

According to research by Callan Associates, lower returns expected across a variety of asset classes would require investors to take significantly higher risk today to reach the same expected returns as in the past (see Figure 1).

Most investors would find such an increase in risk undesirable, and many have already responded by trimming return expectations to some extent.

However, we believe investors should also consider non-traditional approaches and strategies with the potential to enhance returns with lower incremental risk. Among these, strategies that combine returns from two different asset classes for the same invested dollar can potentially offer a better risk/return trade-off than a blunt shift toward riskier assets – provided that the asset classes combined have a relatively low correlation. This approach – variously known as portable alpha, double value or overlays – is simpler than it sounds.

DOLLARS WORKING OVERTIME: AN ILLUSTRATION

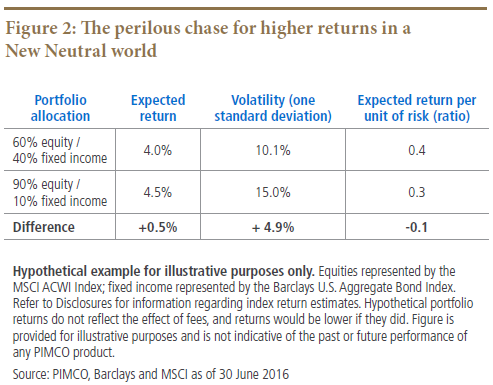

Consider an investor with a traditional 60/40 equity-bond portfolio. In The New Neutral environment, this portfolio is expected to return about 4.0% annualized over the next 10 years, based on PIMCO’s capital market assumptions. If our investor seeks to compensate for lower return expectations with a riskier asset allocation, she could boost her return expectation by 50 basis points (bps), to 4.5%, by drastically shifting the portfolio to 90% equity/10% fixed income. However, as shown in Figure 2, this would increase her risk exposure by a whopping 50% (with return volatility jumping from 10.1% to 15%). As such, simple asset allocation shifts toward riskier asset classes are unlikely to be an attractive solution.

Let’s now postulate that our investor maintains her equity exposure at 60% of assets. The equity exposure, though, is achieved through the use of an overlay (equity index futures or swaps), which requires only a small capital commitment. The assets that had formerly been deployed in the traditional equity portfolio made up of physical stocks now become available for investment in a portfolio that will serve as collateral for a synthetic equity exposure. Under the right conditions, these assets could be put to work in an effort to enhance the equity overlay returns.

The collateral portfolio should have these attributes:

• Relatively low correlation to equities

• High probability of outperforming the equity overlay financing rate (i.e., earning a return meaningfully above Libor)

If these conditions are met, the risk/return trade-off could be significantly better than the traditional re-risking approach shown in Figure 2.

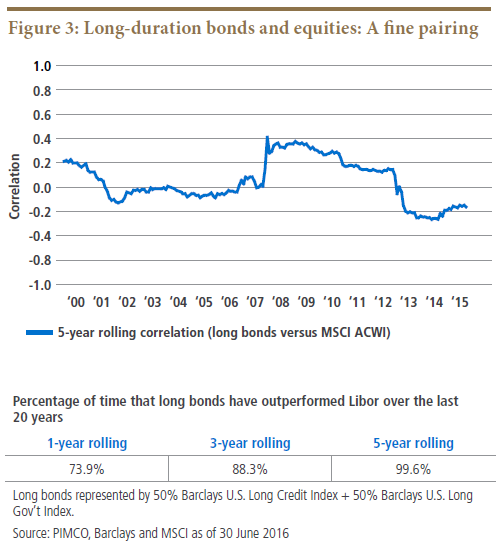

Given their historically low correlation to equities and outperformance potential relative to the financing rate, long-duration bonds could represent a good choice for the collateral portfolio investment (see Figure 3).

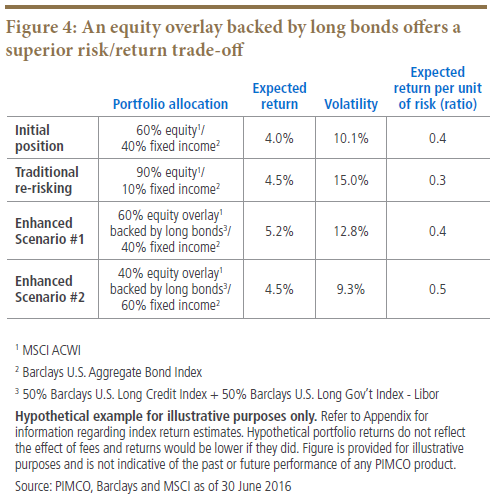

In fact, with the equity overlay approach, our hypothetical investor could maintain her equity exposure at 60% while achieving a significantly higher expected return and lower incremental risk (Enhanced Scenario #1) when compared with the traditional re-risking approach. Alternatively, if she sought less return enhancement, she could match the return target of the traditional re-risking approach with 38% lower risk as in Enhanced Scenario #2. (See Figure 4.)

BUT WHAT ABOUT …

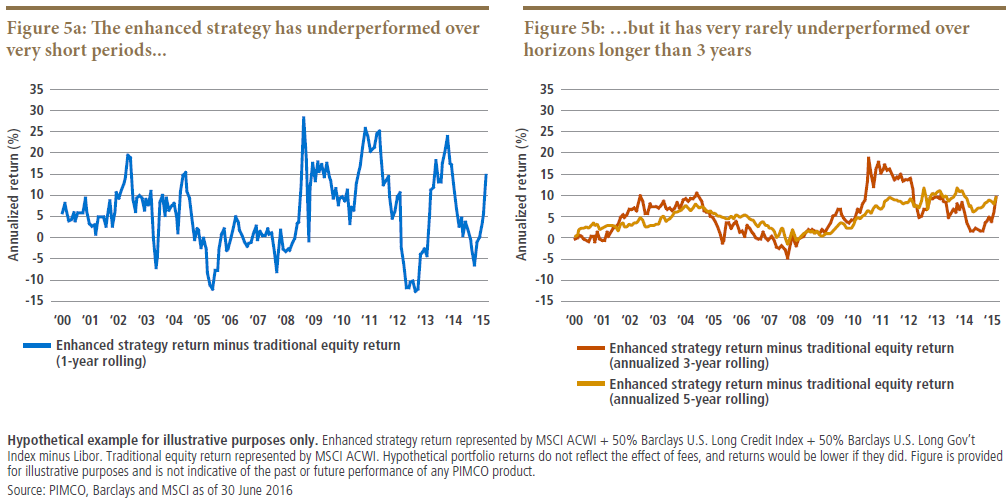

Rising interest rates: While the long bond collateral could be negatively affected by rising rates in the short run, over the medium to long term long-duration bonds are likely to achieve a return consistent with their yield at the time of purchase (absent defaults) – and therefore may provide the expected return enhancement even in a rising-rate environment. In addition, rising interest rates are often accompanied by corporate spread tightening; this could potentially provide a partial offset to the impact of rising rates if a portion of the underlying long bond portfolio is invested in the corporate sector (see Figure 5).

The financing rate: The financing rate on the equity derivatives position will reduce the amount of return enhancement provided by the long bond portfolio. And as the yield curve flattens, return enhancement may be less significant.

However, we would suggest investors employing this strategy consider active management of the underlying long bond portfolio, as well as incorporating a certain amount of credit exposure to further enhance return potential and offset the possible impact of flatter yield curves. With long-dated corporate spreads (as measured by Barclays Capital Long Credit option-adjusted spread) currently yielding about 215 bps (compared with a historical average of about 150 bps) and the potential for alpha from active management, we believe return enhancement is possible even in a flatter yield curve environment. PIMCO CIO for Global Credit Mark Kiesel explores the potential of higher-quality credit in his latest Global Credit Perspectives.|

CONCLUSION

In an era of lower expected returns, traditional approaches may fail to deliver the returns targeted or desired by pensions, other institutions and individuals in tax-deferred accounts (e.g., 401(k)s and IRAs). Investors could raise their expected return potential by increasing allocations to riskier asset classes, although doing so would come with higher volatility and risk.

In our view, a better and more efficient approach would be to replace current traditional physical equity exposure with synthetic equity exposure backed by long-duration bonds. This may enable investors to achieve an increased expected return over traditional equity exposure, with lower incremental volatility.